Canada's inflation rate ticks up to 2.9% on higher gas prices

Core inflation eases, firming up case for Bank of Canada interest rate cut in June

Article content

Canada’s inflation rate ticked up in March but stayed within the Bank of Canada‘s target, firming up the case for a June interest rate cut.

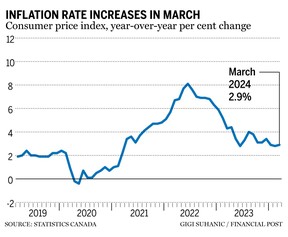

The consumer price index rose 2.9 per cent year over year in March, up from 2.8 per cent in February, according to Statistics Canada data released on Tuesday.

Analysts had expected inflation to rise between 2.9 and 3 per cent.

“We’re almost there, with just one more step to go,” Canadian Chamber of Commerce senior economist Andrew DiCapua said in response to the data release.

Statistics Canada said gasoline prices mainly drove the acceleration in headline inflation, as prices at the pump rose faster in March than in February.

Excluding gasoline, the all-items CPI slowed to a 2.8 per cent year-over-year increase, down from a 2.9 per cent gain in the prior month, it said.

Mortgage interest costs and rent indexes pushed the year-over-year gain in the all-items CPI.

Prices for services continued to rise to 4.5 per cent growth in March compared with February’s 4.2 per cent growth. This outpaced price growth for goods at 1.1 per cent growth, which slowed compared with February on a yearly basis.

On a monthly basis, the CPI rose 0.6 per cent in March.

“For a central bank trying to judge if downward momentum in core inflation has been maintained before it’s next policy decision, today’s release was a case of one down, one to go,” said Andrew Grantham, economist at CIBC Capital Markets.

While headline CPI ticked up slightly, core measures of inflation actually printed weaker than consensus expectations, he noted.

The Bank of Canada’s preferred core measures, CPI trim and median, printed at 3.1 per cent and 2.8 per cent year-over-year respectively. These showed more downward progress than expected by the consensus at 3.2 per cent and 3.0 per cent, said Grantham, adding that these should continue to decelerate in the months ahead.

Both measures eased and averaged below the top end of the 1 per cent to 3 per cent inflation target for the first time since the summer of 2021, said Royal Bank of Canada economist Claire Fan.

The data also builds on two prior months of CPI reports that were both downside surprises, she said.

“March’s reading today confirmed that broad-based easing in price pressures in Canada are indeed underway,” Fan said, adding that she continues to look for slowing inflation to allow for a first rate cut from the Bank of Canada in June.

She said different measures of core inflation all continued to decelerate and the diffusion index that measures the scope of inflation pressures also improved and now tracks a breadth of price pressure that’s similar to pre-pandemic.

Grantham said while there is still one more CPI release before the central bank’s next policy decision, Tuesday’s data keeps watchers on track to see a first rate cut at that June meeting.

Bank of Montreal chief economist Douglas Porter also noted that the federal budget and a reading on gross domestic product are still to come before the next meeting.

• Email: dpaglinawan@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.