Live | China Markets Live - Shanghai and Shenzhen end marginally easier but claws back most of today’s losses; Hong Kong market ends strongly as HSBC verdict on headquarters cheer punters

HSBC stocks lift up after saying headquarters to stay in London, rejecting move to Hong Kong

Welcome to the SCMP’s live coverage of China’s financial markets. The intense volatility in Chinese markets in 2016 due to the implementation of the circuit breaker has roiled world financial markets. Investors are increasingly focused on the broader question of how this episode might affect the wider economy of the country. We’ll bring you the key levels, trading statements, price action and other developments as they happen.

4:10pm Ben Westcott

Hong Kong’s Hang Seng Index has surged after last week’s tumble, closing up 3.27 per cent by the end of the day to 18.918.14.

The China Enterprises index performed even more strongly to close up 4.78 per cent to 7,863.84.

Ample Capital Asset Management director Alex Wong said while the result looked good on the surface, it should have been stronger given last week’s plunge. “It will need to strengthen further to confirm any movement,” he said.

3:26pm Ben Westcott

The Shenzhen Composite finished down 0.04 per cent to 1,750.02.

3:17pm Ben Westcott

In Shanghai, the market got within a few points of closing higher but slipped just before 3 pm to finish down 0.63 per cent, at 2,746.20. At the beginning of the day it had been down more than two per cent.

Hong Kong was continuing its hot streak on Monday afternoon, an hour before closing, trading almost three per cent higher compared to its poor result on last Friday.

At 3 pm, it was sitting at about 18,856.43 while the China Enterprises Index continued to jump even higher, sitting at about 4.56 per cent up to 7,847.3.

2:05pm - Ben Westcott

In Shanghai, the stock market has slowly clawed back almost all the value lost in morning trading to sit around 2,739.48 points, 0.87 per cent down.

In Hong Kong, the Hang Seng Index stayed high after the midday break, up 2.9 per cent to 18,851.57, while the China Enterprises continued its surge, growing about 4.7 per cent by 2 pm at 7,857.84.

READ MORE: China stock markets down in response to week of global losses

12:50pm: Liz Mak

BEA bank’s reaction on US hedge fund Elliott Management’s recent attempt to talk it into auctioning its assets or replace its management.

In a statement released to the exchange, the bank said:

“The Board is of the unanimous view that, given the current challenging macro-economic and operating environment as well as the business initiatives that are under way, now is a poor time to contemplate a sale.

Consequently, the Bank will not be conducting an auction process. The management team and the Board remain committed to maximising shareholder value and believe that the best way to achieve

this in the current environment is to focus on execution and improving the Bank’s business.

The Bank has built a unique and valuable network across China and overseas which the Board believes will be of great benefit to the Bank and its shareholders in the longer term. The Bank also enjoys a sound capital position which will help the Bank weather the current challenging environment and capture growth opportunities.”

12:36pm Brendan Clift

At the mid-session break, the Shanghai Composite Index stands at 2,720.03 points, down 1.57 per cent, while the Shenzhen Composite is down 1.25 per cent on 1,728.90 points.

Hong Kong has perked up before lunch, the Hang Seng Index trading to to 18,819.59 points, up 2.73 per cent. The China Enterprises Index lifted 4.31 per cent to 7,829.12 points.

READ MORE: Regulation, not Mong Kok riots: why HSBC chose London over Hong Kong

11:28am Brendan Clift

The Shanghai Composite Index has traded up to 2,720.62 points, down 1.55 per cent on last closing. The CSI 300 index of Shanghai-Shenzhen large-caps stands at 2,921.40 points, down 1.43 per cent.

The Shenzhen Composite has also improved on its opening price, going to 1,728.32 points, down 1.28 per cent on last closing. The ChiNext Price Index of emerging tech stocks stands 0.31 per cent down on 2,090.49 points.

The Hang Seng Index has strengthened to 18,767.93 points, up 2.45 per cent, while the China Enterprises Index of major H-share companies is up 3.82 per cent to 7,791.89 points.

11:13am: Enoch Yiu

Onshore yuan traded by mainland traders rose sharply to 6.5154 per US dollar at 11 am, stronger by 0.84 per cent from the February 5 close at 6.57190.

Offshore yuan traded at 11am at 6.5181 to the US dollar, weaker by 0.13 per cent after it has hit a two month high at 6.4984 last Friday.

10:20am Brendan Clift

China’s January exports were down 6.6 per cent year-on-year, according to customs administration data just released, while imports were down 14.4 per cent.

10:05am Brendan Clift

HSBC Holdings has outperformed the Hang Seng in the first half-hour, lifting 3.43 per cent to HK$49.75, investors apparently welcoming the bank’s decision not to engage in a costly relocation and deciding the stock was oversold last week.

9:48am Enoch Yiu

The People’s Bank of China (PBOC) set the mid price fix for the onshore yuan at 6.5118 to the US dollar, stronger by 196 basis points or 0.3 per cent from February 5 before the market shut for a week due to the Lunar New Year holidays.

The fix would allow the onshore currency to catch up with the strengthening of the offshore yuan in the past week.

The offshore yuan market traded by international investors have strengthened by 0.51 per cent last week.

