A growing number of U.S. financial institutions — including Citigroup, Bank of America, and Wells Fargo — are empowering their customers to fight fraud by giving them an on/off switch for their debit and credit cards. By using an app or going online, customers can temporarily turn off their cards so they can't be used for new purchases.

This month, American Express joined the list of banks and major credit card companies offering this on/off feature for consumer and business cards. A “freeze” lasts for seven days, unless canceled, and does not affect recurring transactions, such as subscriptions or monthly bills posted to the account.

As Amex explains on its website, “If you can’t find your card, freeze it to help protect your account and give yourself peace of mind while you look for it. Once you find it, unfreezing is quick and easy."

Discover was the first major credit card company to give customers this added control. “Freeze It” was introduced in 2015 and has become one of the card’s “most popular features,” according to Discover Vice President Laks Vasudevan.

“While true that all Discover credit cards come with our $0 fraud liability guarantee, nobody wants their credit card to be misused,” Vasudevan told NBC News. “Freeze It is a simple way to prevent the potential misuse of your card, and assuming you’re able to relocate it, to turn your card back on and continue using it in a matter of seconds.”

These other major credit card companies now offer an on/off switch:

- Bank of America: All debit cards

- Capital One: Card Lock for all credit cards

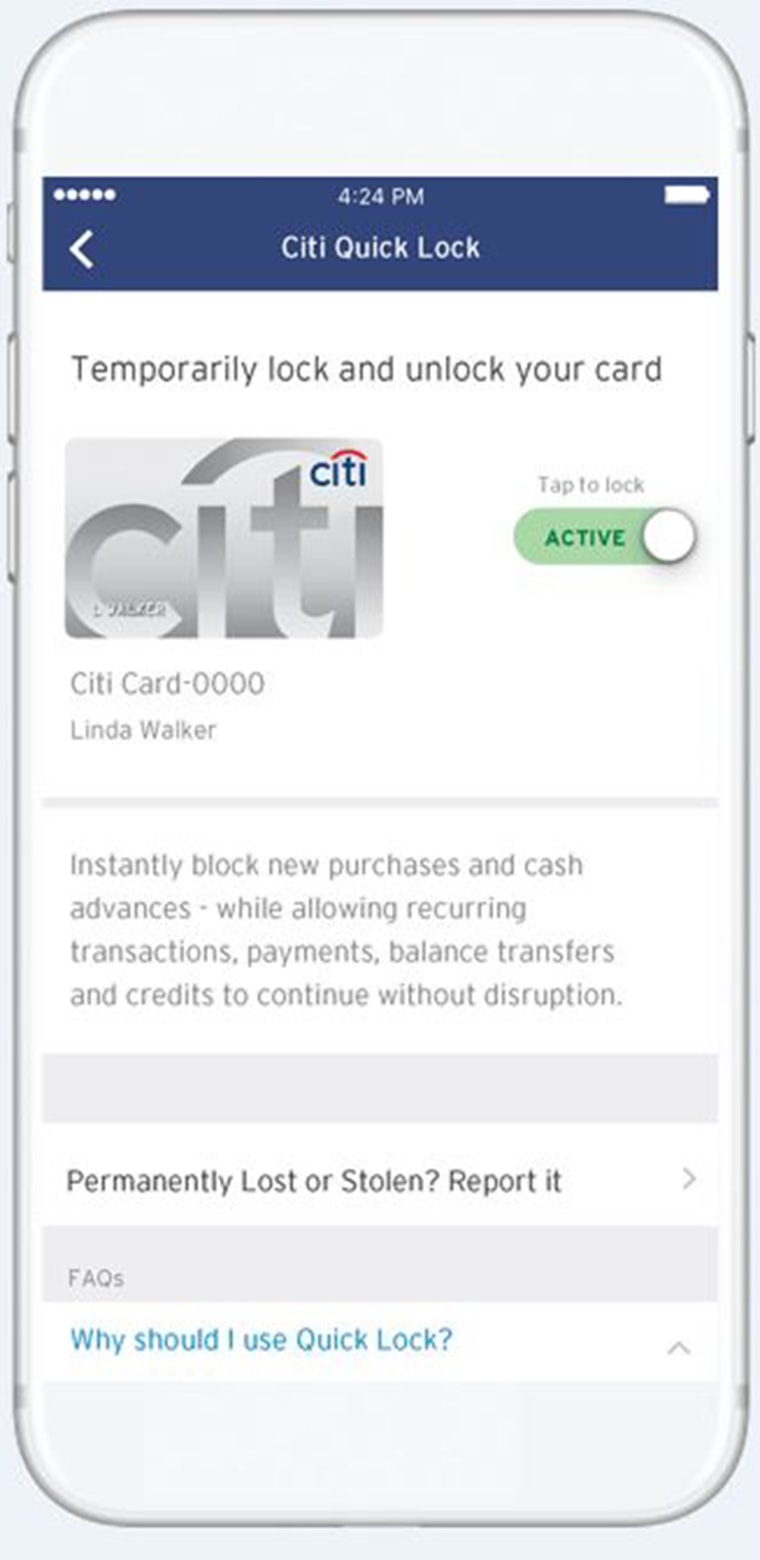

- Citi: Quick Lock for all debit and credit cards

- USAA: All credit and debit cards

- Wells Fargo: All debit cards

Bank of America launched the locking feature for its debit cards in 2016. The service is now used more than a million times a month, the bank told NBC News.

“We started with debit cards because more people have anxiety about their debit cards — someone wiping out their checking account — versus running up charges on their credit card,” said Michelle Moore, head of digital banking at Bank of America.

Wells Fargo said its debit card customers “love the convenience and simplicity” of the on/off switch, according to Katherine McGee, head of digital product management. It’s so popular that the bank will soon add this feature to its credit card accounts, she said.

“Our goal is to provide customers with more control, simplicity and transparency, and this feature does exactly that,” said McGee.

Citibank’s Citi Quick Lock for debit cards proved so successful with customers that the bank expanded the feature to its credit cards in October.

“Since our customers are increasingly active on mobile or online, we’re giving them another tool to directly control their account activity across the bank,” said Citibank’s Elyse Lesley.

Mark Hamrick, senior economic analyst with Bankrate.com, is a big fan of enabling the customer to fight fraud.

“Effective tools that limit fraud end up benefiting both cardholders and the financial service firms providing them,” said Mark Hamrick, senior economic analyst with Bankrate.com. “It’s also, frankly, good marketing. People are worried that their accounts are at risk, so addressing those fears is smart.”

Some smaller banks and credit unions now offer apps that give their cardholders this on/off capability. CardValet (Fiserv) and CardNav (Cop-Op Financial Services) allow more sophisticated control of credit and debit accounts. Both apps can be downloaded by any cardholder.

"It’s way better to block any fraud rather than try to clean it up afterwards.”

For example, you can set spending limits, block transactions at certain kinds of merchants (such as a jewelry store) or limit the geographic region where that card can used (i.e., only within 25 miles of my mobile device or not outside the U.S.). You could also prevent any cash withdrawals until you’re right at the ATM.

“It’s pretty powerful,” said Dave Keenan, a senior vice president at Fiserv. “You get control of your card and when and where it can and can't be used. It’s way better to block any fraud rather than try to clean it up afterwards.”

And remember, if you find that misplaced credit or debit card — even if it’s locked or frozen — you should contact the bank or issuer. This will ensure you won’t be held liable for any fraudulent transactions on your account.

Herb Weisbaum is The ConsumerMan. Follow him on Facebook and Twitter or visit The ConsumerMan website.