Applying hydrophilic coatings to medical devices is a sophisticated process that requires skill and careful thought.

February 18, 2011

|

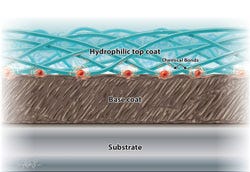

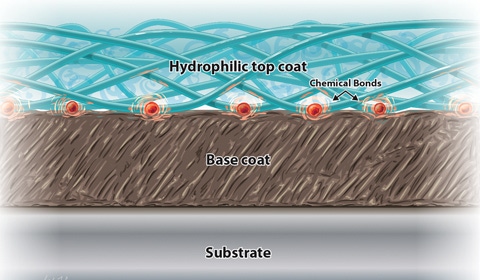

A cross-section illustration demonstrates the bonding mechanism common in hydrophilic coatings. |

Hydrophilic coatings exhibit water-loving characteristics. Chemically, this means they participate in dynamic hydrogen bonding with surrounding water. In most cases, hydrophilic coatings are also ionic and usually negatively charged, which further facilitates aqueous interactions. Physically, these chemical interactions with water give rise to hydrogel materials that may exhibit extremely low coefficients of friction. Taken together, such chemical and physical characteristics describe a class of materials that are wettable, lubricious, and suitable for tailored biological interactions.

Lubricity is a property that describes how slippery a surface is, i.e., the value of its coefficient of friction. Disposable medical devices such as catheters and guidewires benefit from this type of slippery surface treatment because it reduces the insertion force and allows them to traverse the vasculature more easily, avoiding possible puncture damage and severe abrasion between the device surface and the vessel walls. Common guidewires such as the Terumo Glidewire are known to employ hydrophilic coatings for this purpose. An added benefit of a hydrophilic coating is its potential to reduce or eliminate thrombosis when a catheter or guidewire is used.

In the field of ophthalmology, intraocular lenses (IOLs) are small devices used as replacements for the eye’s natural lens in cases for which the natural lens has experienced degradation from age or trauma. Delivery cartridges used to place IOLs must employ slippery surfaces to reduce damage to the IOL as it is injected in through the cartridge into a small incision before unfolding spontaneously within the eye. The lubricious coating in the cartridge also has the benefit of reducing the mechanical force on the cartridge material, which reduces the incidence of a catastrophic bursting of the cartridge during IOL injection. The use of such coatings has permitted a substantial reduction in the incision size with attendant improvements in patient recovery time. Major ophthalmologic device companies such as Alcon, Bausch & Lomb, Abbott Medical Optics, and Hoya Medical all employ coatings on IOL cartridges to achieve these objectives.

The ability to wet evenly with water is another useful property possessed by hydrophilic coatings used in medical devices. For in vivo medical devices that employ optically clear surfaces as lenses or windows, the clear surface can fog up. The remedy is using a hydrophilic coating to allow ambient microscopic droplets of water to spread over the surface evenly, forming a monolayer of water that is optically clear like the lens material. Diagnostic devices, such as glucose meters often require a coated film component that allows a liquid sample (such as blood) to spread evenly over the film before the tab is inserted into a reader. Hydrophilic coatings enable the aqueous sample to spread evenly over the film.

Hydrophilic coatings also find use in advanced applications, such as drug delivery and biological interactions. However, usage in drug delivery and other advanced applications requires detailed review. For any given new coating and any given drug, the combination must be tested. Chemical interactions between coatings and drugs are not constant, and reflect the functional groups, charges, and concentrations among the constituents. Nevertheless, once application specifics are resolved are worked out, hydrophilic coatings can be used to deliver antibiotics and other active pharmaceutical ingredients.

