Crypto voices: investors speak about the market shock

Simply sign up to the Cryptocurrencies myFT Digest -- delivered directly to your inbox.

Criminals using bitcoin on the Silk Road, the online black market for illegal goods like drugs and weapons, have tainted the cryptoasset’s reputation for years. But for Neil Baker, it was the bust of the Silk Road by law enforcement officers that first led him to become a crypto investor.

Baker recalls reading news reports about the FBI and Europol’s swoop on the online network, which has been called the “Amazon of heroin and cocaine”. He was appalled by the criminality, but noted that bitcoin did not crater after the raids — and he reasoned that the digital tokens must have some merit other than buying drugs online.

“I’m not some sort of tin foil hat, weed-smoking weirdo. I’m a married father of one,” says Baker, 37, from Eastbourne in south-east England. “The market didn’t crash after the Silk Road. That was what got me on to it.”

Baker, a marketing and sales executive at a housebuilder, first invested in crypto in July 2017, after the Silk Road episode piqued his interest. It began a lasting interest in crypto investing that weathered the wild swings in the digital asset market over the years.

Like other crypto investors, though, he has now seen his stake badly hit by the most recent meltdown in prices, as markets for these assets are gripped by one of the most severe crises in their 13-year history.

The losers include millions of UK retail savers, who were swept up by the enthusiasm. Many have already been wiped out as their leveraged bets went bad. Others have funds trapped in collapsed or suspended crypto companies. And still more are now wondering what to do next with their diminished holdings.

The pain extends far from sophisticated crypto traders to millions of have-a-go amateurs, including many British retail investors. Several agreed to tell FT Money how they came to join the crypto bubble — and what they will do now that it appears to be bursting.

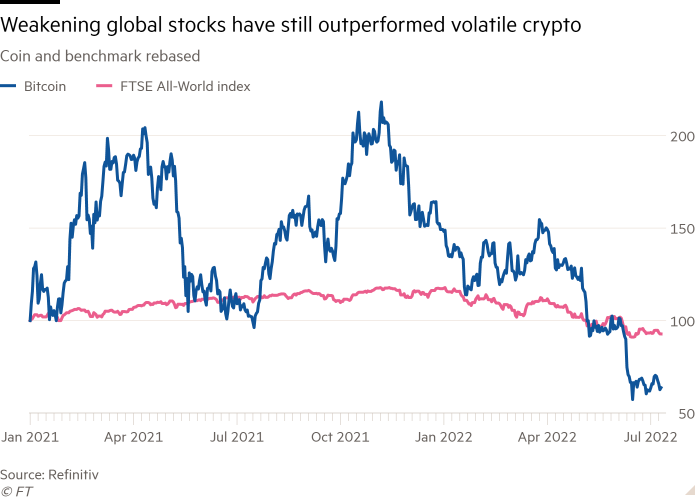

Crypto plunge wipes out $2tn

Total crypto market value has dropped below $1tn, down by more than two-thirds from a peak of $3.2tn last autumn.

Bitcoin, the largest cryptocurrency, has fallen 70 per cent in the same period, hitting levels not seen since 2017, wiping out years of gains for digital asset true believers.

For some, the price fall represents close to an existential crisis for bitcoin. Launched in the aftermath of the 2008 financial crisis, the flagship cryptocurrency had been touted as a stable store of value independent of government-back paper money, which would be immune to inflation and free from the politically minded meddling of central bank governors.

Now, even bitcoin investors admit that the crypto token, like other markets, just can’t fight the Fed. The powerful US central bank has this year reversed a decade of ultra-loose monetary policy, choking off the supply of cheap money to calm the economy and tame runaway inflation.

The result has been a bloodbath for high-risk assets as investors seek safety and reckon with rising interest rates. Crypto assets have been first on the auction block, given their risky reputation.

