While overall M&A has cooled, plastics and packaging deal-making is up in 2017, according to an investment banking firm.

December 6, 2017

Driven by both strategic and private equity buyers, plastics and packaging merger & acquisition volume continued at a robust pace through the first three quarters of 2017, according to P&M Corporate Finance (Southfield, MI). Globally, plastics industry deals that include packaging increased by 24 (or 10%) versus Q3 YTD 2016, creating a strong likelihood that 2017 will surpass 2016's total.

Driven by both strategic and private equity buyers, plastics and packaging merger & acquisition volume continued at a robust pace through the first three quarters of 2017, according to P&M Corporate Finance (Southfield, MI). Globally, plastics industry deals that include packaging increased by 24 (or 10%) versus Q3 YTD 2016, creating a strong likelihood that 2017 will surpass 2016's total.

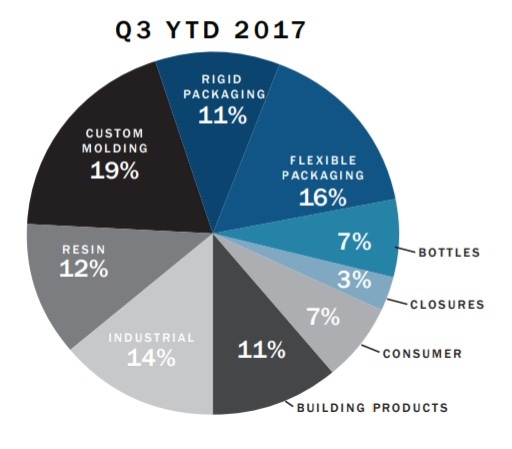

Within the global plastics packaging segment, Q3 YTD 2017 volume totaled 100 transactions, up 9 deals (or 10%) versus the 91 deals in Q3 YTD 2016. 2017 YTD activity reflects continued growth in deal activity since the first half of 2017.

Despite lower volume trends globally for M&A, the plastics and packaging segment remains highly active and 2017 could finish at a multi-year high for completed transactions. As a result, seller’s market conditions remain including elevated valuation levels.

"The plastics industry continues to attract strong interest from buyers interested in shaping the segment’s rapid consolidation,” says PMCF managing director John Hart. “The changing landscape is creating unique opportunities for large and mid-size players to enhance their positions via M&A.”

Historically, strategic buyers have been losing ground to private equity, decreasing through Q3 2016. However, through the first nine months of 2017, strategic buyer activity has gained momentum. These buyers have driven deal volume higher, increasing to 61% of total segment M&A in Q3 YTD 2017.

Industry strategic buyers were primarily focused on fragmented sectors including injection molding and more specialty processing types including foam, fabrication, and profile extrusion. Larger strategic buyers reflected higher activity levels for raw material businesses.

“Strategic buyers remain highly acquisitive, using M&A to offset low GDP growth and meet shareholder growth expectations,” Hart points out. “These dynamics have driven up pricing and created a unique environment for prospective sellers of plastic businesses.”

Go west to explore packaging, plastics and more February 6-8, 2018, during WestPack that’s co-located with PLASTEC West in Anaheim, CA. For more information, visit the WestPack website. |

While private equity was down slightly in terms of total deal count, investors remain focused and highly active in the segment. This was reflected in part via several notable deals including MSD Partners’ (Michael Dell) platform acquisition of RING Container Technologies and add-ons such as Tekni-Plex’s (Genstar Capital) acquisition of Alfatherm’s Self Adhesive Tape Business and ProAmpac’s acquisitions of PolyFirst Packaging and Clondalkin Flexible Packaging Orlando.

The latter deal, from August 2017, is one of a number of transactions that the report highlights. That’s when ProAmpac (Cincinnati) announced its acquisition of Clondalkin Flexible Packaging Orlando from Holland-based Clondalkin Group. Clondalkin Flexible Packaging is owned by Dutch-based private equity firm, Egeria. The division is an established leader in the liddings, foils and films segments. In 2002, Clondalkin acquired Spiralkote and renamed the business Clondalkin Flexible Packaging Orlando in 2014. The acquired operations will become part of the Extrusion and Laminations Division of ProAmpac. ProAmpac is owned by Pritzker Group Private Capital and is one of the top 10 packaging converters in the U.S. ProAmpac seeks to utilize the acquisition to meet increasing demand for daisy-chain portion-pack lidding.

In other news, Parkway Plastics (Capital Partners) acquired Avenue Mould and LMR Plastics to expand its growing custom molding platform. While investors recorded success, they were forced to meet sellers’ rich pricing expectations to prevail in competitive sale processes.

Deals favorable for sellers

On valuations Hart notes, “Pricing for plastics deals continues to be very favorable for sellers as deal multiples are at multi-year highs. These strong valuations can be attributed to the availability and low cost of capital, a fair level of optimism in the economy, and increased competition for a limited number of quality acquisition targets.”

Looking forward the outlook for plastics and packaging M&A appears to be favorable. Regarding the current environment Hart comments, “Q3 2017 was characterized by a growing economy with improved forward visibility, continued gains in the stock market, ample lending, and relatively stable energy prices.”

However, despite all these positives, PMCF research notes the extended length of the current cycle and cautions sellers that these conditions will eventually revert. Hart says, “The current buyer dynamics create a strong outlook for plastics M&A for the balance of 2017 and throughout 2018. With M&A multiples at multi-year highs, we believe it may prompt additional sellers and even traditionally longer term investors to contemplate a transaction in the short term.”

The full report can be found here: Q3 2017 Quarterly.

About the Author(s)

You May Also Like