In certain applications, a benefit may be to incorporate molecules that have a biological function into the coating, which can interact with the body’s tissues in specialized ways.

|

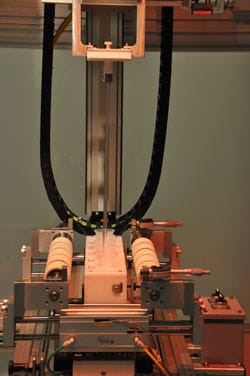

The dip-coating chamber shows funnels holding coating solution and rods suspended from a manifold which will lower into the funnels to be pulled back up again at a defined computer controlled speed. |

Understanding a Hydrophilic Coating Application

Whether a device will benefit from a hydrophilic coating or not requires an understanding of the device application. There are several key pieces of information to collect. First, it is important to be familiar with all materials used in the device, particularly those on which the coating will be applied, as well as the environmental conditions in which the device is manufactured, sterilized, stored, and used. Next, it is important to understand the extent to which the device will interact with biological tissues. In most medical applications, the device will require sterilization before use, and therefore, the parameters for sterilization and their effects on the device must also be understood. Developers should establish what effects the environment of use maybe be expected to have on the hydrophilic coating, and from there, the required durability of the coating. Finally, how much of the surface of the device needs to be coated to provide the required device function while providing the benefits of a hydrophilic coating.

Bonding

Device materials and the types of additives used in them can have profound effects on coating adhesion and durability. Depending on the substrate, a hydrophilic coating may adhere tightly or not at all. Even within a particular class of substrate, adhesion may vary according to a manufacturer’s proprietary additive package, processing conditions, or postprocessing treatment. Because of such material variability, it is difficult establishing a generalized set of rules governing coating adhesion. Each hydrophilic coating vendor has some substrates for which its coating works well, substrates that can be coated after special treatment, and others that its coatings cannot adhere to (see Table I). For example, one vendor may have a hydrophilic coating that adheres to polyurethane without difficulty, whereas another vendor’s coating may not adhere to that substrate whatsoever. Those two vendors could have the situation reversed for nylon. A common rule of thumb dictates that if a plastic substrate contains chemical groups containing oxygen or nitrogen, then hydrophilic coatings can be prepared to bond either through covalently or noncovalently to that plastic, depending on the coating reagents used. In some cases, either from inherent chemical structures or surface modification, plastics surfaces may contain reactive groups such as –OH or –NH that would allow a variety of chemistries to be employed to covalently attach the hydrophilic coating to the surface. If the polymer has no such functional groups, as is the case with polyethylene, polypropylene, and others, then plasma or coronal treatments may be used to temporarily functionalize the surfaces to get the coatings to stick. However, even in these cases, the treatments are often temporary and the coating must be applied within hours to days after the surface treatment. Covalent attachment between the coating and substrate is often touted as the desirable outcome of a coating process; however, it is often difficult to achieve significant covalent bonding in practice. Covalent bonding is not necessary for good adhesion. Many noncovalent bonds are as strong or stronger than covalent bonds. In fact, some of the best adhesives known in the world are based on cyanoacrylates, which adhere mostly through polar, hydrogen, van der Waals bonding and mechanical interactions, with no covalent bonding to the substrate. Specific substrate-coating combinations must be tested on a case-by-case basis against the application to determine which surface treatments are suitable.

|

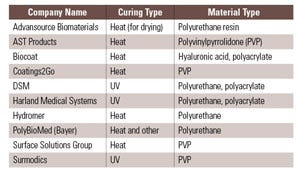

Table I. Major companies offering hydrophilic coatings via licensing, outsourcing, or other models. |

Perhaps more important than material interactions between coating and substrate are the chemical, environmental, and mechanical stresses that the device will experience at various stages of its life cycle. As a first step, does the coated device survive the abrasion conditions between the coated surface and any adjacent surfaces, such as tissues or other devices encountered during its use? How many cycles of abrasion will occur? How hard will the device press against the opposing surface(s)? Answers to these questions will determine durability requirements of the lubricious coating in its end-use environment, i.e. the number of cycles to coating failure.

Sterilization

Another consideration is the effect of the chosen sterilization method on the coating. For some sterilization methods, a single sterilization cycle may damage the coating and render it useless. In fact, all types of sterilization (ethylene oxide, gamma irradiation, e-beam, hydrogen peroxide vapor, autoclaving, etc.) may damage polymers, and hydrophilic polymer coatings are no exception to this. To determine whether a coating is compatible with a sterilization method, designers need to think about the application and the sterilization type together. For example, if a single-use needle with a hydrophilic coating needs to be sterilized in an autoclave and the application calls for a single insertion of the needle into the vasculature, after which it is removed a few minutes later, there is a decent chance that a given vendor’s hydrophilic coating will be suitable for that application, even though it is known to degrade severely with autoclaving. Enough of the coating will remain after autoclaving to lubricate the needle for one cycle. On the other hand, if the application is a guidewire used in coronary artery catheterizations, consider that during usage it may see many passes of a hard, microscopically rough, hydrophobic plastic catheter over its surface through tortuous vasculature. The chance that autoclaving will work in such an application is greatly decreased. Not enough coating will remain on the guidewire to keep it lubricous through the procedure.

