Natural Gas Futures Trim Gains After 100 Bcf-Plus Storage Build; Cash Weakens

Weather data volatility spilled over into the natural gas futures market on Thursday, with prices swinging in and out of positive territory amid mixed signals over prospects for sustained cold. After reaching an intraday high of $2.365 and a low of $2.284, the November Nymex gas futures contract settled at $2.318, up 1.5 cents. December climbed 2.1 cents to $2.516.

Cash prices, however, were a sea of red despite some chilly conditions in the Northeast. With Texas and the South expected to be mostly comfortable and high pressure gaining ground, the NGI Spot Gas National Avg. fell 12.0 cents to $1.935.

So far this winter season, bouts of cold weather have been quickly followed by periods of milder temperatures, and with weather data flip-flopping a bit, natural gas traders are understandably uncertain over the prospects for sustained cold later this month. The weather models overnight Wednesday trended colder overnight, with both the Global Forecast System (GFS) and European models adding heating demand to the outlook.

“The GFS model has been quite aggressive with the amount of cold into the U.S. and had been the odd/cold model out” until overnight trends saw other models shift colder to close the gap, NatGasWeather said. “How long cold can last into November is the primary question ahead of the weekend break and likely at least a few days into it.”

As for the midday GFS model run, it was little changed through early next week, but lost a little demand Oct. 27-29 by seeing a little break between cold shots. The dataset, however, still favors another solid cold shot into the United States Oct. 31-Nov. 2.

“Overall, still a solid bullish run from the GFS, but lost the 5-6 heating degree days (HDD) it gained last night, which should be no surprise as it’s been trending colder for days in a row and giving back a few HDDs was warranted,” NatGasWeather said.

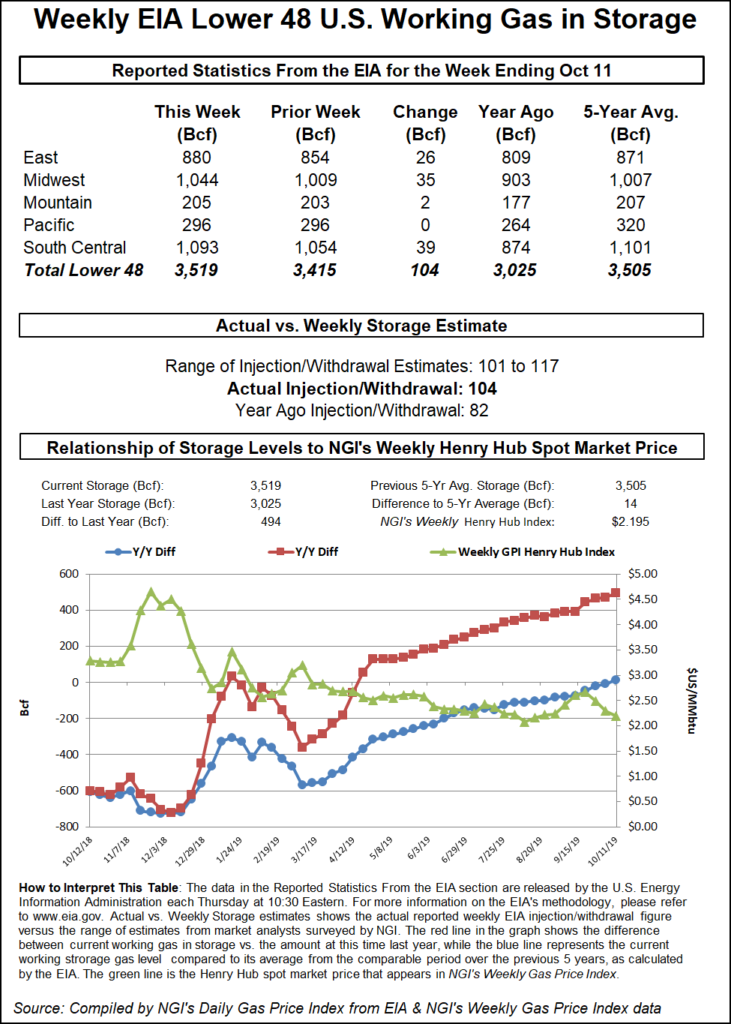

Without more convincing evidence of sustained cold in the coming weeks, fundamentals remain largely bearish for the market. On Thursday, the Energy Information Administration (EIA) reported a 104 Bcf injection into natural gas storage inventories for the week ending Oct. 11, marking the third time in four weeks that stocks have risen by at least 100 Bcf.

The reported build easily surpassed last year’s 82 Bcf injection and the five-year average of 81 Bcf, but it did fall on the lower end of expectations. Ahead of the EIA report, a Bloomberg survey produced a median 108 Bcf estimate, with estimates ranging from 101 Bcf up to 117 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at 108 Bcf. NGI’s model predicted an injection of 115 Bcf.

Speaking on the industry chat platform Enelyst.com, Bespoke Weather Services chief meteorologist Brian Lovern said the 104 Bcf injection doesn’t really change the supply/demand picture in its model, even though its 105 Bcf projection was in line with the actual print. “From here, the trade depends on the next shift in the weather models.”

