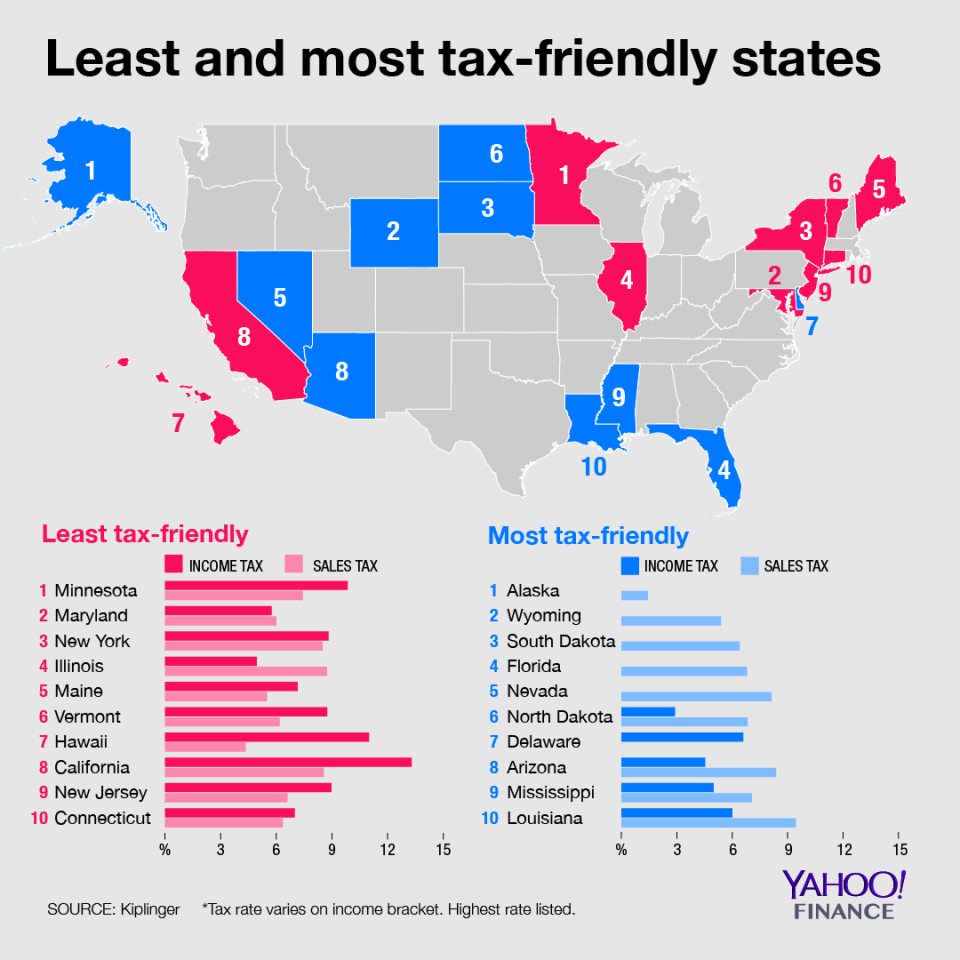

MAP: The most and least tax-friendly states

If you want to avoid paying lots of taxes, you might want to steer clear of the Northeast and venture towards the South instead. According to Kiplinger, these are the most and least tax-friendly states.

Many states that make up the Northeast were among the least tax-friendly, including Maryland, New York, New Jersey, Connecticut, Vermont, and Maine.

The top spot, however, went to Minnesota. With a state income tax ranging from 5.35% to 9.85%, depending on one’s taxable income bracket, Minnesotans are hit the hardest. The average local sales tax stands at 7.43% (depending on local municipality) while gas taxes and fees are at $0.29 per gallon.

Maryland isn’t too far behind with state income tax between 2% to 5.75%. Its sales tax is 6% and its gas taxes and fees are $0.35/gallon. Additionally, according to the Comptroller of Maryland, “the state’s 23 counties and Baltimore City also levy a local income tax, which is collected on the resident state tax return as a convenience to local governments.”

The states with the highest sales tax include New York, California, and Illinois, with each of them above 8% when combining local and state taxes.

New Jersey has the highest property taxes and some of the highest gasoline taxes in the U.S. Its 6.6% sales tax makes it one of the less-friendly states, although grocery food, clothing, and prescription/non-prescription drugs are exempt. However, one of its most southern counties, Salem County, only collects a 3.3% tax instead of the 6.6% tax, which is “a policy designed to help local retailers compete with neighboring Delaware, which foregoes a sales tax,” according to the Tax Foundation.

On the other side of the spectrum are states like Alaska, Wyoming, South Dakota, Florida, and Nevada, none of which even have state income tax.

Alaska’s sales tax is a measly 1.43%, and it’s only for certain jurisdictions. Wyoming’s rate stands at 4%, with an average local tax rate of 1.46%. Nevada, which relies heavily on the gambling industry, has some of the lowest property taxes.

Adriana is an editor for Yahoo Finance. Follow her on Twitter.

Read more: Kiplinger: 14 Ways for Everyone to Save on Taxes Under the New Law