San Diego County property now valued at record $604B

The assessed value of San Diego County properties, including residential, industrial and commercial, is now the highest it’s ever been.

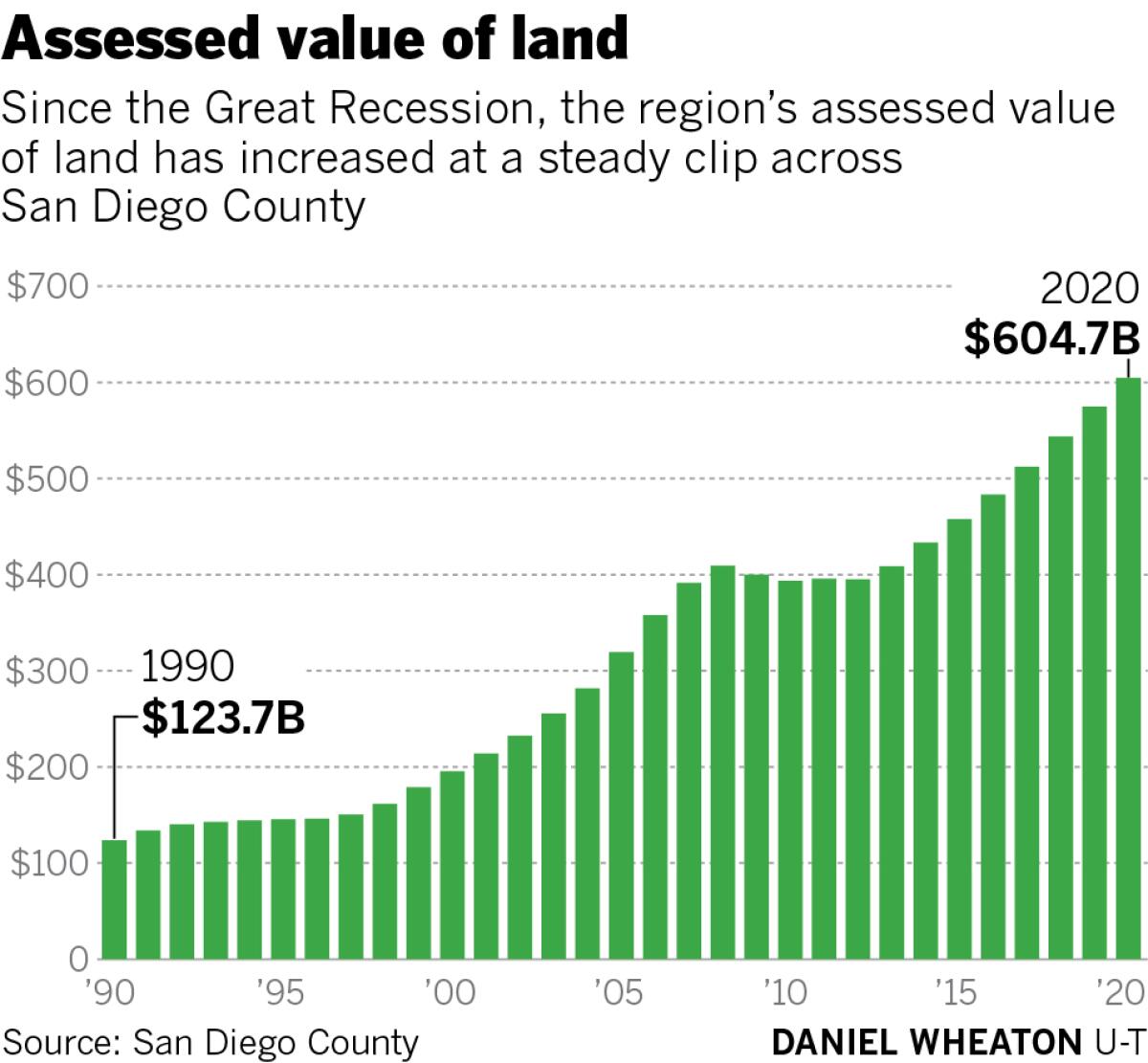

The value of land in San Diego has never been higher.

