With more than 40% of the U.S. population fully vaccinated (according to New York Times data as of June 15), the economies of many cities have started rebounding at a faster pace. However, the rebound has not occurred at the same rate nationwide. Factors like vaccination rates, public spending, poverty rates, tax revenue and politics have contributed to varying rates of recovery. Keeping this in mind, SmartAsset has identified and ranked the cities with the strongest economic recoveries in 2021 from the COVID-19 pandemic.

Our study considers several economic factors to determine how a city is recovering in the wake of the pandemic. First, we examined changes in overall consumer spending. Then, we took a look at small businesses, specifically how many of them are open and their overall revenue compared to their pre-pandemic numbers. And finally, we took a look at overall job postings and the unemployment rate in cities across the country. For more details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Small businesses are still hurting. Two of our metrics, the number of small businesses that are open for business and small business revenue, are still down when compared to pre-pandemic levels. Data shows that while there is some improvement in terms of these two metrics, it will take more time to return to March 2020 levels.

- Mid-size cities are doing better. Of the top 10 cities in our study, only one (Jacksonville, Florida) is in the top 20 nationally in terms of population size. The rest are scattered throughout the top 50, but none of the larger cities in the country – like New York, New York; Los Angeles, California or Chicago, Illinois – are rebounding as quickly. Out of the biggest cities by population, the highest-ranked is Dallas, Texas, which places 19th in our study.

National Trends

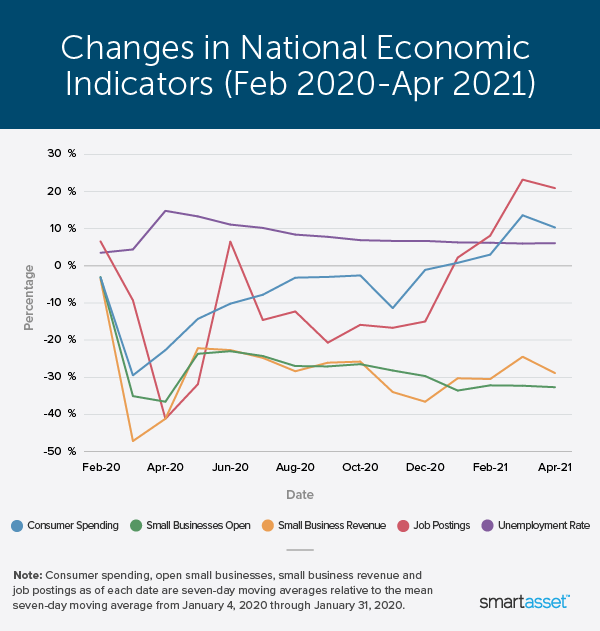

Consumer spending and small business revenue bottomed out nationwide in March 2020. That month, the seven-day moving average for credit/debit card spending was 29.5% lower than the mean seven-day moving average in January 2020. Similarly, small business revenue was more than 47% lower than it had been in January 2020.

The number of small businesses that were open, as well as job postings and unemployment fell to the lowest levels in April 2020. There were 35.1% fewer small businesses open when compared to January 2020 and job postings also fell during that same time period by 41.2%. Additionally, national unemployment peaked at 14.8%.

Since then, there have been different rates of recovery. At the end of April 2021, there were still roughly 33% fewer small businesses open when compared to the average number open in January 2020. Additionally, small business revenue was almost 29% lower than it was in January 2020. The chart below shows all five economic factors and their progression from February 2020 through April 2021.

Cities With the Strongest Economic Recoveries

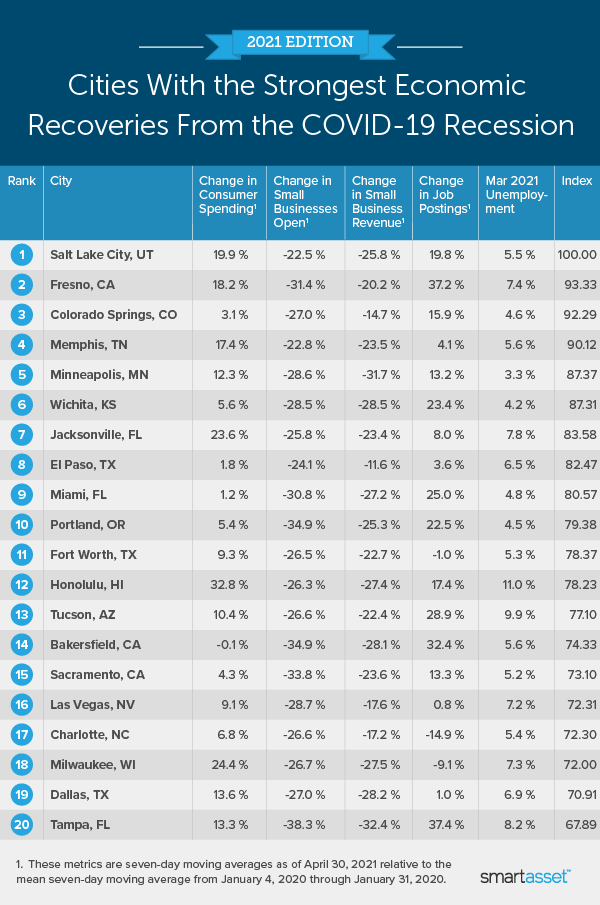

SmartAsset analyzed data for 49 of the largest U.S. cities to identify the local economies with the strongest recoveries. Considering the economic factors referenced above, we compiled a list of the top 10 cities recovering best from the COVID-19 pandemic.

