To Prevent Identity Theft, Set Up Web Access for Banking, Phone & Other Accounts

Seniors often think they're safer if they avoid all online activity. Experts say that's not the case.

Staying offline doesn't keep you safe from online threats.

That's bad news for many older Americans. According to a 2017 study by the Pew Research Center, 34 percent of senior citizens in the U.S. don’t use the internet. If you narrow that list to include only those over 80, the number rises dramatically, to 56 percent.

Tech-averse seniors may think that by staying offline they can avoid web-based scams that cost so many consumers both money and peace of mind.

“There’s this fear of the unknown, and it’s totally understandable,” says Marci Lobel-Esrig, founder of Silver Bills, a service that handles household bills for seniors electronically. “But I think there’s a false sense of security in hard-copy checks."

Privacy and security experts say that staying offline actually carries big risks. Carrie Kerskie, president of Griffon Force, a Florida-based firm that helps identity theft victims, explains that online accounts that haven’t been set up can fall into the hands of cybercriminals.

"It's much easier for bad guys to access accounts than most people imagine," she explains.

Anatomy of an Online Scam

The problem starts when criminals buy basic information about a consumer on a criminal marketplace, probably on the dark web. “I can go online and buy personal data for as little as five dollars,” Kerskie explains.

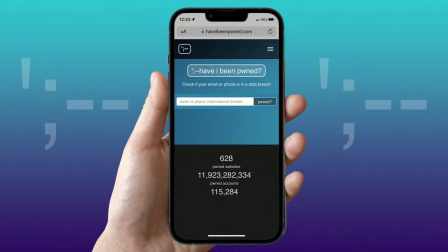

Such information could include your name, address, phone number, birthdate, and a Social Security number, which may have been stolen in a data breach and then put up for sale. And that material can be enough for a cybercriminal to initiate online access to an existing banking or investment account—sometimes even with the help of an unwitting customer service rep.

“The bad guy pretends to be the account holder,” Kerskie says.

How to Protect Yourself

There’s a simple way to deal with the problem.

We contacted JPMorgan Chase, Fidelity, and Charles Schwab, and they all had the same security solution: Just open online access for your account and secure it with a strong, unique password, which you shouldn't share with anyone you wouldn't give account access to.

"The advantage of an online account is that you can get instant access. You can get real-time information about any transaction," says Tom Kelly, a spokesman for Chase. He also encourages consumers to check their balances and statements regularly, either on paper or online, and report any unusual or unauthorized transactions immediately.

Although financial accounts should be your first priority, also make sure to protect your telephone and wireless accounts, which are a prime target for cybercriminals.

Kerskie says hackers target cell phones because they are commonly used to access banking and investment accounts, credit cards, and other important services. If criminals gain access to a single bank account, the damage can be severe. But a consumer's smartphone can help to unlock a range of accounts.

If you’re the sort of consumer who's simply not interested in doing business online, get someone to do it for you. If you have an adult child or a trusted friend who can set up the online account features and monitor them for unusual activity, you're golden.

For further peace of mine, says Lobel-Esrig, you can add a service such as Eversafe, an identity theft monitoring program she recommends that has senior-friendly features, including the option to allow an adult child or other authorized representative to receive notices of unusual account activity on your behalf.

Passing the Password Test

What's your password strategy when it comes to protecting your online accounts? On the "Consumer 101" TV show, a Consumer Reports expert explains what you need to know about password managers.