Update: Gaia (NASDAQ:GAIA) Stock Gained 80% In The Last Five Years

It might be of some concern to shareholders to see the Gaia, Inc. (NASDAQ:GAIA) share price down 17% in the last month. But at least the stock is up over the last five years. In that time, it is up 80%, which isn't bad, but is below the market return of 120%.

View our latest analysis for Gaia

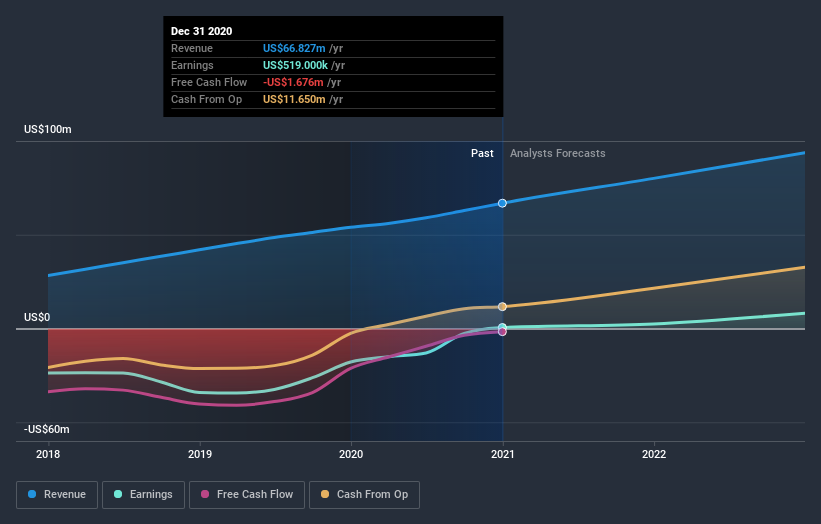

While Gaia made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Gaia can boast revenue growth at a rate of 31% per year. That's well above most pre-profit companies. While long-term shareholders have made money, the 12% per year gain over five years fall short of the market return. You could argue the market is still pretty skeptical, given the growing revenues. It could be that the stock was previously over-priced - but if you're looking for underappreciated growth stocks, these numbers indicate that there might be an opportunity here.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Gaia in this interactive graph of future profit estimates.

A Different Perspective

Gaia shareholders gained a total return of 21% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 12% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Gaia better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Gaia you should know about.

Gaia is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.