Broken down by region, the South Central added 39 Bcf into storage, including a 17 Bcf injection into salt facilities and 22 Bcf into nonsalts, according to the EIA. Midwest inventories rose by 35 Bcf, while the East rose by 26. Pacific stocks held steady at 296 Bcf.

Total working gas in storage as was 3,519 Bcf, 494 Bcf above year-ago levels and 14 Bcf above the five-year average.

“It looks to me like, psychologically, the market has accepted the high end-of-season number, and is cautiously stepping forward with minimum anxiety,” Huntsville Utilities’ Donnie Sharp said on Enelyst.com. “Other than some more short-covering rallies, I think the towel is ready to get tossed. Just waiting on weather. Weather rules. The anxiety can change very quickly.”

DTN’s current Week 4 outlook presents a continuation, albeit considerably milder, of the warm Southwest/cool eastern United States pattern from Week 3. The 105 gas-heating degree day (GHDD) forecast registers 3 GHDD above normal and represents an 8 GHDD increase week/week to increase demand by 1.4 Bcf/d, according to EBW Analytics Group.

“While confidence is building in chilly weather for late October, conflicting weather models may be overly quick to develop colder weather — and slower development may let cooler temperatures slip into early November,” the firm said.

Early-season cold in the Rockies and on the East Coast proved not intimidating enough to boost prices, while mild weather across the South and Southeast resulted in double-digit declines in those regions.

In California, SoCal Citygate next-day gas plunged 21.5 cents to $3.055, while farther north, Malin dropped 11.0 cents to hit $1.965.

Northwest Sumas in the Rockies plunged more than $1 to average $2.470, while Cheyenne Hub tumbled 29.0 cents to $1.345.

The declines occurred even as a train of weather systems began moving through the region on Thursday. None of the storms appear to be powerful enough to bring widespread damaging winds, but they will bring rounds of rain and mountain snow and periodic blustery conditions, according to AccuWeather.

“Each successive storm will add snow and bring episodes of poor visibility, falling temperatures and gusty winds. Through the middle of next week, several feet of snow may pile up over the high country,” AccuWeather senior meteorologist Alex Sosnowski said.

On the pipeline front, Transwestern Pipeline declared a force majeure on Wednesday due to an equipment failure at its Station 8 in Corona, NM. A mechanical failure at one of Transwestern’s compressor stations moving gas west through New Mexico led to a roughly 250 MMcf/d operating capacity reduction, to 485 MMcf/d from 728 MMcf/d, through Station 9 at Roswell.

The repair work cut about 130 MMcf/d of westbound flows for Thursday.

Transwestern has declared an average of one force majeure/month this year, with none of them lasting longer than five days, according to Genscape Inc.

Over on the East Coast, gusty winds are ushering in some of the coldest air of the season so far, with lower temperatures being funneled into the region behind a ”meteorological bomb’ that brought flooding rainfall, damaging winds and pounding seas at midweek, according to AccuWeather. But with sunnier skies on Friday, spot gas prices across the region slipped.

Transco Zone 6 NY fell 2.5 cents to $2.015, while Dominion South in Appalachia was down 9.0 cents to $1.725.

Over the next week, Texas Eastern Transmission (Tetco) will begin two significant events outside the more important M3 winter maintenance.

First, Tetco will conduct pipeline maintenance on its Line 30 between the Berne, OH, and Holbrook, PA compressor stations from Oct. 19-28. During this outage, the Markwest Majorsville processing plant meter will be shut in, after averaging 88 MMcf/d and maxing at 121 MMcf/d in production month to date. This should not greatly affect production in the Northeast as Markwest has various reroute options, according to Genscape.

Then on Oct. 22, 24 and 27, Tetco is scheduled to perform various cleaning tool runs on different segments of Line 16 between the Tivoli, TX, compressor and the end of the line at the Pemex Mexico delivery point, which will affect various power plant meters. Deliveries to the Nueces Bay power plant will be shut in on Oct. 22 and 24, and the Barney Davis Plant will be shut in on Oct. 24.

“Flows and pressures may fluctuate on these days, but deliveries to the Magic Valley Plant and to the Pemex export point should not be shut in,” Genscape analyst Josh Garcia said.

Month-to-date deliveries to Nueces Bay have averaged 71 MMcf/d and maxed at 101 MMcf/d, and Barney Davis month-to-date demand has averaged 94 MMcf/d and maxed at 120 MMcf/d, according to Genscape.

As for next-day prices in Texas, losses were seen across the state, with the steepest declines occurring in West Texas, where El Paso Permian cash was down 14.0 cents day/day to $1.210.

Meanwhile, the National Hurricane Center (NHC) continued to monitor a tropical disturbance over the southwestern Gulf of Mexico. In its 2 p.m. ET update, the NHC said that the system was moving toward the north near 7 mph. A turn toward the northeast was expected late Thursday, and a northeastward motion at a faster forward speed was expected on Friday and Saturday. On the forecast track, the system was forecast to approach the northern Gulf Coast on Friday.

Elsewhere, double-digit decreases were seen throughout the Midcontinent and Midwest, where Chicago Citygate tumbled 14.0 cents to $1.970.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |