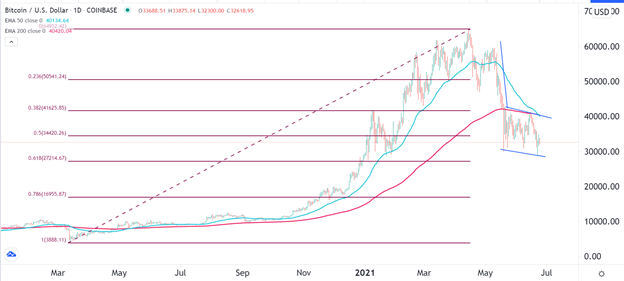

Bitcoin fluctuated during the trading session on Wednesday as we continue to try to build a bit of a base. The hammer that formed on Tuesday was a very bullish sign, as it sits just above the crucial $30,000 level. That being said, the market did very little during the trading session on Wednesday, which suggests that the market is simply too weak to continue going higher for much longer. Not only do we have the 200-day EMA above at the $36,770 level, but it is also very flat, so that suggests that we are simply grinding sideways more than anything else.

That being said, I think we could see a little bit of a short-term bounce, but more likely than not we will see sellers coming back into this market to put more bearish pressure on Bitcoin. If we were to break above the 200-day EMA, then it is likely that the market will go looking towards the $40,000 level. The $40,000 level has been important a couple of times, and I think if we could get a daily close above the 50-day EMA, which is currently just above there, then we could change the attitude about Bitcoin itself. Right now, it certainly looks as if we are about to see Bitcoin lose even more value.

One thing is for sure: this bubble acted very much like the one from a few years ago, as people were suddenly calling for Bitcoin to reach $1 million. It was preposterous that it was going to happen anytime soon, and now that we have lost roughly 50% of the overall rally, it does seem like “hindsight is 2020” when it comes to most traders. Another thing that is worth noting is that we are now basically flat for the year, so that is something to keep in mind as well. It is because of this, that if we were to break down below the hammer from the session on Tuesday, I believe that opens up the “trapdoor” to lower prices that would almost certainly put a target on the $20,000 level. Regardless of what happens next, the rectangle that we have been in should continue to see quite a bit of choppy behavior.