Our View On Home Capital Group's (TSE:HCG) CEO Pay

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

This article will reflect on the compensation paid to Yousry Bissada who has served as CEO of Home Capital Group Inc. (TSE:HCG) since 2017. This analysis will also assess whether Home Capital Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Home Capital Group

How Does Total Compensation For Yousry Bissada Compare With Other Companies In The Industry?

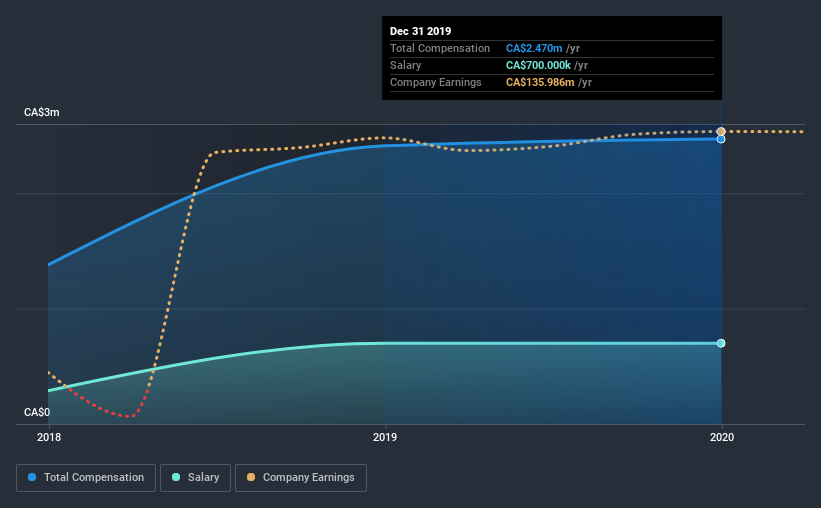

At the time of writing, our data shows that Home Capital Group Inc. has a market capitalization of CA$1.0b, and reported total annual CEO compensation of CA$2.5m for the year to December 2019. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$700k.

On comparing similar companies from the same industry with market caps ranging from CA$543m to CA$2.2b, we found that the median CEO total compensation was CA$2.8m. This suggests that Home Capital Group remunerates its CEO largely in line with the industry average. Moreover, Yousry Bissada also holds CA$1.0m worth of Home Capital Group stock directly under their own name.

Component | 2019 | 2018 | Proportion (2019) |

Salary | CA$700k | CA$700k | 28% |

Other | CA$1.8m | CA$1.7m | 72% |

Total Compensation | CA$2.5m | CA$2.4m | 100% |

Speaking on an industry level, nearly 47% of total compensation represents salary, while the remainder of 53% is other remuneration. It's interesting to note that Home Capital Group allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Home Capital Group Inc.'s Growth

Home Capital Group Inc. has reduced its earnings per share by 14% a year over the last three years. In the last year, its revenue is up 9.1%.

Few shareholders would be pleased to read that earnings have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Home Capital Group Inc. Been A Good Investment?

Most shareholders would probably be pleased with Home Capital Group Inc. for providing a total return of 51% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As previously discussed, Yousry is compensated close to the median for companies of its size, and which belong to the same industry. This isn't great when you look at it against the backdrop of earnings growth, which has been negative for the past three years. But on the bright side, shareholder returns have moved northward during the same period. We're not saying CEO compensation is too generous, but shrinking EPS is undoubtedly an issue that will have to be addressed.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Home Capital Group.

Switching gears from Home Capital Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.