Autonomy and vehicle data are setting the stage for a change in the way car insurance premiums are assessed and administered.

April 17, 2019

Forget the gecko, the good hands, and the mayhem guy. Your next car insurer might be an automaker.

A combination of technical and economic forces is conspiring to change the way car insurance is administered, and automakers are moving closer than ever to playing a key role in that process.

Prime among those forces is the rise of the autonomous car. But a second force has also begun to emerge: An unprecedented amount of data is making its way into the vehicle, creating a foundation for change. And automakers may hold the key to that data.

“The combination of autonomous driving and data changes the whole game,” Brian Carlson, director of product line management for connectivity and security at NXP Semiconductors N.V., told Design News. “So we’re starting to see where automotive OEMs will take more responsibility for insurance.”

It’s not yet clear how that would happen. The two could work cooperatively, enabling automakers to sell name-brand insurance along with vehicles. Or automakers could decide to do it themselves, bankrolling and selling insurance in the same way they now provide new-car financing. Either way, experts believe it would be a natural product extension for the industry.

“If they want to get into insurance, they will, and they should,” noted Sam Tawfik, CEO of LMP Motors, an e-commerce platform for buying and renting vehicles. “They already have the installed base of distribution. And if vehicles become autonomous, they can just roll the insurance onto that.”

The New Role of Real-Time Data

To be sure, the idea of automakers in car insurance is hardly new. The industry has floated the idea for years. Toyota, for example, started a jointly-held car insurance services company called Toyota Insurance Management Solutions USA, LLC in 2016. And Tesla, Inc. launched a program called Insure My Tesla, also in 2016.

|

In 2016, Toyota took a small step toward insurance, launching Toyota Insurance Management Solutions. (Image source: Toyota Corp.) |

More recently, however, the concept has begun to pick up steam as automakers roll further down the road to autonomy. The reason is simple: Autonomy takes the burden of driving away from the human, and places responsibility for it squarely on the shoulders of the automaker. “Autonomous cars change the equation because the OEM is basically making the driving decisions,” Carlson said. “So the question becomes: Is the automaker going to have to self-insure the vehicle?”

Moreover, as part of their autonomous effort, automakers are now collecting mountains of vehicle and driver data that would have been unthinkable only a decade ago. To some degree, the data is there for the study of human driving, as a means to improve robotic systems.

But there’s also an opportunity for insurers and automakers to monetize that data, using it to reduce the premiums for human drivers while autonomy is still on the drawing board. The key is the existence of data buses, already in place on all vehicles, and new electronic gateways, which can extract sensor data and convert it to meaningful information.

Such gateways are available today. NXP, for example, rolled out a chipset in February that serves as a foundation for automotive “service-oriented gateways.” The chipset processes vehicle data from CAN, LIN, and FlexRay buses, which contain a constant stream of data bits from every sensor around the vehicle.

