Portfolio management is a well-planned investing strategy based on an investor’s objectives and risk tolerance. Portfolio management entails selecting and monitoring investments such as stocks, bonds, and mutual funds. The primary goal of portfolio management is to invest in a way that allows maximizing returns while minimizing risks to achieve financial objectives. Portfolio management can be done with the assistance of a professional, on your own, or through an automated service. There are four common approaches to portfolio management, as discussed below: This is a type of portfolio management that seeks to produce higher returns than the market's benchmark. It involves intricate and aggressive strategies such as short-term investments, regular buying and selling, timing the markets, and more. Successfully managing a portfolio takes research, diligence, careful planning, and ongoing monitoring. Furthermore, it also requires a great deal of knowledge of the securities involved, including their behavior in different circumstances. This type of investment management attempts to match an index's or benchmark's performance. Passive portfolio strategies enable investors to reap the rewards from long-term investing in low-cost index funds and mutual funds that track popular benchmarks. Although this may not always yield outstanding returns, it can still offer a steady return over time with less risk than active trading strategies. This type of portfolio management allows professionals to make decisions about a client's holdings without the need for ongoing authorization from the investor. It is ideal for clients who value the expertise of a registered investment advisor and want someone else to manage specific aspects of their finances. This approach requires the investor to be actively involved in every decision, including what investments are bought and sold. The manager only provides advice and guidance on investments to buy or sell but does not have the final say. Investors can fully control their portfolio and risk exposure and make decisions based on their knowledge and experience. A portfolio management process is a systematic approach to making investment decisions. It requires careful planning, execution, and feedback to be successful. An effective portfolio management process begins with careful planning. It comprises the following steps: Identify the investment objectives, which refer to any desired outcomes for the client regarding return and risk. Similarly, identify constraints that refer to any limitations on investment decisions or choices. Draft an effective investment policy statement that provides valuable direction for investors' resource allocation decisions. To help investors assess the potential investment returns and determine the long-term outlook, formulate expectations for risk and return of various asset classes. There are two strategies to consider here, strategic and tactical. A strategic asset allocation strategy is a long-term strategy that necessitates regular rebalancing to ensure you do not deviate from your goals. A tactical asset allocation strategy, on the other hand, takes a more active approach that reacts to changing market conditions. This means that despite having a long-term plan, you make frequent changes for short-term gains. Execution is the crucial next step after completing the portfolio planning stage. Here, important decisions must be made regarding various aspects of the portfolio to execute it properly. This involves an investor deciding which assets to include in their portfolio. It requires balancing risk and return expectations while accounting for external factors, such as inflation and taxes, to ensure a favorable outcome. Poorly timed and managed portfolio executions can result in significant transaction costs. When executing a portfolio, it is essential to consider both explicit and implicit costs. Explicit costs are quantifiable expenses that appear in the cash book of a business and are used to calculate profitability. Implicit costs are not defined and are not flagged up as spending. When a company allocates its resources, it loses its ability to profit from using them elsewhere. It is the cost of operating an asset. Any changes are thoroughly examined to ensure they are consistent with long-term objectives. A portfolio manager should regularly monitor and evaluate risk exposures within the portfolio to rebalance it according to the strategic asset allocation. Evaluating a portfolio using absolute and relative returns gives a complete picture of its strengths and weaknesses. Such help portfolios reach their full potential and give investors the confidence that their funds are managed well. Investment portfolio management is a crucial part of any long-term investment strategy, as it plays a major role in helping individuals and organizations to minimize risks and maximize returns. The following are the key strategies to be considered when managing portfolios: Asset location refers to the placement of assets within various accounts, such as tax-advantaged or taxable accounts, Roth IRAs, or 401(k)s. Understanding the tax implications of various investments can potentially maximize returns. Depending on the investor's objectives and financial situation, proper asset location can help them reduce their overall tax payments. Investing in diversified portfolios is a fundamental principle of portfolio management. This strategy helps reduce the risk profile of an investment as it spreads out the portfolio over multiple asset classes or sectors. The goal of diversification is to lower portfolio volatility without sacrificing overall returns. In this way, investors can benefit from holding a combination of stocks and bonds, as asset classes tend to perform differently in varying market conditions. Rebalancing is a strategy that regularly reassesses the asset allocation and cash holdings in a portfolio according to predetermined goals. This helps keep the composition of a portfolio in line with its objectives, such as capital growth or income generation, and helps minimize risk exposure and take advantage of new opportunities. By reviewing different types of investments within an overall portfolio and shifting money from sections that have exceeded their target proportions back into those that have dipped below them, savvy investors can work to maintain optimum performance over time. Tax minimization is one of the most sought-after strategies used in portfolio management. The idea is to hold investments that provide maximum tax benefits and use available deductions to reduce the overall tax liability. Tax minimization includes claiming deductions and credits, understanding the difference between capital gains and earnings, and keeping abreast of changing tax codes. It also involves choosing proper investment vehicles, such as REITs or Roth IRAs, which defer taxation until certain conditions are met. Portfolio management is the process of creating and maintaining a well-diversified collection of investments that align with an individual's financial goals and risk tolerance. These include monitoring performances, setting goals, analyzing risk factors, and devising investment strategies. There are four main portfolio management types: active, passive, discretionary, and non-discretionary. A successful portfolio management process involves careful planning, execution, and feedback. Investment strategies can assist investors in making an educated choice about an investment. The key strategies involved in portfolio management are asset allocation, diversification, rebalancing, and tax minimization. Consider speaking with a financial advisor who can assist you in analyzing your investment needs and developing an investment plan.What Is Portfolio Management?

