SC lawmakers debate cap on payday loans. Here's how that would change the lending industry.

South Carolina lawmakers are contemplating a law that would bar short-term lenders from charging an interest rate that exceeds 36%.

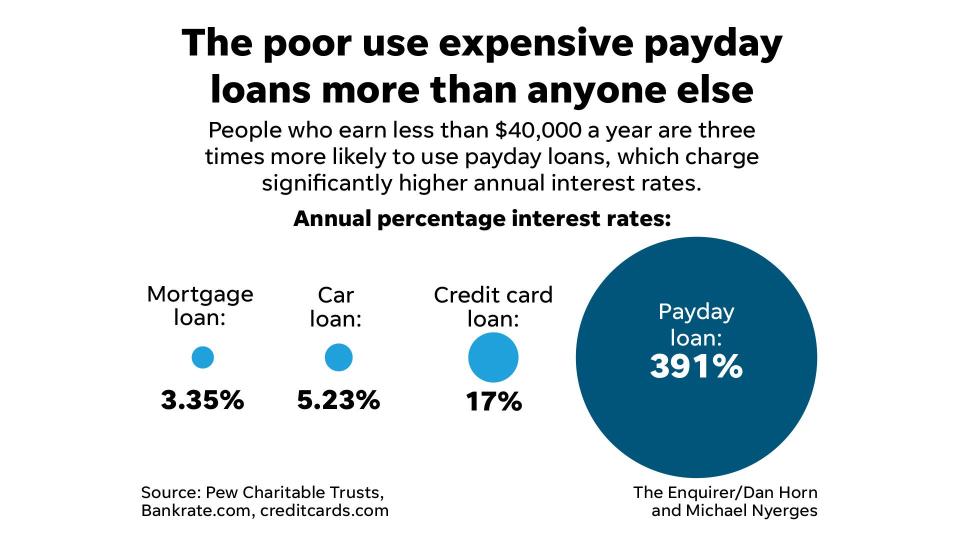

For years, advocates have argued that "payday" lenders − who often cater to low-income borrowers with low credit scores − charge an interest rate that exceeds 395%.

That means, if you borrow $100, you're paying $395 in interest alone. Unable to pay off the interest quickly, the loans become so insurmountable that borrowers remain in the stranglehold of long-term debt.

Lenders argue their high rates exist because they assist riskier customers with low credit ratings, and a 36% cap would force them to shut shop. Lenders have made similar arguments against the federal law on the national level.

Some in the state remain protected from exorbitant interest rates. Military professionals fall under the protection of the federal Military Lending Act which caps all interest rates at 36%. The federal government passed the law in 2006 to help members of the military and their families, who were incurring massive debt while relying on short-term loans to cover rent or emergency expenses.

The high price of desperation: How a $3,000 repair ballooned into a $14,000 debt

Bill would align SC law with federal law

If S.518, a bipartisan bill backed by Sen. Katrina Shealy, R-Lexington, Sen. Brad Hutto, D-Orangeburg and Sen. Kevin Johnson, D-Clarendon, passed, it would align state law with federal law and extend that same protection to all borrowers. The subcommittee will meet again and vote to advance the bill next week.During a Wednesday hearing, Charles Vercelli, an executive at the 1st Franklin Financial Corporation, which has branches all over the state, said his company would lose significant revenue if the state allowed a 36% cap. On average, 1st Franklin Financial loans out $2,000-$2,500 per loan in the state, and their smallest loan amounts to $600, Vercelli said.

Unlike traditional banks that have a large pot of money and can borrow from the Federal Reserve for lending, Vercelli said his company takes loans from traditional banks and re-loans it to borrowers with bad credit scores. "A bank can get the money that they're going to lend out for a pittance of interest," Vercelli said. "During the last five years or so, that pittance has been virtually zero."

Vercelli's company cannot borrow money from the Federal Reserve.

"But we're still this 100-year-old industry that's been helping people all this time," Vercelli said.

Sen. John Scott, D-Richland, asked Vercelli how much of a loss would he make if the state passed a 36% cap?

"That's a very small loss," Scott said.

Vercelli said that it would lead to a 6-8% loss.

Sue Berkowitz, with the SC Appleseed Legal Services, said she has heard similar arguments from lenders since 1995.

"We know that some of the banks, like Capital One, make 8.1% return on equity. We know banks like Wells Fargo and Bank of America make 7.2% on return on equity," Berkowitz said.

But some lending companies, such as World Acceptance Corp, which has branches in the Upstate, had an average of 18.5% return on equity. Advanced America, another lending company, had a 23.6% return on equity in 2020.

"So when I hear about risk, I also know that a lot of money is being made from the very people that these loans are being made to," Berkowitz said.

So why lend money again?

"We know that less than a third of loans are paid outright," Berkowitz said. "Why make a model where it was hard to pay back a loan?"

Here's how short-term loans affect South Carolinians

Berkowitz said consumer data showed, that of 1.2 million short-term loans made in South Carolina in 2021, 46% were "flipped" or "renewed". Berkowitz said this means an individual was either called in because they could not pay the loan or took another loan to refinance it until all the interest and premiums were paid off.

"You've heard testimony from many of these lenders that have said, 'Oh we wouldn't make a loan if people couldn't afford to pay it back,'" Berkowitz continued.

But the 2021 data showed that 17,000 cars had been repossessed. And almost half of the short-term loans were not paid off and because assets put up as collateral were seized. In some instances, borrowers refinanced their debt with another loan and signed updated agreements, Berkowitz explained.

Often, borrowers are mailed checks with writing underneath that does not inform them they could lose personal property, she said.

"So it's no surprise that those loans are refinanced or flipped because when you're charged a high-interest rate, it is often unaffordable for you to be able to pay that back," Berkowitz explained.

North Carolina passed the 36% interest rate cap on licensed lenders in 2005.

Ron Bodvake, SC Commissioner of Consumer Finance, explained a 36% cap would affect lenders on different levels.

Supervised lenders, like traditional banks, credit unions and insurance companies, can offer loans that can be repaid within four months. Others are known as deferred presentment lenders or pay-day lenders, who offer short-term loans with high-interest rates that need to be paid back in 31 days.

In 2009, the SC legislature passed the Deferred Presentment Act, which capped all loan amounts to $550. Since then, the number of companies that offer 31-day loans in the state has fallen from over 500 to just 25 in 2023.

Bodvake said payday lenders won't survive the 36% cap. "There's 25 companies and 24 branches. They can't make it ... not at a 31-day term," he said. "For lenders who offer larger loans, what would have to happen is for companies to show a profit, they would have to make bigger loans worth $3000.

"They'll probably still be here. But it is likely that they would leave smaller towns and continue operating in bigger towns."

Devyani Chhetri covers the South Carolina State House and is a watchdog SC government reporter. You can reach her at dchhetri@gannett.com or @ChhetriDevyani.

This article originally appeared on Greenville News: SC lawmakers debate cap on payday loans. Change predatory lending.