As quantum computing makes its first forays from the lab to the real world, are the latest claims mere hype causing a bubble that will burst before the field finds its feet? Or are investors and researchers right to be enthusiastic about this burgeoning technological revolution? Philip Ball investigates the successes and pitfalls of commercializing quantum information technology

When the world’s “first quantum computer” hit the market in 2015, the response was decidedly mixed. Perhaps it’s not surprising that demand for the machine was not exactly clamorous, given its price tag of $10m. But some accused the makers, the quantum-computing company D-Wave Systems from Burnaby in Canada, of hyping the abilities of its machine – which was not even unanimously agreed to be making use of quantum principles at all.

It wasn’t an auspicious start to the commercialization of quantum information technologies (QITs). But that’s not unusual for a new technology. The first motor cars, after all, were prohibitively expensive for most people and were considered health-and-safety hazards. Raising great clouds of dust on unsurfaced roads, cars incited such public opposition that drivers sometimes carried guns for self-protection. At least we know now that quantum computers – information-processing devices that exploit the laws of quantum mechanics to develop new capabilities – are possible. “There is no known barrier from the physics side to building such machines,” says physicist Ian Walmsley, provost of Imperial College in London. “But we’re now moving to the very difficult and challenging engineering that you need to make these things work.”

QIT has not yet found its Henry Ford or Bill Gates to democratize the industry with affordable and reliable devices. “At this stage it’s a game of iterative engineering improvement, not conceptual breakthroughs,” says Chad Rigetti, founder and chief executive of the quantum-computer company Rigetti Computing in Berkeley, California. But already the commercial sector is growing fast. “This ramping up of industrial activity has happened sooner and more suddenly than most of us expected,” says quantum theorist John Preskill of the California Institute of Technology in Pasadena.

Private and public investment

Projections for the future size of the quantum computing industry vary – but most are big. “I think quantum computing will represent a $1bn market by the middle of this decade, and perhaps $5–10bn by 2030,” says Doug Finke, who runs the QIT-tracking website Quantum Computing Report. The latter value would be 10–20% of the value of the high-performance computing market today. According to an estimate from Honeywell, QIT could be worth $1 trillion over the next three decades.

Quantum computing will represent a $1bn market by the middle of this decade, and perhaps $5–10bn by 2030

Doug Finke

It’s no wonder, then, that the commercialization of QIT is attracting serious investment, both public and private. The US government is putting about $1.2bn into its National Quantum Initiative (NQI) programme, officially launched at the end of 2018, to provide an overarching framework for quantum information science R&D in academia and the private sector. The UK’s National Quantum Technology Programme (NQTP) kicked off in 2013 with around £1bn promised over a 10-year period, and is now entering its second phase. The level of investment by the Chinese government is largely a matter of rumour, although suggestions that it amounts to a whopping $10bn or so are probably wide of the mark, according to Chao-Yang Lu, a quantum physicist at the University of Science and Technology of China (USTC) in Hefei, near Beijing.

