Stocks Finish Mixed; Yields Drop From Year Highs: Markets Wrap

Shares were down in Japan, South Korea and Australia.

(Bloomberg) -- U.S. stocks were mixed and Treasury yields retreated from a one-year high as investors weighed the outlook for economic growth and inflation.

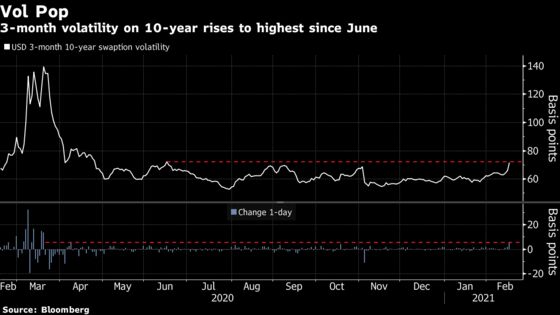

The benchmark 10-year Treasury yield briefly climbed as high as 1.33% before paring its increase. The S&P 500 Index finished little changed, while the Nasdaq Composite slumped. Chevron Corp. led energy shares higher after Berkshire Hathaway Inc. revealed an increased stake. The Dow Jones Industrial Average closed at a record high. Companies that may have difficulty justifying stretched valuations if rising inflation dents profits bore the brunt of selling -- high-flying tech shares among them.

“At some point higher yields could hurt, but I don’t think we’re there just yet,” said Michael Arone, chief investment strategist for the U.S. SPDR exchange-traded fund business at State Street Global Advisors. “That’s going to continue to be a big underlying theme for markets.”

Federal Reserve officials did not see the conditions for reducing their massive asset-purchase program being met for “some time” at their January policy meeting, a record of the gathering released Wednesday showed.

The recent dramatic rise in bond yields has investors wondering afresh how high they can climb before spoiling the risk rally. That adds to concerns that speculative froth may be setting equities up for a fall.

Read More: Yield Surge Stirs Debate on Breaking Point for Everything-Rally

“It’s quite possible that for a while interest rates could rise and yet stock prices could still rise some more because of the tailwinds from the fiscal stimulus, from folks who save money, and people wanting to get out,” said Tom Martin, senior portfolio manager at GLOBALT Investments. “So the tricky part is going to be figuring what level of interest rates will be supportive of stock prices either hanging in there and going higher or what level of inflation or interest rates will then start to become a worry for the market in terms of valuation.”

Elsewhere, oil rose for a third session as an ongoing energy crisis in the U.S. pummeled domestic crude output. The deep freeze causing historic power outages across the central U.S. has led oil output in the country to plunge by a third.

Bitcoin jumped past $52,000 for the first time. China remains shut for a week-long holiday and will reopen Thursday.

These are some of the main moves in markets:

Stocks |

|

|

|

|

|

Currencies |

|

|

|

|

Bonds |

|

|

|

Commodities |

|

|

©2021 Bloomberg L.P.