Two companies begged the US government to raise tariffs on imported solar panels in 2017. “Stop the bleeding,” implored panel maker Suniva in its petition (pdf) to the US International Trade Commission (ITC), joined by a second manufacturer, SolarWorld. Domestic solar panel manufacturers, they argued, needed import taxes to “grow and thrive.” These tariffs, Suniva insisted, would generate at least 114,800 new jobs in the US.

They got their wish. The US trade commission ruled in 2017 that domestic solar manufacturers had been harmed by cheap imports. The next year, the Trump Administration slapped a 30% tax on imported solar cells and panels (also known as modules).

Today, both firms out of business. SolarWorld Americas, actually a US subsidiary of a German company, was bought out of bankruptcy by SunPower in October. Chinese-owned Suniva filed for bankruptcy this month. The company told a judge it plans to exit the solar panel business as soon as it offloads its inventory of panels stockpiled in warehouses.

The saga infuriates people like Constantino Nicolaou, CEO of Massachusetts-based PanelClaw, a 35-person company that sells mounting systems for solar panels. In 2017, Nicolaou joined more than two dozen other solar equipment firms to stop the tariff. In a letter (pdf) to the ITC, they argued the tariffs would disastrously undermine “the cost-competitiveness of solar…and reversing its high growth trajectory. We would be forced to cut our operations, seriously endangering manufacturing jobs at our factories.” Nicolaou said he felt the US was waging a trade war that was impossible to win, and the tariff hawks in the Trump administration refused to listen to business leaders. “Mexico, India, China, Europe—we’ve picked a fight with the whole world,” he told Quartz.

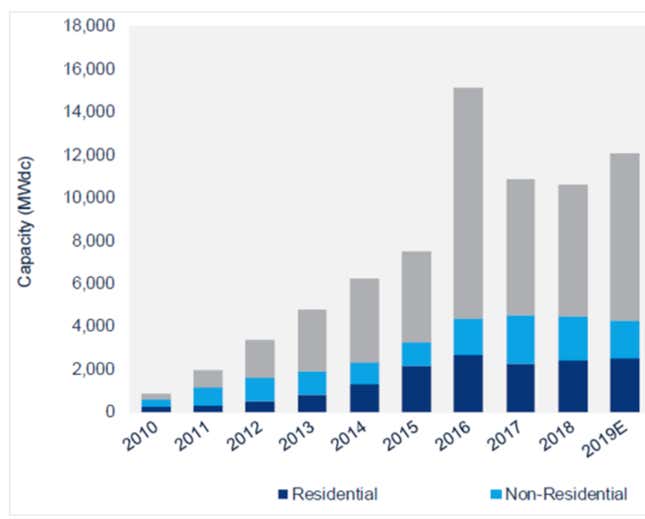

Many of Nicolaou’s concerns have come to pass. Solar installations stalled after peaking at more than 14 gigawatts (GW) of power added in 2016, according to energy research firm Wood Mackenzie. The Solar Energy Industries Association (SEIA) estimates that nearly $8 billion in new solar investments capable of generating 7 GW were lost because of the tariffs, along with the loss of 9,000 jobs due to layoffs or hiring freezes, far less than the expected increase in manufacturing jobs. Only about 2,000 (pdf) of the 260,000 solar jobs in the US are in cell and module manufacturing; the rest involve supply chain equipment, installation, and other services.

The industry is now recovering, led by an uptick in residential sector installations, Wood Mackenzie reports, but it’s slow going. Nicolaou said he’s now making his first new hire in two years, rather than the 13 jobs he had planned before the tariffs. The loss of demand cut deep into his balance sheet: After the import taxes took effect, steel and aluminum duties sliced 20% off PanelClaw’s cash flow, and nearly a quarter of its solar projects were delayed or canceled. “[The tariffs] didn’t kill us but it did slow us down,” Nicolaou said. “We’re having a good year, but without the tariffs, it could have been a phenomenal year.”

Despite press releases and some evidence of foreign firms ramping up existing facilities, it’s “highly unlikely” any new plants could turn a profit before the tariffs fall, according to Wood MacKenzie. The Trump administration’s tariffs will ease as import duties decline 5% per year until reaching 15% in 2021.

Solar manufacturers outside the US (accounting for 98% of global production) are getting back on track by cutting prices and moving factories to countries unaffected by tariffs primarily aimed at China, such as Mexico and the Philippines. Wood Mackenzie reports solar installations have risen for three straight quarters, and total installed solar capacity in the US is expected to double over the next five years. Yet the industry may not reach its former glory until 2021, when installations are expected to exceed its 2016 peak for the first time.