Gary and Liz Stigen were on their spring vacation a couple of months ago when the coronavirus outbreak cut it short. Just days after arriving back home in Coon Rapids, both were out of work.

Now they wonder if they will ever work again.

At 61 and 59, the Stigens and millions like them are at an age that is particularly vulnerable during hard times — too young to retire and too old for a job market in which employers' options have exploded.

"Nobody is going to hire us at 60-something years old," said Liz, who passes that milepost early next year.

"Now all of a sudden, we're facing a new chapter in our lives that we really thought we had a few more years to plan for," she said.

The hair salon where she's been a stylist for 30 years closed in mid-March when social distancing restrictions took effect in Minnesota. Gary's job as a regional facilities manager at Cabela's in Rogers was eliminated later that month, and he's now collecting severance.

They ponder next steps amid other constraints. Their retirement savings have eroded because of the broad decline of stocks and other investments. And they're taking care of Liz's 83-year-old mother, who is undergoing cancer treatment and, as a result, is even more vulnerable to the virus.

Even so, the couple have been saving money for years and so far nobody close to them has encountered the virus.

"There's a heck of a lot more people out there that are in more dire straits," Gary said.

The Stigens aren't alone in the pandemic's demographic gray zone. Of the 550,000 Minnesotans who have sought unemployment benefits since March 15, 16% are between 55 and 65, and 6% are 65 or over, data from the state jobs agency showed last week.

Financial advisers have been inundated by clients approaching retirement who, after years or decades of planning and saving, now face challenges they never imagined.

"It's unprecedented. That word is overused certainly, but in this case, it's totally fitting and it's thrown a lot of people's personal financial success up in the air," said Patrick Egan, director of financial guidance at Minneapolis-based Thrivent Financial.

In contrast to the last recession in 2008 and 2009, this economic downturn comes with the added complication of health concerns, Egan said.

"This added burden of concerns about health because of the coronavirus, that is what I'm noticing is an undercurrent," he said. "There's heightened interest in that element of financial planning right now."

Easing into retirement

Even before the pandemic, baby boomers on the brink of retirement were falling into a different path — called phased, or flexible, retirement — that involved some form of part-time work to maintain income longer because people are living longer lives.

"A lot of people were starting to do that by choice," Egan said. "Now, they don't always have the choice."

Fear and uncertainty weren't factors in the Stigens' life back in early March. They were vacationing in Florida when they decided to end the trip two weeks early as coronavirus spread and began to limit the places and people they could visit.

They got back to Minnesota just as the salon where Liz worked had closed. A few days later, the downsizing at Cabela's began, though the outdoor retailer was deemed an essential business and allowed to remain open.

Liz is anxious thinking about returning to the hair salon when it reopens, fearing close contact with clients while also caring for her mother. "I have to make a choice of being safe for my mom," she said.

As a hair stylist, she is considered self-employed and was ineligible for ordinary unemployment benefits. Last month, Minnesota became one of the first states to distribute federal jobless aid to self-employed and contract workers, but Liz said the process has been difficult.

She's called the state jobs agency dozens of times only to hear a dial tone after a connection. "I've tried every single day that it's available and I still haven't been able to get through," she said.

Gary said he'll file for unemployment benefits after his severance pay runs out next month.

The Stigens are considering several options, including early retirement. That would mean selling their home and moving into their cabin in Annandale. They own the cabin and could reduce their monthly expenses by selling their house.

But the trade-off is distance from Liz's mother, Nancy Hartwell, who lives in a senior apartment community in Anoka. Liz delivers her mother's medication and groceries as the sole caretaker.

When Hartwell has a doctor's appointment, the Stigens wear masks and she rides in the back seat.

"She still has to go in and see the oncologist, but she's scared to death," Liz said, because people have been diagnosed with COVID-19 at the apartment complex.

The couple have a financial adviser who has guided them on savings and retirement plans. In recent weeks, the value of their investments dropped by $80,000, and they hope that will recover before they have start relying on their nest egg for income.

"It's just we don't know when that's going to happen," Gary said.

He hopes to secure a part-time job or seasonal work and try out semiretirement. "It's all so much up in the air right now because there's nobody hiring yet. So it could be three months or a year before things start picking back up and jobs become available," he said.

Gary has applied for six maintenance jobs. "It goes out into cyberspace and you never hear anything back," he said.

Liz said the couple simply doesn't know which way to go at the moment.

"We thought that, to plan out the perfect retirement, we'd have a few more years of smoothing out the edges and building up our coffers," she said. "We were on the cusp ... getting our ducks in a row, and then all of a sudden things just changed."

"And our world turned upside down," Gary added.

'The big unknown'

Michelle Young, an adviser with Ameriprise Financial, said two months ago she mostly heard from clients about the volatile market. Now, she's getting more calls from people who have been furloughed or laid off.

"You lose your job, the market's down, you can't leave your house, and you're worried about getting sick," Young said. "It's just so many things at one time and it feels like nobody is able to have a lot of control and make a lot of plans."

She advises people in their late 50s and early 60s who have lost work to cut expenses first and take some time to consider bigger moves. The decision to retire or work part time is a big one. When it is forced by an external condition like the pandemic, Young said, emotions can get in the way.

"The more things start to go back to whatever our new normal is going to look like, I think that will help people feel a little more comfortable or a little more at ease with what's going on," she said.

The Stigens said they know people in more challenging situations, without food or money saved to help make it through what Liz calls "the big unknown." They're making plans of their own, starting with a real estate agent coming by to value their home. Gary said he might start a chicken coop up at the cabin.

"Once the reality hits in and we lose our severance and we have to live on unemployment, we'll be growing a garden, too," Liz said.

kim.hyatt@startribune.com 612-673-4751

Marijuana's path to legality in Minnesota: A timeline

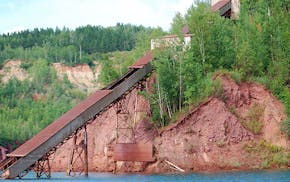

Minnesota to close state park on Iron Range, turn it back into a mine

U.S. Steel won't get exception to pollution rules that protect wild rice, MPCA says

Taste of Minnesota to be enjoyed on the ground and in the air this year