It is no longer news that the marketplace is gradually moving online. With about 101.72 million mobile internet users in Nigeria, you can be sure that a significant fraction of the 37 million MSME’s in Nigeria is jostling for business online.

These online businesses are powered by e-commerce which is providing limitless product choices. When doing business online, cash is not necessarily king and as such there are diverse e-payment options. A payment card is one of the most popular payment methods.

While most cardholders have physical cards, the security risks associated with them are just too much because they link directly to bank accounts. What if you can transact using a virtual card that isn’t directly linked to a bank account?

What are virtual cards and how do they work?

Virtual cards have the qualities of physical cards. You can use them for the same purposes only that you can’t hold them physically. They are issued by fintechs like Visa, Flutterwave etc, as well as traditional banks who have started issuing their own virtual cards to their customers with the promise of safety and efficiency in transactions.

According to the Mercator Advisory Group, there will be $315.1 billion dollars a year in commercial purchasing with virtual cards by end of 2021.

A virtual card allows you to pay for goods and services online or on apps without needing to use your real card and without your actual account information.

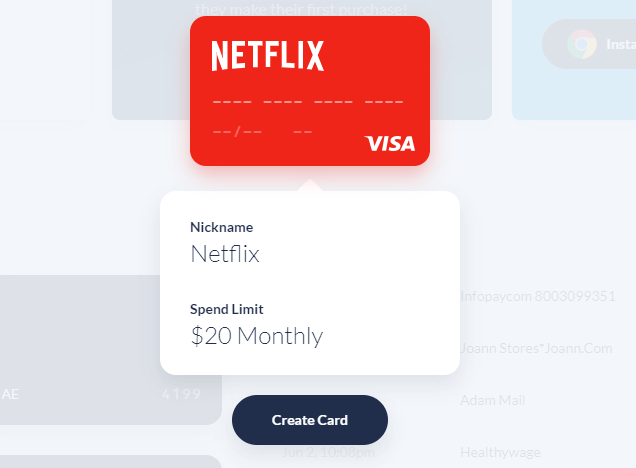

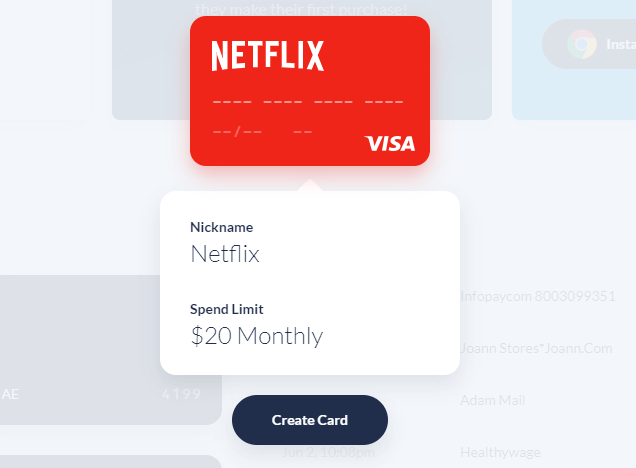

To get one, users can simply create a virtual card on any fintech platform or bank that issues one, load money from your account onto the card and use it for whatever transactions you need to carry out online. This means the amount of money in it is limited.

With a virtual card, one can make payments for both local and international purchases. It kind of makes everything easy.

Virtual cards vs physical cards

A physical card, by its name, has a physical form. As such it could be carried about in wallets, bags etc. Virtual cards, on the other hand, are intangible and therefore can’t be seen or carried about. As such, one doesn’t need to worry about theft, damage, etc.

Usually, a physical card is issued by a bank and traditional financial institutions. Virtual cards on the other hand, can be issued by fintech companies and traditional banks.

The card has a sixteen-digit number that is unique to you and also 3 digits at the back known as CVV- Card verification value. This number is vital for completing online transactions and should be known only to you.

With physical cards, the numbers issued on the card are constant and are valid for about 3-4 years before they expire. This permanency is a risk because once fraudsters have knowledge of it, they can have direct access to your account.

Virtual cards instead have numbers that are generated randomly for each transaction. A user could choose the amount they want to fund their virtual card with and that sum will be separate from the actual account.

Why virtual cards?

Virtual cards can be issued for single-use or recurring use – for example in the case of a monthly subscription renewal. People have often complained about how they link their actual cards to subscription services and when they stopped using those services or when they didn’t need them, the subscription fee was still deducted.

This issue can be avoided if a virtual card is used to sign up for the service as only the amount needed at a particular time can be funded.

Virtual cards help you to protect your real account information especially when you are unsure of the credibility of a website. You can also curb financial excesses as only a certain amount is made available on the card. You can transact using different currencies like with the Barter dollar card by Flutterwave.

The Visa virtual cards have added security measures. They are protected by encryption technology and cannot be traced back to your account or to your business. The cards cannot be used to withdraw money, and they can expire immediately after they are used or after a short duration, this means that if anyone finds the numbers and tries to use them later, it would be unsuccessful.

Andrew Uaboi, Country Manager of VISA NIGERIA

Per Experian, disposable card numbers can add an additional level of security in an age when retailer data breaches seem to be commonplace. If a hacker manages to get ahold of your virtual credit card information, you can simply cancel that virtual card without needing to close your entire account and get a new one.

However, because virtual credit cards are designed for online transactions, there are some situations in which using a virtual number could backfire.

For instance, if you make a purchase online and you have to return it and request a refund, it will be difficult to get the seller to send the refund to another number instead of the one you initially used.

Also, as virtual cards enjoy more adoption and become more popular, you can expect scammers to employ their ingenuity into ferreting out ways to exploit the system and defraud people of their hard-earned money. Country Manager for Visa noted as much when he said:

“People’s lifestyle and shopping behaviour around the world has changed dramatically in the past year. And while the increased availability of online shopping and contactless payments is convenient, it makes it more lucrative for scammers to trick buyers into paying for goods they will not receive or obtain their personal information for financial gain.”

Moving on

With the Covid-19 pandemic ushering in an era of remote work, the WHO advises that when possible, contactless payments are a good idea. Physical cards can still pass from hand to hand at the point of exchange but with virtual cards, its’ entirely in your hands.