Get your 2022 taxes done for free: Who qualifies, what to know

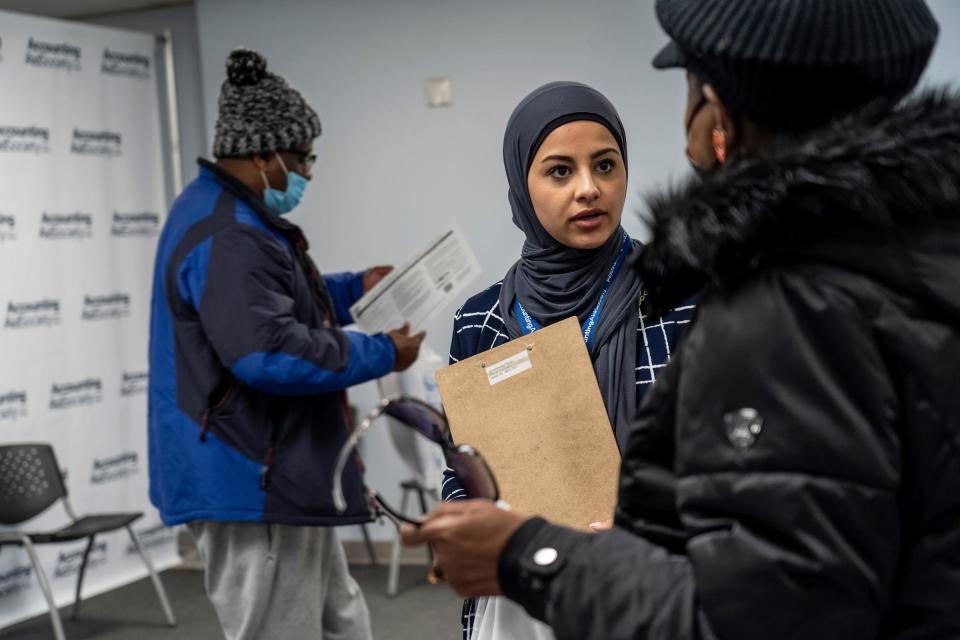

Lamis Alnajjar experiences a calm job satisfaction that's actually refreshing during the hectic tax season.

She happily recounts the story of an older woman, perhaps in her 80s, who came into the tax site in northwest Detroit one day in mid-March. The woman's husband died in 2022 and she was troubled about how she was going to file a joint return for the couple, as allowed, this year.

Her husband had an "Identity Protection PIN" that was known only to him and the IRS. A new number, which is often used when there has been tax-related identity theft, is issued each year. The widow didn't have the number and had no idea what she was supposed to do now.

"We helped her out and it was a really nice moment," said Alnajjar, site coordinator for the Accounting Aid Society's Northwest Financial Hub in the basement of the Henry Ford Medical Center on West Outer Drive.

They walked the woman through step-by-step on what she'd have to do to get that Identity Protection PIN information promptly from the IRS. She did so and her return was prepared, completed and quickly filed for free through the Accounting Aid Society. She'll be getting a refund.

"She gave me a call this morning, it was so cute, right when I walked it at 8:30. She thanked me so much, saying how much she loved what we did for her."

Free is no doubt a big draw for taxpayers who use volunteer tax preparation services, such as those offered by the Accounting Aid Society, Wayne Metropolitan Community Action Agency, and the AARP.

"If you can't afford it, you just come right here," said Deborah O'Neal, 62, who has been having her taxes done for free for at least 10 years. O'Neal says she once paid about $75 to get her taxes prepared several years ago but she is on disability and the price of everything is going up. Her rent alone went up about $400 a month — hitting $1,250 a month in Detroit — after all the inflationary price hikes.

Natisha Holder, 48, used to pay about a $100 to get her taxes done. But the Romulus mother couldn't reach her accountant during the pandemic and started looking online for a free option. "You feel comfortable coming here. You don't feel degraded," said Holder, who is out of work currently and visited the Accounting Aid office in northwest Detroit in mid-March.

More:People may not realize they're eligible for Earned Income Tax Credit on 2022 returns

More:IRS in Detroit to offer taxpayers help without an appointment: 4 days you can walk in

What do you need to do to qualify for free tax help? Typically, you need a relatively simple return but you often can qualify even if you have a low to moderate income. You will need proof of income, such as a Form 1099-R for pension income or a W-2 for wage income.

Volunteer income tax assistance

Volunteer income tax assistance sites offer free tax help to those who generally make $60,000 or less; people with disabilities and limited English-speaking taxpayers. The sites are staffed by volunteers and run by IRS partners. The IRS offers ways to locate the nearest IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly site. Use the Locator Tool or call 800-906-9887. See https://irs.treasury.gov/freetaxprep/ for information.

Some free options

Accounting Aid Society: Appointments remain available this tax season at several sites in southeast Michigan. Go to www.accountingaidsociety.org and click on the site to make an appointment, or call 313-556-1920 from 9 a.m. to 4 p.m. Monday through Friday.

Accounting Aid has 19 in-person sites for traditional tax preparation, plus four Drop and Go sites that give you a chance to bring your information at a scheduled time and talk to an intake specialist. You'd return when the taxes are done for a review. And there is a totally remote, over-the-phone option called "VITA ACE."

Traditional tax preparation services are being offered through April 18; the Drop and Go and VITA ACE services will end about April 11 to provide sufficient processing time.

Sites may have tax preparers who can speak a variety of languages, including, but not limited to Spanish and Arabic.

People who do not qualify for free services include:

Those with household incomes above $60,000.

Taxpayers with rental income.

Business use of home.

Those who are self-employed with an inventory of goods.

