Hamden, Connecticut, received its second hit from a rating agency in four days and third in seven months when Fitch Ratings on Monday night downgraded the 61,000-population New Haven suburb's general obligation bonds to BBB from BBB-plus.

The outlook remains negative.

Fitch said the downgrade and outlook reflect the town's weakened financial status as a result of pressure from the COVID-19 pandemic on revenues and projections for a depletion of already limited reserves for the June 30 fiscal year end.

S&P Global Ratings on Friday dropped Hamden GOs two notches, to BBB-plus from A.

S&P also assigned its BBB-plus rating to the town's Series 2020A and B GO restructuring. The outlook on all ratings is negative.

Hamden, just north of New Haven and home to Quinnipiac University, intends to issue a negotiated GO debt restructuring around July 22 in two tranches.

They consist of roughly $21.6 million of Series 2020A bonds, to refinance outstanding bond anticipation notes and refund a portion of outstanding GO bonds, and $9.6 million of Series B taxable bonds, to refinance a portion of outstanding GO bonds.

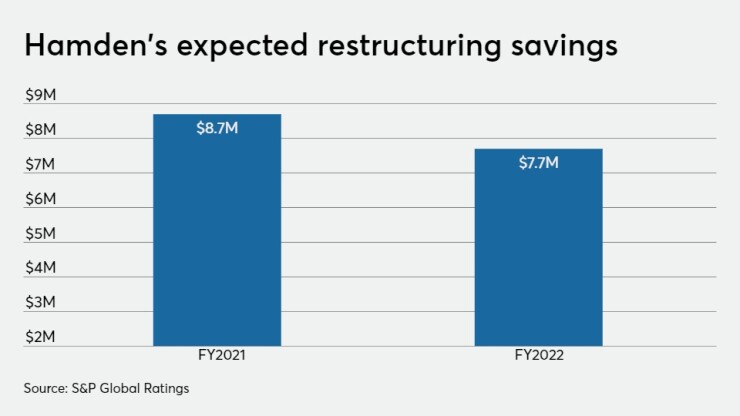

While the refunding would provide near-term spending relief and surplus money to boost reserves, additional restructuring plans may be necessary to avoid additional high tax rate increases in the next fiscal year due to an ascending debt service schedule, according to Fitch.

"Spending pressures are evident in the town's escalating debt service structure and increasing pension contributions given the low funded status of the town's single-employer pension plan and history of pension underfunding," Fitch said.

Moody's Investors Service in December downgraded Hamden to Baa3, the lowest investment grade rating, from Baa2, while retaining a negative outlook.

"No one likes to see a downgrade, but Hamden is working really hard on addressing financial challenges," Mayor Curt Balzano Leng said in a response. "These challenges were created over many decades and I’m proud that we’ve turned the corner in addressing them, but it takes time.

"Pension reform, medical insurance negotiated changes, staffing reductions and other efficiency measures are building a stronger Hamden for the future — one that is financially stable, resilient and where businesses and families alike will want to invest in.”

S&P analyst Victor Medeiros cited the town's weak financial position and projected deficit for fiscal 2020 that will lower the general fund balance to a negative position, as well as "high pension and other postemployment benefit liabilities, largely due to years of underfunding pension liabilities, including in fiscal 2019.

"We view the town's repeated debt restructurings and its plans for another in 2021 as a sign of budgetary distress and limited financial flexibility," S&P said.

Leng in February hired Curtis Eatman as finance director. Eatman is a former deputy finance director for Schenectady, New York.