|

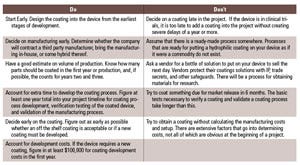

Table II. The Dos and Don’ts of hydrophilic coatings. (Click on the image to open up a larger version) |

Cleaning and Storage

Engineers should also consider the temperature, UV light exposure, and humidity of storage conditions for coated devices. High humidity, UV light, and temperature can accelerate the degradation of many hydrophilic coatings, although adjustments to packaging can often help remedy these risks. Once the device is removed from the package, a host of other environmental considerations come into play. Again, temperature and humidity ranges seen in the application are important, as well as the pH of fluids to which the coated surfaces are exposed. In some cases, a device is cleaned with harsh chemicals before or after use, hence the effects of all cleaning agents on the hydrophilic polymer surface need to be considered.

Another crucial consideration is whether the device is disposable or reusable. Multiple cleaning and usage cycles may be detrimental to a given coating, in which case a single disposable use may be more suitable. Multiple usage cycles often include multiple sterilizations, which can also present opportunities for unwanted coating degradation.

Hydrophilic Coating Vendor Selection

Once the basic parameters of a coating application are understood and the product requirements are written, choosing a hydrophilic vendor becomes a priority. Every vendor possesses unique core competencies and abilities. Aside from specializing in different areas of chemistry, coatings vendors approach their craft differently (see Table I). Some simply qualify existing industrial chemicals for use on medical devices, formulate those chemicals, and do limited testing to establish that the formulation is hydrophilic and feels lubricious when applied to a test specimen. In this scenario, potential customers do their own development and testing. Other vendors manufacture coatings from basic raw materials, apply the coating to a company’s device, evaluate whether the hydrophilic coating performs as the customer wishes, and works closely with the company to transfer the technology to a chosen manufacturing site. To fairly evaluate these differences, potential coatings clients (i.e., OEMs) should ask pointed questions to a number of vendors. These questions should focus on the coating processes, equipment, throughput, quality systems, and compliance with international standards such as ISO.

There are various considerations when choosing and working with a coatings vendor (see Table II)

Application and Cure Techniques

Hydrophilic coatings may be applied to surfaces in a number of ways. Dip coating is seen most often. This process entails suspending an article from a support and lowering it into a liquid coating solution and then withdrawing it at a known speed. Coating will stick to the surface as the article is drawn up and out of the solution. Spray coating can also be used for some applications. Spray coating is akin to airbrushing, where a nebulized mist is sprayed over a surface. Film coating is another type of process, seen mainly in long rolls of material, whereby the roll is drawn from reel to reel through a tank of coating solution and a curing area. Less common processes for hydrophilic coatings may include chemical vapor deposition, and silk screening for flat surfaces. The type of process dictates the kind of equipment necessary.

Within most coating processes there is a drying and curing step. The two major methods for curing hydrophilic coatings are heat and ultraviolet light (UV). In a heat cure system, coated items are placed in an oven for a certain time. Controlled heating accelerates drying of the solvent and any necessary chemical reactions taking place within the coating that allow it to stick to the surface and give it durability. In many cases, heat cured coatings become crosslinked. In UV cured systems, the coated items are exposed to UV light instead of heat for a period of time, which also has the effect of stimulating necessary chemical reactions for curing but has no effect on solvent evaporation. As part of vendor evaluation, a prospective coating client should determine those conditions. What is the curing temperature, if any? How long is the exposure time for UV light or heat? How many layers must be applied to obtain the desired performance? Additionally, OEMs should understand that additives in the coating facilitate these reactions. Although most hydrophilic coating vendors will not disclose the exact nature of their additives, they will give information on their general chemistry and toxicity. For UV cured coatings, the additives produce the functionality that allows crosslinking under UV light. These materials are known to sometimes be toxic.