Within the crypto industry, tumbling prices have triggered a chain reaction of defaults. Several high-profile crypto projects have hit the rocks, including stablecoin Terra and lender Celsius. The contraction in lending has been likened to a “credit crisis”, producing a cascade of liquidations and a downward spiral in token prices.

A British buying spree

Nearly one in five UK adults have invested in crypto, according to a survey from crypto exchange Gemini this year. Crypto investing was more prevalent in wealthier cohorts, the study found, and 65 per cent of backers were male.

The research found that 45 per cent of British crypto investors took the plunge for the first time in 2021 during the massive run-up in token prices, which has now crashed back to earth.

“It’s more important than ever to make sure you aren’t the last one in a line of greater fools,” says Dan Lane, analyst at investment app Freetrade, which plans to offer crypto trading. He argues the downturn in crypto could help to shake out the many “bizarre spin-offs [that] have popped up over the pandemic”.

“Unfortunately, that reshaping is likely to take some investors’ money in highly-speculative digital coins to zero,” he adds.

For Baker, the sell-off has been painful but not ruinous. As we spoke, he loaded up the mobile app for the crypto exchange Coinbase on his phone to check on the value of his investments.

“Oh Jesus Christ, I shouldn’t have loaded up Coinbase, should I?” he says, gazing at the price of his ethereum, the second largest cryptocurrency, which has fallen some 70 per cent since November. “It’s a good job this isn’t a grand sum of money.”

He counts himself lucky that his crypto holdings never exceeded 10 per cent of his investments at their peak, and he owns his home and a second property as an additional safety net.

“I’m not a crypto bro. I buy ETFs and dividend stocks. But it just felt like something I needed to add in,” says Baker

In Baker’s view, the crypto market is split between speculative coins that amount to gambling and tokens like ethereum that have potentially useful applications through technologies like smart contracts, meaning they could hold their value and grow over a decade.

He nonetheless put £100 into dogecoin, the joke cryptocurrency named after a meme of a shiba inu dog, after chatting with the attendant at the car wash next to his local supermarket. “I messed around with dogecoin because it was fun. Obviously I take all my financial advice from the man at the car wash,” he quips.

But he is concerned by the addictive, lottery-like features of crypto investing. “There’s a lot of people who get that dopamine hit from playing these things. I think it’s something that as a society we need to reckon with,” says Baker.

Dogecoin’s price surged early in the pandemic in part because of supportive Tweets from Elon Musk, the Tesla and SpaceX entrepreneur whom Baker has been following for a decade.

On reflection, Baker doesn’t think much of Musk’s diversion into cryptocurrencies. “I much prefer ‘rocket Elon’, the one who just talks about rockets and nothing else, and maybe cars. Everything else just makes him sound like an absolute clown,” says Baker.

As to whether he’s tempted to quit crypto now that the market has crashed, Baker says he has little choice but to hold on. Most of his holdings are in Ethereum, which he has “staked”. This is the crypto term for locking up your coins to support a new project and earn interest, in this case the transition from the environmentally damaging “proof of work” blockchain to a new system called “proof of stake”, which requires less computing and saves electricity.

“I don’t think crypto can be adopted as a global means of anything when you’re using the same energy as a top forty country uses,” he says.

Baker says he would worry more about what to do with his remaining crypto wealth if he had a choice about whether to sell it. “Maybe if I had a Sell button in my app I might be slightly more stressed . . . It’s not an option for me to sell it. So I’m OK with it.”

Deep under water

Baker sits among the majority of cryptoasset investors who view tokens as a “fun investment”, according to research published this month by HM Revenue & Customs. A smaller cohort, one in five, said cryptocurrencies were “‘core part” of their investment portfolio.

Lyle, 27, is one investor who crossed over from treating crypto investment as an exciting activity to making it a big part of his total wealth. Now, he is still holding on to his tokens because his losses are already so severe that all he can do is hope for a rebound.

The graduate student from London is completing a PhD in astrophysics and artificial intelligence and has worked as an intern at a hedge fund.

