At a time when the interest rate in the country is looking to go down, investors banking on fixed-income investments will find the latest NCD offer from L&T Finance interesting. L&T Finance Limited, which is a wholly-owned subsidiary of L&T Finance Holdings, is coming out with a public issue of Secured Redeemable Non-Convertible Debentures (Secured NCDs). The Tranche I NCD issue will open on December 16, 2019 and close on December 30, 2019, with an option of early closure or extension, if the issue gets fully subscribed before the last date.

Under the NCD offer, there are four categories of investors defined as Category I (Institutional Investors) Category II (Non- Institutional Investors), Category III (High Net-worth Individuals) and Category IV (Retail Individual Investors). As a retail investor, the features, interest rate and other benefits will be as per Category IV.

What’s in store for investors

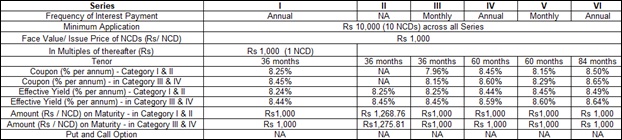

The NCD has six different Series representing varying tenure and frequency of interest payments. One can choose a term of 36 months, 60 months or 84 months. The interest payment is either annually, monthly or cumulative on maturity. The coupon rates for retail investors range from 8.45 per cent per annum to 8.65 per cent per annum. The cumulative option is available only on NCD for 36 months in which on an investment of Rs 1000, the maturity value is Rs 1275.81, a yield of 8.45 per cent per annum. If one wishes to exit or redeem the NCDs before the maturity, they can be traded on the stock exchange.

The Secured NCDs have been rated CRISIL AAA (stable), CARE AAA / Stable and IND AAA / Stable. The rating of Secured NCDs by CRISIL, CARE and India Ratings indicate that instruments with this rating are considered to have the highest degree of safety regarding timely servicing of financial obligations. Such instruments carry the lowest credit risk.

Alternate investment options

Bank fixed deposits are an alternative investment option but the interest rate in most banks is lying low. SBI FD interest rate is 6.25 per cent per annum for 1 year to 10 year FD scheme. The interest rate on ICICI Bank FD is in the range of 6.2 to 6.4 per cent on 1 to 10-year deposit. The FD of Axis bank is offering 6.4 per cent per annum to 6.7 per cent per annum over 1 to 10 year period. In the case of the post office savings schemes, the interest rate on NSC ( five years), KVP (113 months) are 7.9 per cent and 7.6 per cent respectively.

L&T Finance Holdings Tranche I Issue – Features

What to do

It should be noted that no matter how high the Rating of a bond or NCD is, they may change over time and, therefore, one should not invest solely on the basis of Ratings. As an investor, look to invest if your risk profile allows and the lock-in period matches your long term goal. The interest earned in NCD is fully taxable as per the individual’s tax rate in the year of receipt. Therefore, look at the post-tax return and then decide.