The central bank set the mid-price for the yuan against the Japanese yen weaker by 1,460 points to 5.7437, also reflecting the strengthening of the yen over the past week.

It set the mid price for the onshore yuan against the euro at 7.3397, weaker by 64 basis points, and it set the mid price for the onshore yuan against the pound at 9.4868, firmer by 612 basis points from the level on February 5.

Traders are allowed to trade two per cent above or below the midpoint set daily by the PBOC.

9:43am Brendan Clift

China markets take a hit on resumption as expected. The Shanghai Composite Index dropped 2.84 per cent to open on 2,684.96 points, while the Shenzhen Composite sank 3.25 per cent to 1,693.81 points.

But Hong Kong markets show signs of a rebound. The Hang Seng Index opened the week on 18,668.87 points, up 1.91 per cent, while the China Enterprises Index lifted 2.16 per cent to 7,667.35 points.

READ MORE: China stock markets open down after a week of global losses

8:47am Enoch Yiu

Here’s Hong Kong Monetary Authority chief executive Norman Chan’s response to decision by HSBC Holdings to stay put in London and not relocate it’s headquarters to Hong Kong.

“The HKMA appreciates that for a large international bank such as HSBC, relocation of domicile is a very major and complicated undertaking. We respect the decision of the Board of HSBC Holdings Plc to maintain the status quo.”

“I would like to stress that Hong Kong is the premier banking and financial hub in Asia, with all but one of the 30 Global Systemically Important Banks operating in Hong Kong. We note that The Hongkong and Shanghai Banking Corporation, which is headquartered in Hong Kong, has all along been the biggest source of profits for the HSBC Group, which will continue to use Hong Kong as the headquarters to grow and develop its business in the Asia Pacific region, including the major business investment plans in the Pearl River Delta”.

Hong Kong is located in the Pearl River delta of southern China.

READ MORE: HSBC announces it will stay in Britain, rejecting move to Hong Kong

8:20am Enoch Yiu

Hong Kong’s Hang Seng Index (orange) has lost almost 1,000 points in the two trading days last week to close at 18,319.58 on Friday, February 12.

The index has lost 16.4 per cent this year. The Hong Kong market closed from Monday to Wednesday last week for the Lunar New Year holiday.

Hang Seng China Enterprises Index (purple), also called the H-share index, closed at 7,505.37 on Friday February 12. It has lost 22.31 per cent so far this year.

Click to enlarge the chart.

8:20am Enoch Yiu

Shenzhen stock market will resume trading today after the Lunar New Year holidays.

Shenzhen Composite Index (orange) closed at 1,750.70 on February 5, off 1.15 per cent on the day and down 24.18 per cent so far this year.

ChiNEXT, the Nasdaq style start up market in Shenzhen, last traded at 2,096.99, down 1.39 per cent on February 5 and weaker by 22.74 per cent this year.

Similar to Shanghai, the Shenzhen market is seen opening to catch up with the losses suffered by most global markets.

Click to enlarge the chart

8:20am Enoch Yiu

The Shanghai stock market will resume trading today after the Lunar New Year holidays.

The Shanghai Composite Index (orange) closed on February 5 at 2,763.94, down 0.61 per cent on the day and off by 21.92 per cent so far this year.

The CSI300 (purple) which tracks large cap companies listed in Shanghai and Shenzhen, settled at 2,963.79 on February 5. It is down 20.56 per cent this year.

Analysts believe the Shanghai market would open lower as it plays catch up with the global rout which has hit world financial markets.

Click to enlarge the chart.

8:15am Enoch Yiu

Bank of East Asia will be the first local lender to report results today.

Chairman David Li and senior executives are expected to meet the media for a briefing at 1:30 pm about the company’s result and their view about hedge fund Elliott Management Corp, which now holds 7 per cent of the bank and has called for the board to explore selling the bank at an “appropriate premium”.

Bank of East Asia (orange) closed at HK$22.55 on Friday, down 0.44 per cent of the day and weaker by 21.84 per cent this year, compared with a loss of 16.40 per cent by the Hang Seng Index (purple).

Click to enlarge the chart.

8:15am Enoch Yiu

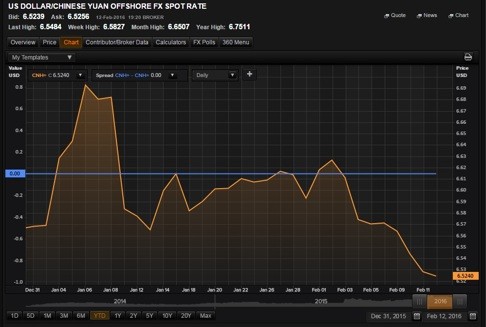

Offshore yuan (CNH) has had a bumpy ride so far this year . The currency rose strongly last week against the US dollar. It is now up 0.48 per cent versus the dollar as of the close of trade last week after depreciating 2 per cent in the first week of 2016. It traded at 6.5239 to the dollar at 7.30 pm last Friday.

The onshore yuan (CNY) market had been closed for the Lunar New Year holiday and reopens for trading today. It last closed at 6.5710 to the dollar on February 5. The currency has depreciated 1.2 per cent so far this year.