Introducing Xinyi Automobile Glass Hong Kong Enterprises (HKG:8328), The Stock That Dropped 22% In The Last Year

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Xinyi Automobile Glass Hong Kong Enterprises Limited (HKG:8328) share price is down 22% in the last year. That falls noticeably short of the market return of around -14%. Xinyi Automobile Glass Hong Kong Enterprises hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Xinyi Automobile Glass Hong Kong Enterprises

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Xinyi Automobile Glass Hong Kong Enterprises share price fell, it actually saw its earnings per share (EPS) improve by 361%. Of course, the situation might betray previous over-optimism about growth. It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Xinyi Automobile Glass Hong Kong Enterprises managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

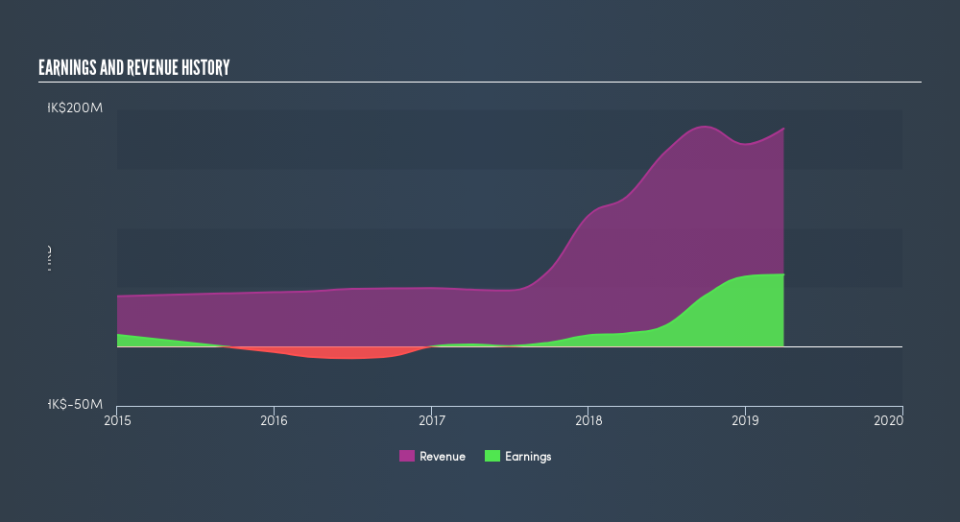

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at Xinyi Automobile Glass Hong Kong Enterprises's financial health with this free report on its balance sheet.

A Different Perspective

Xinyi Automobile Glass Hong Kong Enterprises shareholders are down 22% for the year, even worse than the market loss of 14%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 5.8% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before forming an opinion on Xinyi Automobile Glass Hong Kong Enterprises you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.