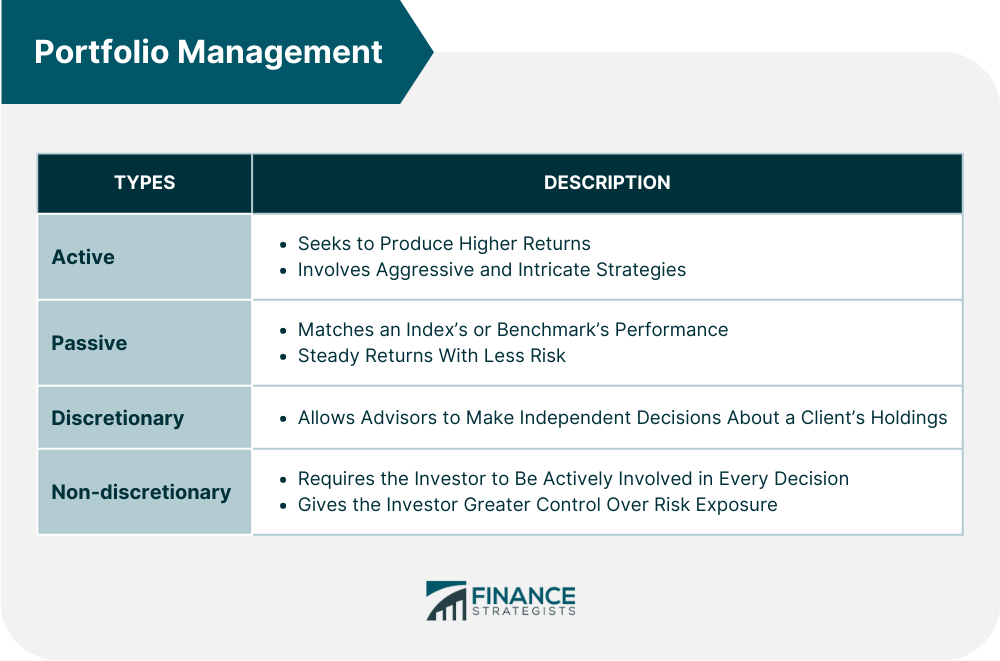

Types of Portfolio Management

Active Portfolio Management

Passive Portfolio Management

Discretionary Portfolio Management

Non-Discretionary Management

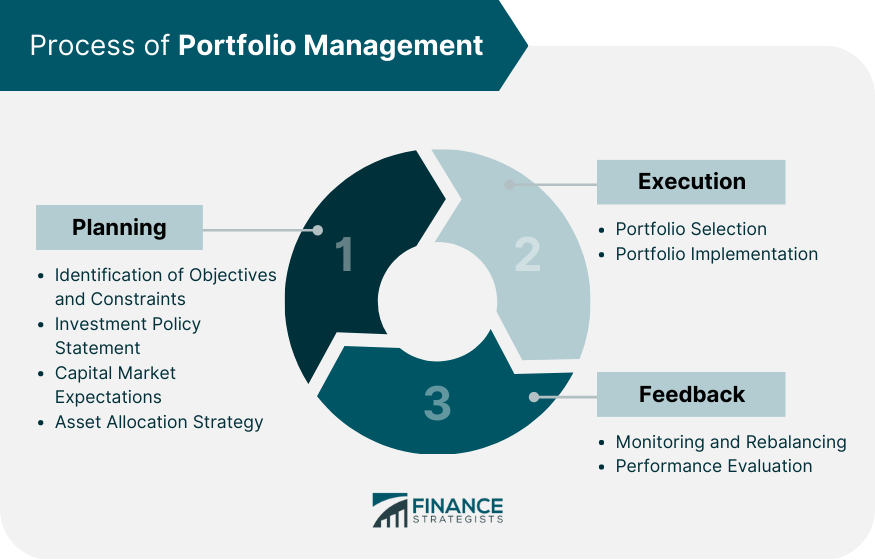

Process of Portfolio Management

Step 1: Planning

Identification of Objectives and Constraints

Investment Policy Statement

Capital Market Expectations

Asset Allocation Strategy

Step 2: Execution

Portfolio Selection

Portfolio Implementation

Step 3: Feedback

Monitoring and Rebalancing

Performance Evaluation

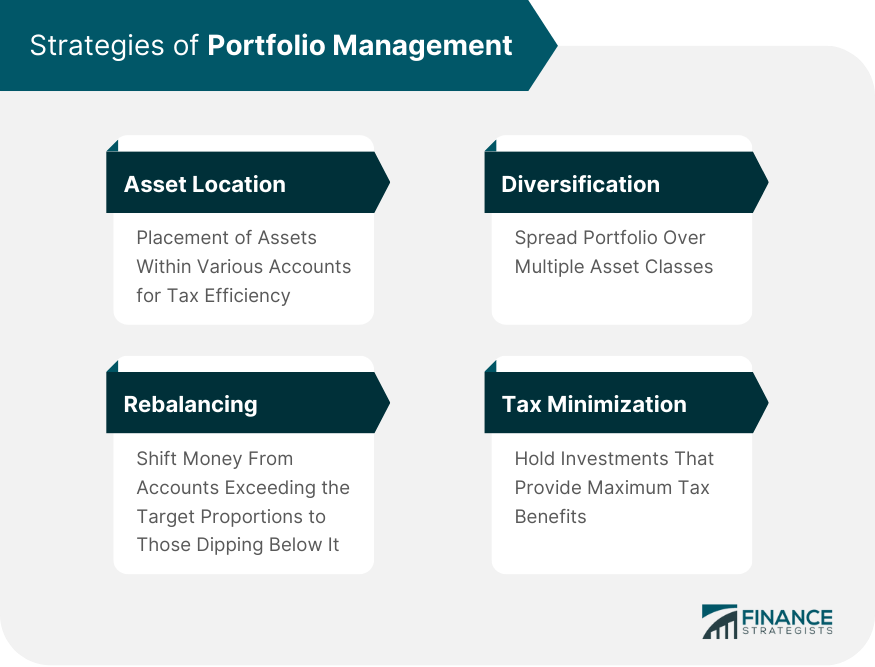

Strategies of Portfolio Management

Asset Location

Diversification

Rebalancing

Tax Minimization

Final Thoughts

Portfolio Management FAQs

The main objective of portfolio management is to maximize returns on investments by utilizing different strategies and techniques. Portfolio managers are responsible for creating portfolios that meet the investor's objectives while ensuring they are aligned with market conditions and risks.

An investment portfolio manager develops and oversees a portfolio that aligns with an investor's financial goals, risk tolerance, and time horizon. They will analyze financial markets to identify suitable investment opportunities and make decisions based on this research. The aim is to optimize the return on investments while minimizing risk.

Portfolio management has many benefits, including better investment decisions, risk minimization, returns optimization, performance tracking, and liquidity management.

Portfolio management is a multi-step process. The core process involves planning, execution, and feedback. Planning necessitates the identification of objectives and constraints, drafting an investment policy statement, setting capital market expectations, and establishing an asset allocation strategy. Execution involves portfolio selection and implementation, while feedback involves monitoring and rebalancing, and performance evaluation.

The two main types of portfolio management are active and passive investing. Active investing involves frequent trading to take advantage of market trends or opportunities for profit, while passive investing relies on buying and holding assets for an extended period.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.