Keventer Agro has set its sights on the number two slot in eastern India’s burgeoning UHT (ultra high temperature) milk market, backed by contra pricing strategy, smart packaging and a logistic advantage over its peers.

The company, which has made a Rs 150-crore investment to set up an aseptic processing facility at Barasat, is looking at a 25 per cent share by March 2020, to trail only market leader Amul.

The Keventer plant is the only one in the entire east to produce the ultra high temperature milk that goes into aseptic packaging, widely known by the brand name of the leader in the category, Tetra Pak.

The east consumes around 4.5 lakh litres per day of UHT milk, valuing the market at Rs 1,000 crore. Even though it is only a fraction of the total milk consumption (55 million litres a day) in the region and of the sale by organised players (50 per cent), the UHT market is growing 23 per cent annually.

Keventer has put up a facility that can process 2 lakh litres per day.

The company has come up with three variants — standardised, toned and double toned, which contribute over 90 per cent to UHT sales. They will be sold under the “Keventer” brand instead of the ”Metro” brand, which has so far been the brand for pouched milk and ice cream.

The UHT milk will allow Keventer to step out of Bengal to the rest of the eastern states and northeastern states. Pouch milk requires refrigeration and hence it is not economical to carry pouches to distant locations because of the high costs of cold chain management. Moreover, pouch milk has a limited shelf life compared with UHT milk, which can be safely stored for six months and can be drunk without heating or cooling.

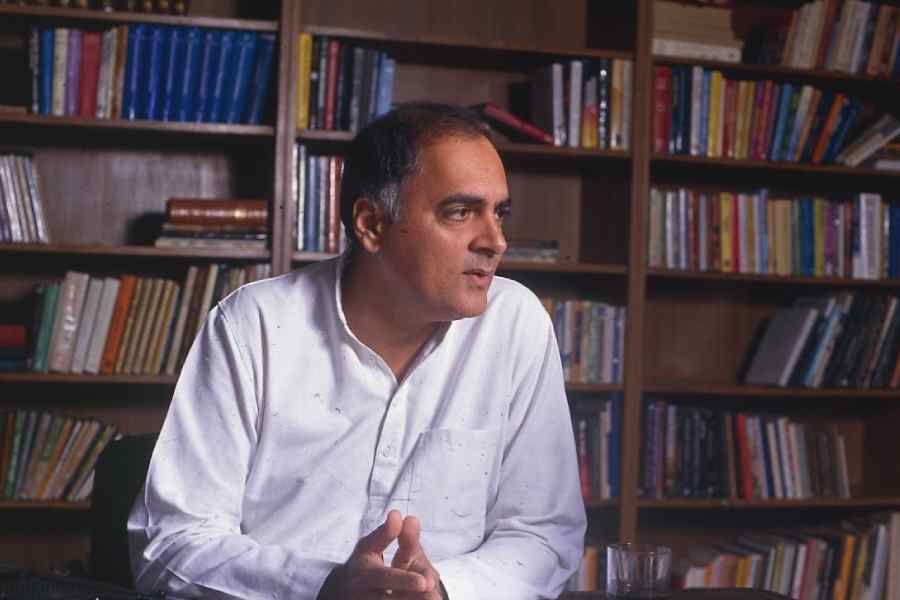

“We want to establish Keventer as a top player in the dairy business in the east. There are a slew of products which will be launched going forward,” Jalan said at the launch. Ashutosh Manohar, managing director of Tetra Pak India, was also present.

Since Keventer is the only local player to put up such a plant, it would at least enjoy Rs 5-6 a litre advantage over the competition. Amul, for instance, brings its packaged milk all the way from Gujarat. Moreover, Keventer has gone for contra pricing with a litre of standardised milk (4.5 per cent fat content) costing the most, while double toned milk will cost the least. Usually, double toned milk cost more in the market than standard and toned ones.

Toned milk (3 per cent fat) is the biggest chunk of the market and Keventer has priced its product aggressively against competition.