“I’m supposed to be someone who knows about finance,” says Lyle, who asked the FT not to use his real name.

“I started very carefully and had this confidence going in that nothing too bad could happen because I knew what I was doing,” he says. “By the end, you get caught up in the bubble and you’re just like anyone else.”

His first foray into crypto came in September 2020, with encouragement from his father, just as token prices began the wild surge that would take the price of bitcoin from around $10,000 at the beginning of September to $60,000 by March 2021.

“It was all pretty exciting. It went up quite a lot in a short period of time. I was just sort of fooling around with it. I was only putting in small amounts,” he says.

He spent time learning about Web3, a new version of the internet constructed using blockchain technology. “It seemed like a technology that would sort of last in the long term. More and more friends were getting into it,” he recalls.

The excitement reached fever pitch early in 2022, as more and more friends shifted large chunks of their savings into the crypto market. Eventually, Lyle bowed to peer pressure.

“I moved 50 to 60 per cent of my net worth into either a crypto fund or Coinbase. I should have figured out that this was a bad idea. You’re supposed to be a bit more diversified than that,” he says. “Having all my semi-intelligent friends doing the same, I sort of felt I was missing out. It’s the classic bubble thing.”

Lyle’s decision to double down came at the peak of the market. His investments have more than halved. The losses are a major financial setback. “It’s only really dawned upon me this week that I had actually done really well as a PhD student and managed my investments quite well, until I dumped it all into crypto,” he says.

“It’s pretty annoying because I have a big student loan that I could have paid a significant chunk of off,” he adds.

The fear of missing out undoubtedly played a major role in Lyle’s decisions. Many commentators blame advertising from crypto firms, paid social media influencers and breathless media coverage for hyping crypto even further. But Lyle prefers to take personal responsibility.

“I don’t get the sense that we were hard done by as consumers at all,” he says. “I just did the worst possible type of trading, which is reading one piece of news and going on your phone and buying a bunch of stuff. The sort of casual day trading that usually ends up with you losing a lot of money.”

For him, the lesson is simple: “It’s so hard to be rational when all your friends are telling you how much money they have made.”

Fortunate timing

Although Lyle’s losses are painful, they could have been worse. Half of British 18-29-year-old crypto investors used debt to fund their purchases, with many turning to credit cards and student loans, according to research last year by Interactive Investor.

Sylvia, who also started crypto trading in lockdown, counts herself lucky for avoiding the trap of debt-fuelled investing and for fortunate market timing.

The London-based fund manager caught the crypto bug from friends at the height of the first strict Covid-19 lockdown.

“I bought at the time and kind of rode the wave until the end of last year. I got really lucky because for personal reasons I wanted to go back to cash. So I sold at the peak,” says Sylvia, who asked for her real name to be withheld. “It was like winning a little bit at the casino for a year.”

She counts herself lucky not just for good market timing, but also for avoiding the danger of taking out debt to buy even more crypto. “I know some people who have leveraged themselves to buy,” she says.

Leveraged strategies backfired for many crypto traders, as falling token prices left them with outstanding loans and no crypto proceeds to pay them back.

Even though she avoided this trap, the experience was not all positive for Sylvia. “Because I sold so high, I reinvested part of it and then lost part of it,” she says, “I thought the whole psychology of it was very interesting.”

She also noted the psychological effects on her colleagues. “I had a junior working for me. He was making more money from his crypto trade than I could give him as a salary. I think that really changed the attitude of some young people towards money [after they] made easy money for more than a year,” she says.

For some novice crypto investors, the searing experience of recent months has turned them off tokens for good. Others see the market downturn as a test of faith, and believe that those who hold on will be richly rewarded.

I ask what Sylvia had learned from watching prices crash. There is a long pause. Then she says: “Not to underestimate the risk and only invest money that you are only really, really ready to lose.”

This article has been amended to clarify that Freetrade plans to offer crypto services. . It has not started yet, as was mistakenly stated earlier.

Comments