San Diego County’s assessed value of all taxable property — including residential, commercial and industrial land — is now $604.75 billion, the Assessor’s Office said this week. It represents an increase of 5.18 percent from last year.

The valuation date is set at Jan. 1 each year, so any potential impact from COVID-19 is not included in this year’s numbers. If the real estate market crashes this year, even though that is not predicted by most housing analysts, it could mean a change when new valuations are calculated in January 2021.

While the valuation was expected to increase and not a huge surprise, it might be welcome news to government planners. A drop in sales and income taxes is likely for all of California as it wrestles with increasing cases of the coronavirus and record unemployment.

County Assessor Ernie Dronenburg credited the 1978 Proposition 13 as a reason for steady increases, which caps increases up to 2 percent annually based on the purchase price at the time of the sale.

“Prop. 13 is a static measurement,” he said Monday. “It provides a reliable government funding source for key services.”

Property values have grown considerably since 1990 when San Diego County was assessed at $123.7 billion. The most values ever went up in a year was in 2005, at the height of the housing boom, when it increased 13.3 percent.

The Great Recession caused property values to drop 2.31 percent in 2009, 1.56 in 2010 and 0.14 in 2012. Part of the reason for lowered valuation besides homes selling for less money was Prop. 8, which allowed California assessors to reduce the assessed value of properties if market values dropped significantly.

While that may be a possibility for some homeowners if home values are hurt by the economic fallout of COVID-19, home prices in San Diego County are still on the rise. As of May, the median home price was at a near-record high of $590,000, increasing 3.5 percent in a year. Analysts point to a variety of factors keeping prices up: Low inventory of homes for sale causing price wars, the increased value put on homeownership as workers continue to work from home and low mortgage rates.

Residential properties make up the vast majority of taxable land in the county with 936,884 parcels. It is followed by commercial with 27,087 parcels, industrial with 11,233 parcels and recreational with 15,319.

National City saw its assessed value grow the most under the new valuation, up 7.1 percent in a year. It was followed by Santee at 7 percent, Chula Vista at 6.26 percent and Del Mar at 6 percent. The lowest increase was Poway at 4.33 percent.

In terms of overall values, the city of San Diego has the highest assessed land at $291.3 billion. It was followed by Carlsbad at $37.3 billion and Chula Vista at $33.7 billion. Lemon Grove had the lowest at $2.53 billion.

The majority of taxes, around 45 percent, collected went to schools in the last fiscal year in San Diego County. The other big recipients were the county with 13.1 percent and individual cities at 12.6 percent.

The biggest property taxpayers that fiscal year were SDG&E with $148.3 million, Qualcomm with $25.6 million and the Irvine Co. with $14.4 million.

It might be a while before San Diego County’s value increases can be compared to other parts of California because several counties have delayed publishing tax rolls as they deal with COVID-19, which is slowing their ability to complete work.

The county’s valuation might have been around $36 million higher but several programs from the Assessor’s Taxpayer Advocate outreach program lowered bills for welfare institutions, like churches, museums and nonprofits. Its program to greatly reduce tax bills of disabled veterans cut about $14 million off the tax rolls.

There could be changes coming to tax rolls after November because of a new initiative called Proposition 15. It would remove commercial properties from the same tax roll benefit homeowners get under Prop. 13, with the idea it would increase taxes on corporations that could fund schools and other government programs.

Prop. 15 would affect only commercial properties worth more than $3 million and businesses with 50 or fewer employees would be exempt. Proponents like the California Teachers Association say commercial properties paying taxes on current assessed values, unlike the original sale price in Prop. 13, would unlock seriously needed funding after the pandemic. Opponents, such as the California Assessors’ Association (Dronenburg is president-elect), are opposed largely because of implementation costs tied to a newly trained workforce and concern it could lower taxes in small and rural counties.

Get U-T Business in your inbox on Mondays

Get ready for your week with the week’s top business stories from San Diego and California, in your inbox Monday mornings.

You may occasionally receive promotional content from the San Diego Union-Tribune.