After most coating processes, additives and functional materials that are not bound to the surface must be rinsed out or otherwise removed, and this removal process is important for clients to understand. In addition to catalyst residues, the materials that must be removed include surfactants present in small amounts, which are used to facilitate wetting of a hydrophobic surface with a hydrophilic liquid coating solution. Surfactants are also known to perforate cellular membranes through interaction with biological lipids, and must therefore be either rinsed out or left behind in quantities so low as to not cause cytotoxicity.

Manufacturing

Once it is known whether the vendor uses a heat or UV cured system, and whether the system is a dip coat, spray or other kind, considerations for manufacturing come into play. Overall, coating equipment breaks down into three groups: application equipment, curing equipment, and postprocessing equipment. Application equipment is specific to how the coating is first applied. For example, dipping machinery can be custom made. Differences in dipping equipment are not dependent so much on the curing system as on the physical characteristics of the devices to be coated (i.e. length, diameter, and other dimensions). Is the outer diameter (OD) or inner diameter (ID) receiving a coating? Is there some other surface or geometry present?

After applying the coating, it must be cured. Considerable curing equipment differences exist between vendors. A heat cured system requires an oven, whereas UV cured systems require UV lighting systems. Generally, heat cured systems are more suited to coating ID’s than UV cured systems because it is difficult to get dependable intensities of light to shine evenly over an inner surface, especially if the material is opaque or small diameter. UV cured systems tend to have short cure times, and for small throughput systems with appropriate geometry they can be more efficient. Finally, postprocessing equipment includes all items necessary for washing and sterilization. Usually, water requirements for rinsing coatings are not too stringent. Devices are rinsed before packaging and sterilization, so bottled distilled water can suffice. It is important to pay attention to the nature of the distilled, bottled water because many water suppliers add salts back into purified drinking water to improve taste. Although salts may not harm the coating, they do leave a salt residue in the coating that may not be desirable. If a manufacturer is concerned, a water system with Reverse Osmosis and nanofiltering might be in order, but this is probably overkill. Drying newly coated items may be possible at room temperature, depending on the boiling point of the solvent used for the coating, but may also be accelerated at slightly elevated temperatures. If the accelerated method is chosen, that will add to the list of equipment requirements.

Various combinations of equipment can be inserted into a process to influence throughput. Controlling the number of devices coated per day is dependent on the type of curing step used. Consider the case of a batch process that uses an oven. The oven size can be increased as much as necessary for minimal cost, and an oven can be made to fit hundreds of objects at once. If a single oven fits 200 objects, 5 objects are coated at a time with a 2-minute dipping cycle, and the entire curing process takes 2 hours plus 40 minutes for dipping 200 objects 5 at a time, the throughput rate is 75 objects per hour. If a UV cure system can dip and cure 5 objects at a time, and each cycle is 5 minutes, the throughput of this step is 60 objects per hour. To increase this, multiple UV machines would need to be added, at additional cost. Other steps in the process also influence throughput. For instance, some hydrophilic coatings, may call for multiple dip cycles before the coating is thick enough. Many coating systems require two layers of coating: a base coat to prime the surface, and a topcoat, which actually has the hydrophilic properties. Other systems may be considered single-coat systems, but require multiple dipping cycles in that single coating solution to get a thick enough coating. It is essential to map out the entire coating process specifically and the required equipment at each step before considering a commitment to a vendor.

Regulatory challenges are another equally important consideration when looking at multiple coating vendors. It is important to note that in the United States, FDA does not approve materials for use, but instead it approves material-device combinations for use in specific indications. Thus, it is not appropriate to ask a vendor if its coating is approved by a regulatory body, but rather whether the coating has been approved for use on any other medical devices currently on the market. In most cases, the coating vendor will have a Master File with FDA that can serve as a reference point for FDA’s questions. Other nations have their own versions of this document that can vary from master files. Even if a vendor has such a document, however, it does not mean the client is exempt from basic biocompatibility or clinical testing. The testing done by a coating vendor is only a starting point, and regulatory bodies nearly always want to see what happens when the coating and the OEM’s device are tested in combination. The OEM needs to pay for this process and add the time to complete this testing to overall product development schedules.

