3 Strong Retail Stocks to Buy During the Market Selloff

Today’s episode of Full Court Finance at Zacks dives into the market after all three major U.S. indexes hit new 52-week lows again on Thursday. The heavy selling is hitting nearly every corner of the market and leaving many investors nervous and on the sidelines.

Investors with longer-term horizons shouldn’t attempt to time the market exactly and some might want to start buying strong stocks that offer solid fundamentals in the current economic environment and beyond.

Few stocks and areas of the economy are safe at the moment from the wave of selling on Wall Street that saw the S&P 500, the Nasdaq, and the Dow all touch new 52-week lows Thursday. The benchmark index is now right on the cusp of bear market levels, down around 18% from its records. Meanwhile, the tech-heavy Nasdaq is trading nearly 30% below its November highs and around where it was in the fall of 2020.

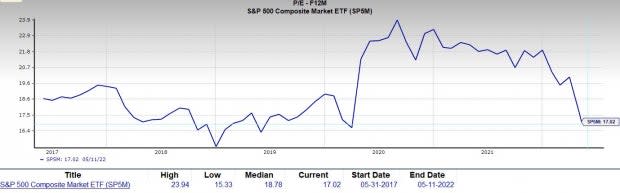

Wall Street is selling stocks and recalibrating valuations to account for higher interest rates as the Fed attempts to tame 40-year high inflation. April’s CPI remained hot, with prices up 8.3%. But consumers, at least for now, are still proving they are willing to spend as they try to live their post-pandemic lives to the fullest.

Image Source: Zacks Investment Research

Investors are clearly pricing in tons of rate hikes, as the Fed plans to keep lifting its core rate. That said, the longer the Russian invasion rages on and China’s zero-covid lockdown policies continue, the more pressure the U.S. and global economy will feel. And the Fed isn’t locked into its current rate hike timeline and likely won’t try to cause a recession in the U.S.

As valuations and stock prices fall further, more investors might start to consider buying some stocks again. There are, of course, benefits to staying in cash as the market slides. But 8.3% inflation and still-historically low interest rates might force Wall Street to start putting money back to work in the market sooner than later.

Playing the market-timing game is risky, to say the least. In fact, many investors who are looking years and decades ahead are likely better served by staying exposed.

With this serving as the backdrop, the first stock we detailed today is Target TGT ahead of its first quarter results on Wednesday, May 18. Target is a one-stop shop powerhouse that’s improved its in-house brands, digital offerings, and beyond to allow customers to shop however they please. Target posted back-to-back blowout years in 2020 and 2021 and Zacks estimates call for more growth this year and next.

Next up is grocery superstar The Kroger Co. KR. Kroger stock soared to new highs after it posted strong fourth quarter results in early March. More importantly, KR offered solid guidance as it adapts to supply chain bottlenecks and rising prices. Kroger is also benefitting from price-conscious shoppers, and that’s just part of the reason why KR shares might be worth buying.

The last retailer on the list today operates a far different business. Buckle BKE is a low-price apparel and footwear retailer that posted a banner year in 2021. Buckle’s outlook is solid as consumers gravitate toward its competitively-priced denim and beyond. Plus, Buckle’s dividend yield is looking rather enticing at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Buckle, Inc. The (BKE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research