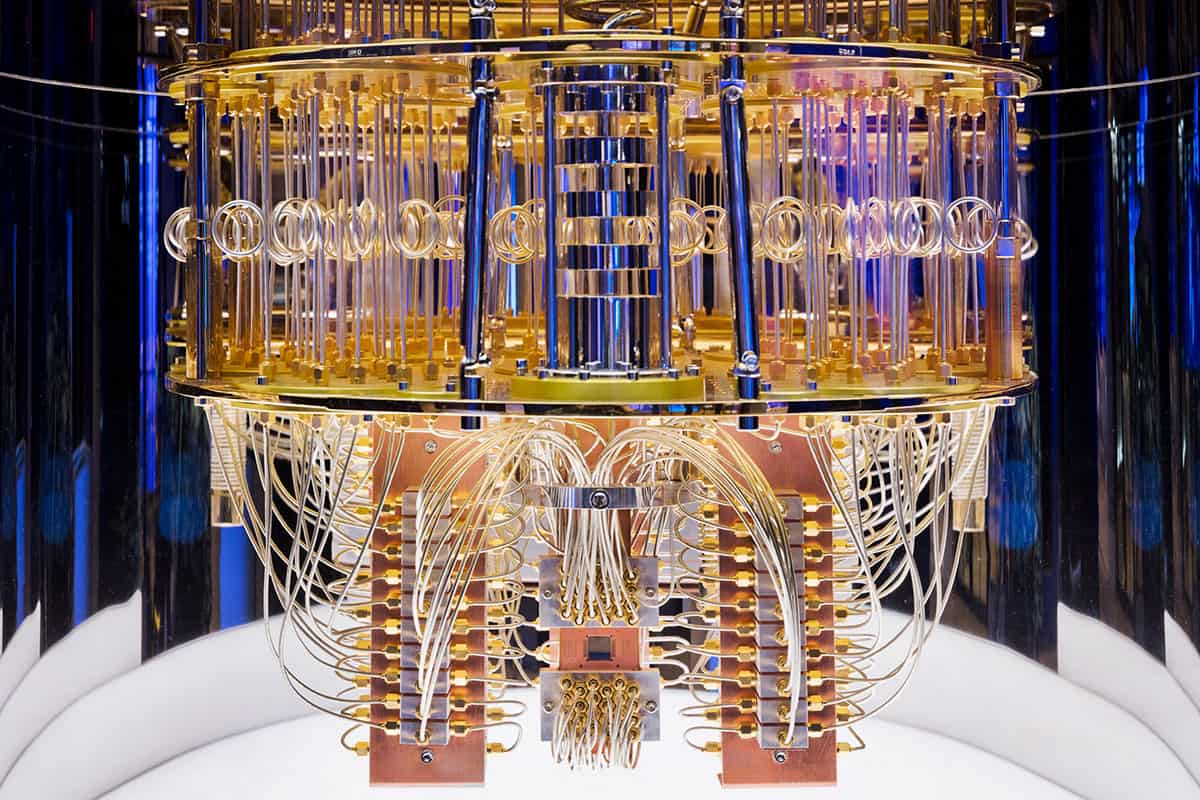

In the private sector, IT giants such as IBM, Google, Hewlett Packard, Honeywell and Microsoft are already heavily invested in quantum initiatives. One recent report claimed there has been more than $1bn of private investment in quantum computing in 2021 alone. In 2019 Google’s quantum-computing team claimed that its Sycamore quantum circuit – with 53 qubits – had demonstrated “quantum advantage” (also referred to as supremacy) carrying out a computation beyond the means of any classical device on a practical timescale. And in mid-2021, Honeywell announced a partnership with quantum-software developer Cambridge Quantum Computing in the UK. The pair came together to form a standalone quantum-computing company that they say will offer “the world’s highest-performing quantum computer and comprehensive quantum software, including the first and most advanced quantum operating system”.

From the cloud to cold atoms

The devices developed by IBM’s quantum- computing division have been made available for use by clients (currently more than 200,000 of them) via a cloud-based service. Users range from academic researchers and companies to schools, and much of it is available for no cost. “You have to get people familiar with this stuff,” says Bob Sutor, who is “chief quantum exponent” at IBM’s T J Watson Research Center in Yorktown Heights, New York state. Those machines have so far been housed mostly on the company’s sites, but IBM has begun to install them elsewhere too, including at one of the Fraunhofer institutes in Germany and at the University of Tokyo, licensed for exclusive use by the clients. However, Sutor thinks that cloud-based services will remain the norm.

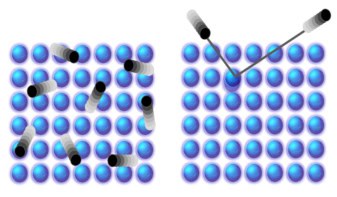

Rigetti has launched its own cloud-based resource too. “People are using it to do things like developing algorithms for problems in finance, chemistry, logistics, signal and image processing,” Rigetti explains. So, too, has IonQ, a start-up in College Park, Maryland, that has so far run around two billion jobs for customers. The company has produced 32-qubit devices in which the qubits are quantum-entangled ions held in electromagnetic traps in a chip-sized device. Their set-up works at room temperature, with lasers being used for input and output by exciting and probing the electronic states of the ions. The technology was developed by Christopher Monroe and colleagues at the University of Maryland. Having raised $83m of investment funding, IonQ began trading publicly on the New York Stock Exchange in October – the first purely quantum-computing company to do so – and quickly raised well over $600m.

D-Wave, meanwhile, is still producing devices that use superconducting qubits in an approach called quantum annealing, where the qubit resources are pooled to find solutions in an approach similar to the classical method of simulated annealing. The company has announced a new quantum chip called Pegasus, that would be used to make devices with more than 5000 qubits, originally scheduled for 2020 – but which has not yet materialized. There are several QIT start-ups in China too, such as QuantumCTek in Hefei, which specializes in quantum encryption and security, and was spun out from the pioneering lab of Jian-Wei Pan, along with Lu at UTSC – but the level of private investment in these firms remains unclear.

Boom or bust?

Even if the QIT industry grows as its advocates hope, it could be risky for venture capitalists to back a particular horse in a field that is still in flux. “There may be a few winners, but there will be a lot of losers too,” says Finke. Of the more than 200 start-ups in quantum technology that his company is currently tracking, Finke estimates that within 10 years the vast majority of them will no longer exist, at least in their present form. “Some will go out of business, some will be acquired and some will be merged,” he says.