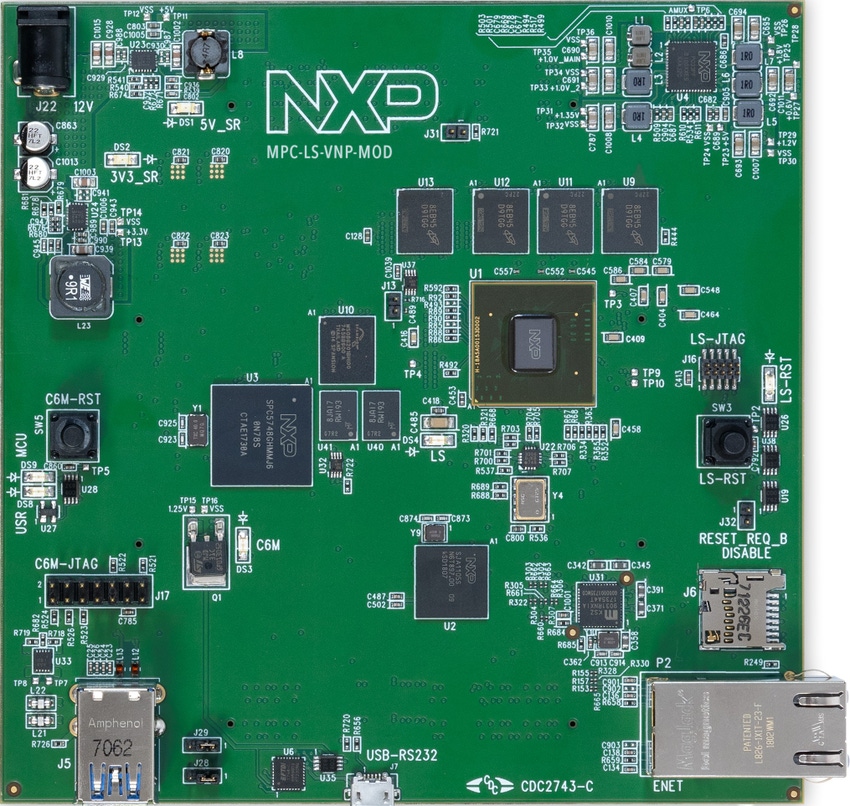

|

In February, NXP rolled out a chipset that acts as a “service-oriented gateway” to enable automakers to collect data from sensors around the vehicle, and convert it to usable information. (Image source: NXP Semiconductors) |

In many cases, the data tells a story that insurers want to hear. Using a combination of wheel speed sensors, engine data, GPS information, and brake sensing, among others, the car itself can now paint a portrait of the occupant’s driving habits. Is the driver aggressive? Does he or she speed? Brake hard? Accelerate fast? Or is the driver cautious and law-abiding?

“There are a lot of activities within the vehicle that can indicate a driver’s behavior,” Carlson said.

Insurers believe that real-time data would provide a more complete portrait of the driver than can be had with simple historical information, such as traffic tickets and accident rates. As a result, they hope to apply it, ultimately lowering the cost of vehicle ownership for certain drivers, who now find insurance to be one of their biggest ongoing vehicle bills.

“The auto company can leverage the data to provide lower-cost insurance capability,” Carlson said. “Whether they do that through a partner company, or whether they take on the whole thing themselves, that remains to be seen.”

Competition or Cooperation?

Analysts who follow the insurance industry are uncertain about how it will play out —whether it will be a competitive or cooperative relationship between insurance companies and automakers. “I don’t think anyone can truly imagine all the implications associated with this – in terms of infrastructure, regulation, and risk,” noted Michelle Krause, a senior managing director and insurance specialist at Accenture. “That’s why we believe they are more likely to lean toward cooperation.”

RELATED ARTICLES:

Krause questions whether data will play a big role in the transformation, but she’s convinced that autonomy will be a game-changer. The big reduction in accidents brought by automation means that collision premiums will drop, and insurers will have to find other products to sell – such as liability and cyber security protection.

“Once cars become more and more autonomous, the need for insurance will fade into the background,” Krause told us. “There’s a lot of speculation about when that will happen, but everybody agrees it will happen.”

Either way, most observers see this as a golden opportunity for automakers to migrate toward insurance. “It would be a brilliant product extension for the auto industry,” Tawfik told us. “Whether the automakers do the brilliant thing…that I can’t predict.”.

Senior technical editor Chuck Murray has been writing about technology for 35 years. He joined Design News in 1987, and has covered electronics, automation, fluid power, and auto.

ESC BOSTON IS BACK! The nation's largest embedded systems conference is back with a new education program tailored to the needs of today's embedded systems professionals, connecting you to hundreds of software developers, hardware engineers, start-up visionaries, and industry pros across the space. Be inspired through hands-on training and education across five conference tracks. Plus, take part in technical tutorials delivered by top embedded systems professionals. Click here to register today! |

About the Author(s)

You May Also Like