Matt Hetherwick, director of individual tax programs for the nonprofit Accounting Aid Society in Detroit, said the nonprofit is seeing a 10% to 15% uptick in clients from a year ago, as people want to keep more of their tax refund in their pockets and return to more in-person tax services since the pandemic began three years ago.

Hetherwick noted that the Accounting Aid Society has turned toward appointment-based services to give clients more space in the waiting areas. Some sites offer walk-in services on a very limited basis when possible.

Special events: SER Metro-Detroit has a Show Me The Money Day from 11 a.m. to 2 p.m. March 29 at the SER Workforce Center at 5200 Stecker in Dearborn, which includes free tax help involving Drop and Go services through the Accounting Aid Society.

Wayne Metropolitan Community Action Agency: Appointments can be made by calling 313-388-9799 or visiting waynemetro.org/tax to schedule online.

To qualify, your annual household income can be up to $60,000. And online self-preparation tax services are available, as well, for those whose income is up to $73,000.

Wayne Metro has five locations that offer free tax preparation help but also has offered services during events in the community at senior co-ops, recreation centers and career centers.

You can get tax help by phone, too. The phone service is available on Fridays but only offered to those who are homebound, elderly or disabled or in unique situations.

Wayne Metro requests that appointments take place before or on April 15 to file in time for the 2022 tax season. Clients need original documents, no photocopies can be accepted. You need a copy of last year's tax return. See www.waynemetro.org/taxes.

Some one-stop help: United Way for Southeastern Michigan has a Get the Tax Facts site to offer scheduling help for those who live in Wayne, Macomb and Oakland counties to obtain free tax services provided by Accounting Aid Society or Wayne Metropolitan Community Action Agency. See www.unitedwaysem.org.

A nationwide program turns 55

AARP Foundation Tax-Aide: The nationwide AARP Foundation tax help program turns 55 this year, with its early roots dating to a small volunteer effort in Florida in 1968.

About 4,000 sites are available nationwide that offer free AARP tax help through the April 18 filing deadline this year. See AARPFoundation.org/taxaide or call 888-227-7669. You can provide your ZIP code with the phone line and online service to help locate a site near you. The online site can tell you the address, hours and types of services offered at a specific site.

Across Michigan, the AARP volunteers provide free tax help at about 123 sites. Some sites in small communities offer help only one or two days during the tax season. But other sites offer more help.

Services are offered at specific days and times at a long list of locations in metro Detroit, including the Dearborn Senior Center, the West Bloomfield Parks and Recreation Center, the Neighborhood House in Rochester, the Detroit Public Library Edison Branch on Joy Road, the Auburn Hills Community Center, the Mount Clemens Public Library, the Southfield Parks and Recreation Center, the Warren City Hall and others. At some centers, appointments are full for the year. But others continue to take appointments.

Lynnette Lee-Villanueva, vice president of tax and credits at the AARP Foundation, said 2023 is the first year since 2020 that many sites will offer walk-in services again. More sites are available, too, once again offering free help.

"People rely on us and we want to be there for them," Lee-Villanueva said.

Before the pandemic, the AARP tax program served more than 2.5 million taxpayers in 2019. But sites closed to protect volunteers and clients during the pandemic, and many people paid to have their taxes done or turned to friends and neighbors for help.

Last year, about 1.2 million taxpayers were served many times through drop-off services or appointments as some restrictions were lifted. The numbers are expected to continue to go up this year.

"All of our volunteers are trained and they have to be certified each year to be able to prepare returns," Lee-Villanueva said. "Taxpayers can be assured that the person they're sitting down with really is prepared and has the knowledge base to be able to prepare their return."

The program targets taxpayers who are 50 years old and older and have low to moderate incomes but it serves people of all ages, including younger families who qualify for the Earned Income Tax Credit.

"They're not having to pay someone that they may not be able to afford at this stage of their life," she said.

Some types of returns cannot be completed, including those with rental income or those who are self-employed and maintaining an inventory of goods. A self-employed person who is an Uber driver or has a house cleaning business would be able to be served.

A variety of ways exist to have your taxes done, including in-person help where tax returns are completed in one visit.

Or you can have your documents scanned and then have volunteers prepare the return remotely. During a second visit, the taxpayer works with a volunteer and the return is finalized.

Drop-off services are available at some locations where you leave your documents with an IRS-certified volunteer, work virtually with a volunteer and then return to a center to finalize the return.

Some remote, drop-off types of services were developed in the past few years to cope with social distancing measures and they will still be offered.

Taxpayers do not have to visit any site if they create digital copies of their tax documents, for example, upload them and let Tax Aide volunteers prepare the return remotely. And there is a "coaching model" where an IRS-certified volunteer can help someone who is preparing their own return in the process.

At the AARP site, you can use OnLine Taxes to do your taxes and file a free federal and state return if your Adjusted Gross Income is between $16,000 and $73,000 — or you are an active duty member of the military with Adjusted Gross Income of $73,000 or less.

More:Tax Day in Michigan: 15 questions you might have on due date, refunds, more

More:IRS free file options: Your 2023 guide to free tax prep services

Free File at IRS.gov

IRS Free File lets millions of people file federal taxes at no cost either through electronic fillable forms or through IRS partnerships with private tax-preparation services.

You'd have access to free tax software through IRS.gov if your adjusted gross income is $73,000 or less. Online tax preparation software is provided by those partners that are part of the Free File Alliance, which coordinates with the IRS to provide such services. The IRS also offers free fillable forms anyone can use regardless of income level.

Contact Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. To subscribe, please go to freep.com/specialoffer.

This article originally appeared on Detroit Free Press: Get your taxes done for free: Where go, who qualifies, more