It’s still not clear what the most important technology platform for QIT, and especially quantum computing, will be, says Walmsley (who until 2018 was director of the NQTP’s Networked Quantum Information Technologies hub at the University of Oxford). IBM and Google are placing their bets on qubits made from superconducting devices, while Honeywell is focusing on trapped ions.

I often caution investors not to concentrate their investments in just one quantum company

Doug Finke

Microsoft is taking what some regard as a high-risk strategy of aiming for “topological quantum computing”, in which the qubits are electron quasi particles – called Majorana zero modes – that are protected by their fundamental topological nature from incurring errors that could derail a computation. To pursue these elusive entities, Microsoft has established research partnerships in labs at the Delft University of Technology and the Niels Bohr Institute in Copenhagen. Others are aiming at photonic quantum computing, including the start-ups Orca Computing (cofounded by Walmsley) in Oxford and PsiQuantum in California.

“There is a lot of diversity in these technical approaches, and there could be significant risk in a company pursuing a specific technology,” says Finke. “So I often caution investors not to concentrate their investments in just one quantum company.”

Practical applications and challenges

So who are the first clients of QIT? Finance, oil, energy, automobile and aerospace are some of the sectors showing most interest, with IBM’s high-end quantum computers currently being used by the likes of Exxon, Daimler and JP Morgan Chase. One of IBM’s new installations is at the Cleveland Clinic in Ohio for use in pathogen research. Honeywell says that applications of its new company’s technologies will serve “cyber security, drug discovery and delivery, material science, finance and optimization across all major industrial markets”, as well as natural language processing and quantum artificial intelligence.

IonQ’s chief executive and president Peter Chapman says that he often only finds out what users have done with IonQ’s cloud-based system when the research is announced later. Volkswagen, for example, has used it for optimization problems in assembly lines, traffic routing and placement of electric-vehicle charging points.

Indeed, quantum computing is well suited to such problems of optimization, where the challenge is to find the “best” solution from a host of other possible ones. That’s a problem faced, for example, in managing supply chains to deliver goods or services to many clients in different locations with differing requirements and deadlines. Typically, there’s no classical algorithm for solving such challenges that doesn’t require trying each option in turn: a number that increases exponentially with the size of the system.

Companies already engaging with quantum computing simply want a head-start with what might soon become possible

Bob Sutor, IBM

Such problems are also common in finance, for example, to work out the optimum pricing of derivatives or to estimate portfolio investment risks. “There is a lot of engagement in quantum computing from the finance industry right now,” says Yianni Gamvros, head of business development at the Palo Alto-based quantum-software company QC Ware. His company has collaborated with Goldman Sachs to develop a quantum algorithm for Monte Carlo simulations, a common optimization procedure that can run on today’s “noisy”, error-prone quantum computers. They claim that the algorithm will be about a hundredfold faster than classical equivalents. IonQ, too, has worked with Goldman Sachs on quantum machine learning. Other possible applications of quantum algorithms in finance, says Gamvros, include fraud detection and trading recommendations. “A lot of the big banks are jumping in with at least one foot, and sometimes two,” adds Rigetti.

IBM’s Sutor stresses, though, that “nobody has a quantum computer that’s doing better than what classical can do yet, so you have to be careful to not sell people on something they think can do more than it can right now”. Companies already engaging with quantum computing, he says, simply want a head-start with what might soon become possible.

Diagnosis to cryptography

Even the most powerful of current quantum computers, such as Google’s Sycamore chip or IBM’s recently announced 127-qubit Eagle circuit, struggle to simulate much more than the simplest of chemical systems, such as small molecules. But it’s hoped that eventually they will be used to predict the properties of new materials and molecules with a precision that can’t be matched by classical simulations. “We expect the market to take off in two to three years for pharma and materials applications,” Gamvros says. But some corporate R&D departments are already laying the groundwork for intellectual-property rights and patents, and to develop the necessary skills. Quantum artificial-intelligence applications that use machine learning, meanwhile, might find uses in biomedical imaging and the detection and diagnosis of disease.

Another growth area for QIT is cryptography. The advent of quantum computers themselves raises the possibility of cracking standard cryptographic methods for secure data transfer via telecommunications networks (such as online credit-card orders) based on the difficulty of factorizing large numbers – quantum algorithms can do that much more quickly. But quantum computing offers a solution to that problem too. Because quantum information can be rendered indeterminate until it is measured, data encoded in this form can be made “tamper-proof”. If information is encoded in entangled quantum bits, such as the polarization states of photons sent along fibre-optic networks or broadcast to satellites, it can be impossible for an eavesdropper to intercept and read the information without being detected.