Costs of Processing

When first proposing a project to a vendor, it is difficult to determine the cost of coating immediately. Engineers seeking a quote that covers the entire breadth of development and manufacturing of their coated device must consider the complexity of the coating process. Costs are difficult to determine because every device has unique details and likely will require a unique process to coat it. Even two seemingly identical devices from two different companies, e.g., two 20-cm long 2 Fr catheters, for instance, will have differences that become important, such as material composition or coated length. Only complete analysis of the device, intended use, and situation by the coating vendor and client can yield the true cost over the development cycle. Major influences inlude whether the OEM will perform coating in-house or via a third party manufacturer, the volume of planned production and rate of production ramp up, and how far along the OEM is in its product development process.

Deciding whether to license or outsource the coating process is a key decision that affects final cost. In the case of a license, an OEM pays the coating vendor a license fee once the decision is made to go ahead with the coating on its devices, and a royalty fee once the products begin selling on the market. Some coating vendors also require minimum royalties or development payments. Clients interviewing different vendors should sort out those costs. Not all vendors have the same price structure. Additionally, once the license is set up, the client will usually also buy the coating solutions and reagents from the vendor as a supplemental cost. In return for these fees, the client should receive design help with its process, as well as tech support on the process for the life of the license. A license from a responsive coating vendor can facilitate problem solving and troubleshooting. The other advantage to bringing production in-house via licensing is that the client has complete visibility over its quality assurance and quality control.

Such is not necessarily the case with the other alternative, outsourcing. In that method, the client employs a third party manufacturer to put the coating on its devices. The client does not pay the coating vendor a license fee or royalty fee for services or coating solutions. Instead, the client pays the contract manufacturer a negotiated flat fee per piece, and the contractor passes its own licensing costs down to the customer. The contractor also may create the manufacturing process, and ideally the contractor will already have some experience coating a particular kind of device. It is likely that the client will need to pay the contractor the cost of setting up and validating the process for its devices. In the end, this may cost as much as a license fee. Some contractors might choose to waive fees for process development all together if the prospect is for profit in the future. When working with contractors, it is also important to determine in advance who owns the manufacturing process how and that ownership may be transferred if the OEM ever decides to bring the process in-house.

Another variable that affects cost is the volume of production and how that production will change from year to year. Clients that only seek to make several hundred coated units per year are not considered good prospects for most contractors and coating vendors. Unless these several hundred devices represent high dollar items and will command economically viable royalties on the coating, there are not many ways for coating vendors and contractors to profitably manage such projects. A client that wants to coat several hundred devices per year with a low cost of goods may want to reconsider paying as much as ten times that amount to coat a single device. Unless the addition of a coating brings significant product improvement and value, the cost of coating may not make economic sense. Small production volumes are not too much of a problem if the ramping up rate is high. Production rates that start out tiny and increase year over year by orders of magnitude are attractive if they can be managed.

However, ramp-up brings its own challenges. Will more machines need to be added to the production floor, or will the customer start out with a large machine that initially has a large amount of excess capacity?

Decisions on production are always easier and clearer if they are made early in the design process. In general, the further along a device company is with a project when the decision is made to use a coating, the more challenging it is. Hydrophilic coatings are too-often perceived as an afterthought, when in reality they are a sophisticated addition to any manufacturing process. If a company in the midst of clinical trials decides at that point to add a coating, the project might delay the release of the device by a year or longer. An accelerated aging study on a hydrophilic-coated item can take four months alone depending on the intended shelf life. Considering the additional time required for acquisition, installation, operation qualification, and process validation for the coating equipment, a one-year extension of the timeline is actually quite modest.

Conclusion

Applying hydrophilic coatings to medical devices is a sophisticated process that requires skill and careful thought. Vendors should be properly vetted, but even more importantly, OEMs should understand the intricacies of the technology as well as how to navigate the complex vendor relationships that are necessary for a successful product. Early involvement, preceded by careful vendor selection is the best way to ensure that the product development process meets internal goals for deadlines efficiently and at acceptable costs.

Josh Simon, PhD is senior product manager at Biocoat Inc. (Horsham, PA).

About the Author(s)

You May Also Like