Bernie Sanders announces plan to eliminate student debt

Democratic presidential candidate Sen. Bernie Sanders says his $2.2 trillion proposal will be paid for by a tax on 'Wall Street speculation.'

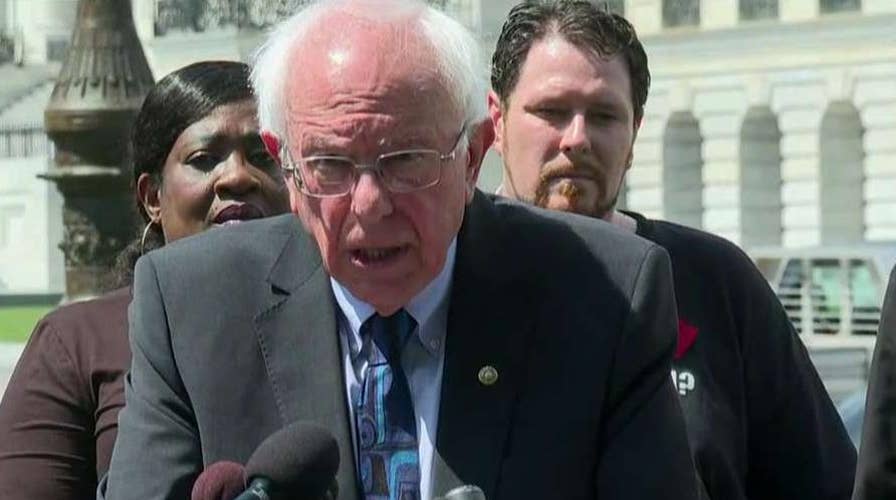

Sen. Bernie Sanders, I-Vt., proposed a plan Monday to eliminate all $1.6 trillion in student debt held by Americans by levying a tax on Wall Street banks.

Speaking outside of the Capitol building and flanked by Reps. Ilhan Omar, D-Minn., and Pramila Jayapal, D-Wash., Sanders called for the elimination of all student loan debt held by 54 million Americans – from both public and private educations – and making public universities, community colleges and trade schools free to attend.

“This proposal will make it possible for every person in America to get a college education no matter what their financial situation,” Sanders said. “We will make a full and complete education a fundamental right.”

STUDENT LOANS ARE BIGGEST SOURCE OF PERSONAL DEBT IN US

He added: “It is unacceptable that the younger generation will have, under no fault of their own, a lower standard of living than their parents’ generation.”

Omar plans to introduce similar legislation in the House to eliminate student debt, while Jayapal – the co-chair of the Congressional Progressive Caucus – has been a champion of tuition-free college.

Sanders said his plan, which would put a tax on speculation from major Wall Street banks, would raise more than $2 trillion over 10 years -- though some tax experts give lower revenue estimates. The proposal would hit financial institutions with a 0.5 percent tax on stock transactions and a 0.1 percent tax on bonds.

“In 2008, the American people bailed out Wall Street,” Sanders said. “Now, it is Wall Street's turn to help the middle class and working class of this country.”

FINANCIAL ADVISER: HERE'S WHAT PARENT'S SHOULD DO AMID EXPLODING STUDENT LOAN DEBT CRISIS

“The American people bailed out Wall Street, now it’s time for Wall Street to come to the aid of the American middle class,” he added.

Sanders' plan is the latest – and most aggressive – one from a 2020 Democratic presidential hopeful to tackle the mounting student loan debt problem in the country.

Sen. Elizabeth Warren, another 2020 hopeful, announced in April a plan to cancel existing student loan debt for millions of Americans. Under Warren’s plan, each person’s student debt would get relief of $50,000 if household income is up to $100,000. Higher incomes would also be entitled to big debt reductions, while households earning over $250,000 would get no student debt reduction.

Former Secretary of Housing and Urban Development Julián Castro has introduced a more modest debt forgiveness plan as well.

Opponents of these proposals, including some Democrats, question why taxpayers should pay subsidies for the education of Americans who, on average, earn more than those with just a high school diploma.

Advocates, however, argue that student debt has become a major problem for the U.S. economy – reducing millennial spending power and putting home ownership out of reach for many, among other problems. The student debt burden has ballooned from $90 billion to $1.6 trillion in about two decades, according to federal data, and the average college student in the U.S. graduates with $29,800 in debt.

“There are currently 45 million Americans with student debt,” Omar said on Monday. “That’s 45 million people who are being held back from purchasing their first home; 45 million people who may feel that they can’t start a family; 45 million people who have dreams of opening a business or going into public service, but are held back.”