Quantum cryptography has already been demonstrated and used over long distances. For example, ballot data for regional elections in Geneva were encrypted this way in 2007 by the Swiss company ID Quantique, heralding the wider use of the technology worldwide. The company, founded in 2001, expects to see applications not just for confidential financial and political information but for medical data and as a defence against cyber attacks. A fibre-optic “quantum internet” network has been constructed in China reaching from Shanghai to Beijing, and in 2020 a team led by Pan at UTSC broadcast quantum-encrypted data over a distance of 1000 km within China via satellite.

Dublin-based market-research company Fact.MR has estimated that the quantum-cryptography market will expand at a compound annual growth rate of 30% over the next decade. “From transferring the confidential data of governments to offering secure banking and finance solutions, quantum cryptography is touted to be the future of encryption and security technologies,” say the company’s analysts, adding that the limiting factor in growth is the high cost of installing the necessary infrastructure and hardware, such as quantum-enabled satellites and signal boosters, along the route.

More qubits, less noise

Sutor is confident that the limitations of today’s quantum computers will recede as they get bigger and better. IBM plans to produce a 433-qubit chip in 2022, followed by a 1121-qubit Condor chip in 2023. Sutor forecasts that by the end of the decade there will be some degree of error-correction available from such advances. That’s currently the bugbear of today’s noisy quantum circuits: a fundamental quirk of quantum physics means that errors can’t simply be corrected by keeping multiple copies of each qubit, as in classical devices. Some error-correction schemes look likely to require hundreds or even thousands of physical qubits to make one error-tolerant “logical” qubit.

But Chapman says that trapped-ion qubits have already been shown to do much better than that. Recent work at IonQ showed error correction with a physical–logical qubit ratio of just 13:1, he says. He adds that because they don’t need bulky and expensive refrigeration, trapped-ion quantum computers can also be scaled up compactly and relatively cheaply. “Ultimately, the question is about cost per qubit,” he says. “Our plans are about dramatically reducing that. We think quantum computers need to be rack-mounted, low-cost devices that don’t need cryogenic systems of any kind.” That would make them amenable to portable uses, such as on aircraft, as well as accessible to companies that can’t afford the delay or security risk of submitting jobs into a queue on the cloud.

High hopes and expectations

But can this exponential growth and interest be sustained without producing inflated expectations? “I think a bubble is almost inevitable with the level of government funding and the number of hardware and software start-ups – probably more than 150 and counting,” says Gamvros. “We are now going through a rapid growth phase, but that will definitely be followed by a consolidation phase with mergers and acquisitions.” Walmsley hopes, however, that the diversity of both implementations and applications of QITs might avoid a dotcom-style bubble. “It’s important to ensure that things don’t run ahead of themselves, and overheat and spoil opportunities,” he says. “We shouldn’t be expecting that these machines will be available on your sofa tomorrow.”

To avoid such false expectations, Sutor says that IBM is being “painfully public about what our machines are and how they work”. What’s more, he says, you can run your own tests on them yourself. Still, “there is a lot of hype from the media because most of them don’t understand the technology”, adds Finke. “There is quite a bit coming from individuals in the quantum-computing industry too. Entrepreneurs trying to get funding may exaggerate the potential.” Gamvros thinks there is more of that on the software side, “because everybody can still claim to have a really strong algorithm while very little can be tested or proven”.

What you need to know before investing in quantum technology

Lu agrees that claims for the potential of QIT coming from industry, both in China and globally, can be inflated in order to raise venture capital. “A major misleading message from the industry is that quantum computing can speed up the calculation of everything by ‘parallel computing’,” he says. “This is not true. So far, the computational problems that can truly benefit from quantum computing are still quite limited, and even fewer enjoy an exponential speedup – others can have a more modest speedup.” Lu compares some of the hype to that which has plagued artificial intelligence – which, as a consequence, has experienced several “winters” of disillusion and neglect.

Lu also worries about how easy it is to distort the potential of quantum computing. For example, demonstrations of quantum advantage like that by Google (and which he and his colleagues claimed in a photonic system in 2020) don’t show “how brilliant quantum computers can be, but quite the opposite: they show what an early stage quantum computation is at”. He thinks that over the next five years or so, these technologies will largely remain useful tools for basic science.

In the next few years we will see successes being announced and organizations using quantum computing for real-world applications

Doug Finke

But Finke is not too concerned about the prospects of a bursting QIT bubble. “Although there will be some people who are disappointed because their investment does not pan out, I don’t believe there will be a general crash of investment,” he says. That’s because he thinks that in the next few years we will see “successes being announced, and organizations using quantum computing for real-world commercial or scientific applications”. Such successes “should be enough to keep the investments flowing from both the private and public sectors”.

Despite the risks of hype and disillusion, Lu is, overall, optimistic about the future of quantum computing. “We are just at the start. [So far] we may have discovered only the tip of the iceberg for quantum technologies. Even the brightest people have no idea how they are going to change the world.”