The Secret Broker: Get me a spin doctor on the phone now!

The Secret Broker

The Secret Broker

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Nuix is the stock that just keeps giving.

Not for shareholders, but for all the papers looking for headlines to jack up their click-through rates.

We only wrote about them a few weeks back when I was speculating that there will be an enquiry of some sort coming.

Well, this week it all got a bit closer.

The headlines this week were all about insider trading. Nothing like having a title with insider trading in it to attract more than the usual amount of clicks.

Incidentally, one of the best ones ever had the words ‘Martha Stewart’ added to the headline.

In 2004, when she was sent to jail for five months for selling a shareholding two days ahead of an announcement that the FDA had rejected an application from that company.

On the day she stepped into her prison cell, the old bog standard porridge got an upgrade to become Toasted Muesli with pumpkin seeds. If you are thinking of doing some insider trading, here is her recipe, so you can get yourself up to speed.

Actually, hers was a hard case to prove because she had acted off a tip from her broker.

He had told her that the CEO of the company was trying to unload US$5m worth of shares, which was his entire holding. He was trying to offload them, two days before the company had to announce how their trials with the FDA were going.

So our Martha was acting on an insider tip, from her broker, who should not have passed on what another client was trying to do.

The Nuix headline this week seemed to be a bit more cut and dry than Martha’s case as ASIC had already approached the courts – not to stop the recent CFO of Nuix from leaving the country, but his brother. There were a lot of details on dates of share sales and their exact prices.

These headlines led to an official ASX announcement by Nuix, which was signed off by none other than Helen McCombie.

Now I remember her from the TV, so I presume that putting out corporate fires is her main gig as I haven’t seen her dial on my TV for some time.

It takes all sorts to become a corporate spin doctor and spin a dodgy yarn into a yarn of silk.

I once remember reading about an American politician who’s grandfather was hung for murder. His bio, after the good doctors got hold of it, stated that his grandfather had died when the stage on which he was standing had suddenly collapsed underneath him, leading to his unfortunate death.

Unfortunately for Nuix, Donald Rumsfeld — the ultimate master of spin — has just passed away, leaving him unavailable when the Nuix call out was made (so they must have called Helen).

Who could forget Donald’s ultimate spin move, after no weapons of mass destruction were ever found in Iraq. When he was pushed into the corner, he responded with the words:

“Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know.”

Let’s hope his gravestone is big enough to fit all those words, otherwise it may have to be abbreviated down to ‘Here lies…Who Knows’ or whatever the spin doctors can think up.

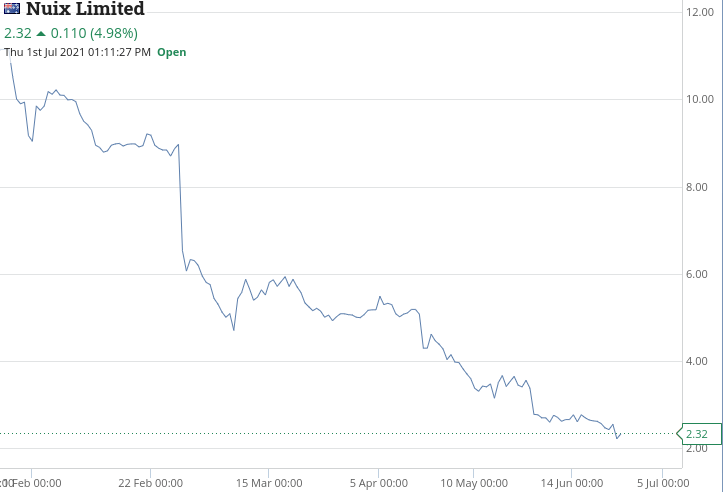

So, the ex-CFO of Nuix, his brother and his father are being investigated by ASIC for allegedly insider trading ahead of the big fall you see in the graph below.

If only they could go Back to the Future with Martin Seamus “Marty” McFly to the UK in 1980, as that was the year when they actually banned insider trading in shares and made it illegal.

These days everything is recorded electronically, unlike my early arrival to Australia where I was introduced to some of the finest insiders from the trading floor.

One had famously produced a chart of a stock, when defending an accusation of insider knowledge to an ASX official who once came knocking at his front door.

What did not dawn on the officer was that it was his trading that had actually created the pattern on the chart and not the other way around. There was no break-out or a move above the 200-day moving average. It was all him.

The very best one for me though was the young intern who’s boss was away. During that time he had permission to take calls and messages, but he was not allowed to take any orders.

A very irate caller wanted to put on a buy order ‘NOW!’ and he kept shouting at the young intern while threatening to have him sacked (when his boss was back).

The next day the ASX arrived at the firm the intern worked for and enquired if anyone had spoken to Mr X about a stock called XXX. The young intern put up his hand and he was duly marched into the boardroom.

There, he was grilled about his conversation with the irate client. Turns out that the client was trying to stack up buy orders (big buy orders, just below the market), all whilst insider selling a big line of his stock ahead of a very bad announcement.

Later on in the pub, the young intern explained to everyone what had happened and how he had been drawn into an insider trading enquiry, even though he had never put an order on in his life.

One of the old brokers patted him on the back and dryly told him that only when he gets called into another two of these, then and only then, would he truly be able to call himself a stockbroker.

I think he is now a real estate agent.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.