Do Hedge Funds Love Fortune Brands Home & Security Inc (FBHS)?

Is Fortune Brands Home & Security Inc (NYSE:FBHS) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments. Is Fortune Brands Home & Security Inc (NYSE:FBHS) a splendid investment right now? Money managers are selling. The number of bullish hedge fund bets dropped by 4 lately. Our calculations also showed that fbhs isn't among the 30 most popular stocks among hedge funds. In the eyes of most traders, hedge funds are viewed as underperforming, outdated investment vehicles of years past. While there are greater than 8,000 funds trading at present, Our experts look at the crème de la crème of this club, about 700 funds. These investment experts administer bulk of all hedge funds' total asset base, and by monitoring their first-class equity investments, Insider Monkey has formulated numerous investment strategies that have historically exceeded the S&P 500 index. Insider Monkey's flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We're going to take a glance at the new hedge fund action encompassing Fortune Brands Home & Security Inc (NYSE:FBHS).

How have hedgies been trading Fortune Brands Home & Security Inc (NYSE:FBHS)?

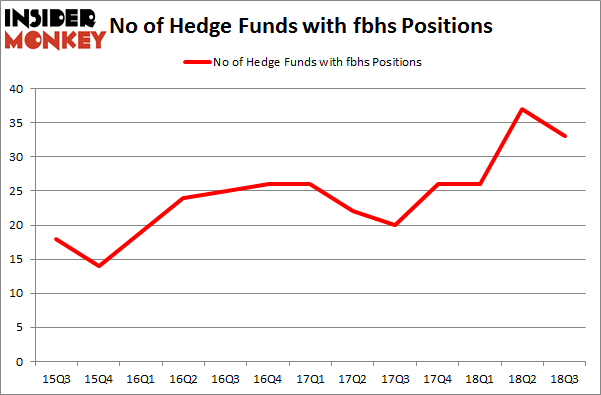

At Q3's end, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -11% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in FBHS over the last 13 quarters. With the smart money's positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Glenview Capital, managed by Larry Robbins, holds the biggest position in Fortune Brands Home & Security Inc (NYSE:FBHS). Glenview Capital has a $127.5 million position in the stock, comprising 0.8% of its 13F portfolio. On Glenview Capital's heels is Incline Global Management, managed by Jeff Lignelli, which holds a $56.6 million position; 4% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism consist of Phill Gross and Robert Atchinson's Adage Capital Management, Mario Gabelli's GAMCO Investors and D. E. Shaw's D E Shaw. Since Fortune Brands Home & Security Inc (NYSE:FBHS) has witnessed a decline in interest from the smart money, it's safe to say that there exists a select few money managers who sold off their entire stakes last quarter. Intriguingly, Jonathan Barrett and Paul Segal's Luminus Management dumped the largest position of all the hedgies followed by Insider Monkey, valued at about $6.7 million in stock, and Gregg Moskowitz's Interval Partners was right behind this move, as the fund sold off about $4.9 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds last quarter. Let's check out hedge fund activity in other stocks - not necessarily in the same industry as Fortune Brands Home & Security Inc (NYSE:FBHS) but similarly valued. We will take a look at Ingredion Inc (NYSE:INGR), The Madison Square Garden Company (NASDAQ:MSG), EPAM Systems Inc (NYSE:EPAM), and RingCentral Inc (NYSE:RNG). All of these stocks' market caps match FBHS's market cap. [table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position INGR,21,338525,-1 MSG,40,1773567,-2 EPAM,21,165154,-1 RNG,42,1084469,2 Average,31,840429,-0.5 [/table] View table here if you experience formatting issues. As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $840 million. That figure was $598 million in FBHS's case. RingCentral Inc (NYSE:RNG) is the most popular stock in this table. On the other hand Ingredion Inc (NYSE:INGR) is the least popular one with only 21 bullish hedge fund positions. Fortune Brands Home & Security Inc (NYSE:FBHS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. In this regard RNG might be a better candidate to consider a long position. Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index