5 Insurance Companies Expanding Earnings

The following insurance companies have grown their earnings per share over a five-year period. According to the GuruFocus discounted cash flow calculator as of July 8, all of them also trade with a margin of safety.

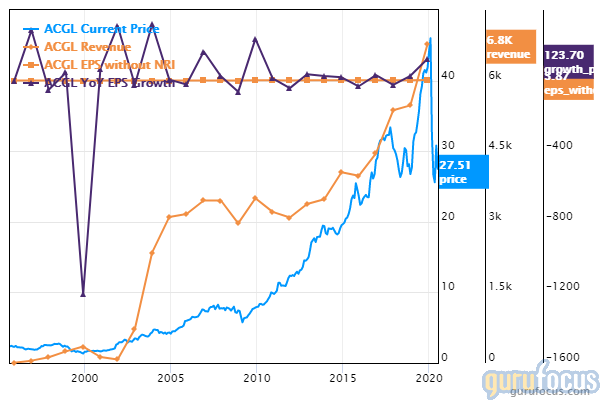

Arch Capital

Arch Capital Group Ltd.'s (ACGL) earnings per share have grown 11.20% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 20.67% margin of safety at $27.51 per share. The price-earnings ratio is 8.82. The share price has been as high as $48.32 and as low as $20.93 in the last 52 weeks; it is currently 43.07% below its 52-week high and 31.44% above its 52-week low.

The Bermuda-based provider of insurance contracts has a market cap of $11.1 billion and an enterprise value of $13.9 billion.

The company's largest guru shareholder is Ron Baron (Trades, Portfolio) with 5.35% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.68% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.12%.

Aflac

The earnings per share of Aflac Inc. (AFL) have grown 8.6% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with an 38.54% margin of safety at $34.62 per share. The price-earnings ratio is 8.72. The share price has been as high as $57.18 and as low as $23.07 in the last 52 weeks; it is currently 39.45% below its 52-week high and 50.07% above its 52-week low.

The provider of health insurance and life insurance has a market cap of $24.8 billion and an enterprise value of $27.4 billion.

The company's largest guru shareholder is John Rogers (Trades, Portfolio) with 0.22% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.06%.

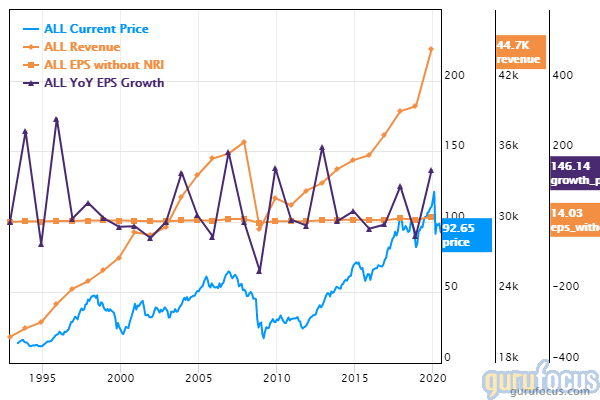

Allstate

Allstate Corp.'s (ALL) earnings per share have grown 15.6% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with an 72.72% margin of safety at $92.65 per share. The price-earnings ratio is $7.77. The share price has been as high as $125.92 and as low as $64.13 in the last 52 weeks; it is currently 26.42% below its 52-week high and 44.47% above its 52-week low.

The property-casualty insurer has a market cap of $29.1 billion and an enterprise value of $37.37 billion.

The company's largest guru shareholder is Cohen's firm with 0.25% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.16%.

Employers Holdings

The earnings per share of Employers Holdings Inc. (EIG) have grown 9.7% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 14.58% margin of safety at $29.12 per share. The price-earnings ratio of 13.8 is underperforming 62% of competitors. The share price has been as high as $45.23 and as low as $25.53 in the last 52 weeks; it is currently 35.62% below its 52-week high and 14.06% above its 52-week low.

The company, which provides insurance to workers, has a market cap of $884 million and an enterprise value of $730 billion.

The company's largest guru shareholder is Renaissance Technologies with 1.79% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.48% and HOTCHKIS & WILEY with 0.42%.

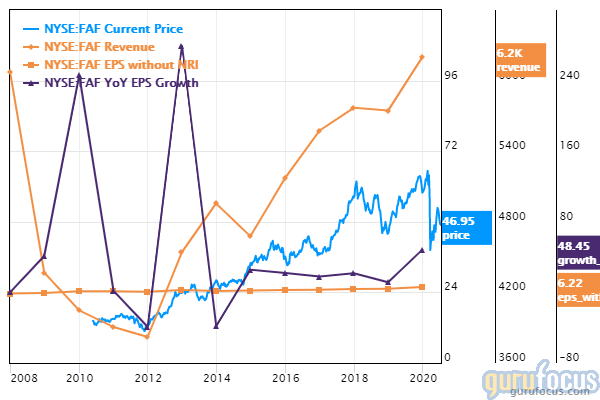

First American Financial

First American Financial Corp.'s (FAF) earnings per share have grown 21.9% per annum over the past five years.

According to the DCF calculator, the stock is undervalued with a 69.07% margin of safety at $46.95 per share. The price-earnings ratio is 8.08. The share price has been as high as $66.78 and as low as $29.36 in the last 52 weeks; it is currently 29.69% below its 52-week high and 59.91% above its 52-week low.

The provider of title insurance and escrow services has a market cap of $5.2 billion and an enterprise value of $5.32 billion.

With 2.9% of outstanding shares, Rogers is the company's largest guru shareholder, followed by Ken Fisher (Trades, Portfolio) with 0.95% and Cohen's firm with 0.66%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Undervalued Stocks With Predictable Business

5 Financial Companies Expanding Book Value

6 Yield-Paying Stocks Trading at Cheap Prices

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.