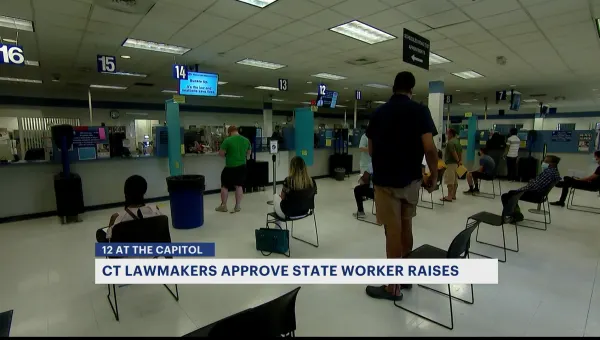

Lawmakers pass bill protecting residents from new tax law

<p>The Connecticut General Assembly fully passed late Wednesday a bill that is intended to protect residents from what lawmakers call the negative effects of President Donald Trump's tax law.</p>

News 12 Staff

•

May 10, 2018, 3:16 AM

•

Updated 2,176 days ago

Share:

The Connecticut General Assembly fully passed late Wednesday a bill that is intended to protect residents from what lawmakers call the negative effects of President Donald Trump's tax law.

The plan from Gov. Dannel Malloy aims to help Connecticut homeowners who face higher federal tax bills because the new tax law caps state and local tax deductions at $10,000 a year.

Malloy estimates Connecticut residents will lose $10 billion in federal tax deductions under the recent tax law.

The idea is that people would receive their local tax bill and make a donation to their municipality's charity in that amount.

Those charities would use the donations to fund town or city services usually paid for by tax dollars and taxpayers would itemize their returns and claim the deduction.

The result would be less money being paid to Washington.

“The disastrous Trump tax law is already hurting middle class Connecticut residents and small businesses,” Malloy said in a news release Wednesday. “Let’s be clear about what the president’s backwards legislation really does. Eighty-three percent of the benefits from this law go to the top one percent, while taxes actually increase for many middle class Connecticut families – all at the same time it causes our federal deficit to explode by $1.5 trillion. It is becoming clearer every day that the Republican law is nothing more than a massive giveaway for the very wealthy while the middle class pick up the tab. The legislation passed today protects Connecticut residents from unfair tax increase brought on by the Trump administration’s reckless agenda.”

Malloy now needs to sign the bill.