1. Salt Lake City, UT

Though nearly every city in our study has seen growth in consumer spending compared to pre-pandemic numbers, consumer spending in Salt Lake City, Utah is up almost 20%. That is the eighth-highest figure for this metric. This city also ranks second for the number of small businesses currently open, with a 22.5% decrease since before the pandemic. It has also seen a significant uptick in new job postings; in the last week of April 2021, there were 19.8% more job postings when compared to the mean seven-day moving average in January 2020.

2. Fresno, CA

Fresno, California has excelled in our new job postings metric, which is up 37.2% from pre-pandemic levels and second only to Tampa, Florida. While the city’s small business revenue is down 20.2% from pre-pandemic levels, it ranks sixth for this metric in our study. However, the city falls behind with a 7.4% unemployment rate, ranking 37th in our study.

3. Colorado Springs, CO

Colorado Springs, Colorado ranks second in our study when it comes to small business revenue, down by only 14.7% from pre-pandemic numbers. Its unemployment rate is also quite low, at 4.6%. Consumer spending, however, is up only 3.1%, which ranks 35th in our study. The city also ranks 12th overall for both the number of small businesses open and the number of job postings.

4. Memphis, TN

Like Salt Lake City, Memphis, Tennessee has one of the lowest decreases in the number of small businesses open. The number of open small businesses in Memphis is only down 22.8% compared to pre-pandemic figures for this metric. Furthermore, this is the third-lowest rate for this metric in the study. Consumer spending in this city has gone up 17.4%. But new job postings are only up 4.1%, which ranks 25th among all the cities in our study.

5. Minneapolis, MN

With an unemployment rate of just 3.3%, Minneapolis soars ahead for this metric above all the other cities in our study. However, it falls near the middle of the pack for small business revenue, which is down 31.7% when compared to pre-pandemic levels.

6. Wichita, KS

Wichita, Kansas is the smallest city in the top 10 of our study. It ranks third for unemployment (with a 4.2% rate) and seventh for new job postings (up 23.4% from January 2020). Its rates for small business revenue (with a decline of 28.5%) and consumer spending (with an increase of 5.6%), however, rank 27th and 26th, respectively.

7. Jacksonville, FL

Jacksonville, Florida’s consumer spending is up 23.6% since January 2020, which is sixth-best in our study. And the percentage of small businesses open is only down 25.8%, which is the fifth-best of all cities in the study. However, this city had a relatively high March 2021 unemployment rate of 7.8%.

8. El Paso, TX

Small businesses in El Paso, Texas are recovering better than most around the country. The number of small businesses open in the city is only down 24.1% since January 2020, which is fourth-best in our study. Additionally, the city ranks first for small business revenue, with a 11.6% decrease over that time period. El Paso, however, falls to the bottom half of the study for the other three metrics. Specifically, consumer spending has increased only by 1.8% compared to pre-pandemic levels.

9. Miami, FL

Although consumer spending in Miami, Florida has only increased 1.2% since last January and the number of small businesses open is down over 30% in the same time period, the city has seen robust growth in the labor market. Job postings are up 25.0%, which is sixth-best in the study, and the city’s unemployment rate is just 4.8%, ninth-best overall.

10. Portland, OR

Portland, Oregon rounds out the top 10 with the highest gains in the labor market. The city ranks eighth-best for new job postings and sixth-best for relatively low unemployment. However, the city falls behind in small business revenue, which is down 25.3% since the pandemic began. It also ranks lower for consumer spending, which is just 5.4% higher than it was in January 2020.

Data and Methodology

To find the cities with the strongest economic recoveries from COVID-19, we considered a total of 49 cities. We compared them across five metrics:

- Consumer spending. This is consumer spending as of April 30, 2021 relative to average consumer spending between January 4, 2020 and January 31, 2020. Data comes from Affinity Solutions and was published by tracktherecovery.org.

- Small businesses open. This is the number of small businesses open as of April 30, 2021 relative to the average number of small businesses open between January 4, 2020 and January 31, 2020. Data comes from Womply and was published by tracktherecovery.org.

- Small business revenue. This is small business revenue as of April 30, 2021 relative to the average small business revenue between January 4, 2020 and January 31, 2020. Data comes from Womply and was published by tracktherecovery.org.

- Job postings. This is the number of job postings as of April 30, 2021 relative to the average number of job postings between January 4, 2020 and January 31, 2020. Data comes from Burning Glass and was published by tracktherecovery.org.

- March 2021 unemployment rate. Data comes from the Bureau of Labor Statistics and is at the county level.

To create our final rankings, we gave each city a score in each of the metrics based on how far above or below the mean they were. We used the sum of these numbers to create our final ranking. The city with the highest cumulative score received a score of 100, ranking as the place that has recovered the most. The city with the lowest cumulative score received a score of 0, ranking as the place that has recovered the least.

Tips for Protecting Your Finances During a Recession

- An emergency fund can help you prepare for the worst. A solid emergency fund helped get many people through the coronavirus pandemic, and it can also help withstand other uncertainties like job loss or the death of a loved one. Typically, an emergency fund should be able to cover three to six months of expenses.

- A financial advisor can help you prepare for an emergency tomorrow. Finding the right financial advisor that fits your needs doesn’t have to be hard.SmartAsset’s free advisor matching tool connects you with financial advisors in minutes. If you’re ready to be matched with local advisors, get started now.

Questions about our study? Contact us at press@smartasset.com.

Photo credits: ©iStock.com/Mahsun YILDIZ