- A combination of factors assisted USD/JPY to gain traction for the fifth straight session on Tuesday.

- The risk-on mood continued undermining the safe-haven JPY and remained supportive of the move.

- Surging US bond yields helped offset USD selling bias and provided an additional boost to the pair.

The USD/JPY pair continued gaining positive traction for the fifth consecutive session on Tuesday and shot to over one-week tops during the Asian session. The progress in the rollout of vaccines for the highly contagious coronavirus disease, along with expectations for a massive US fiscal spending plan has been fueling hopes for a faster-than-anticipated global economic recovery. The optimism continued boosting investors' confidence, which was evident from the ongoing risk-on rally in the equity markets. This, in turn, undermined demand for the safe-haven Japanese yen and was seen as a key factor driving the pair higher.

The JPY was further pressured by dovish comments from the BoJ Governor Haruhiko Kuroda, saying that there is still very high uncertainty over the economic outlook. Kuroda further added that it was premature to debate an exit from the massive stimulus programme, including BoJ's ETF buying. Bullish traders further took cues from surging US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond jumped to the highest level since February 2020 amid worries that rising inflationary pressures would hurt the value of longer-dated debt.

The prospects for the passage of the US President Joe Biden's proposed $1.9 trillion COVID-19 relief package is expected to encourage faster economic recovery and lift consumer prices. Investors' expectations for inflation over the next decade jumped to 2.22% or the highest level since August 2014. The US bond market has been reacting strongly to the developments and remained supportive of the pair's move up. The momentum seemed unaffected by the prevalent selling bias surrounding the US dollar, which failed to gain any respite from rallying US bond yields.

There isn't any major market-moving economic data due for release from the US on Tuesday. This, in turn, leaves the pair at the mercy of the broader market risk sentiment. Apart from this, movement in the US bond yields and the USD price dynamics will also be looked upon for some meaningful trading opportunities.

Short-term technical outlook

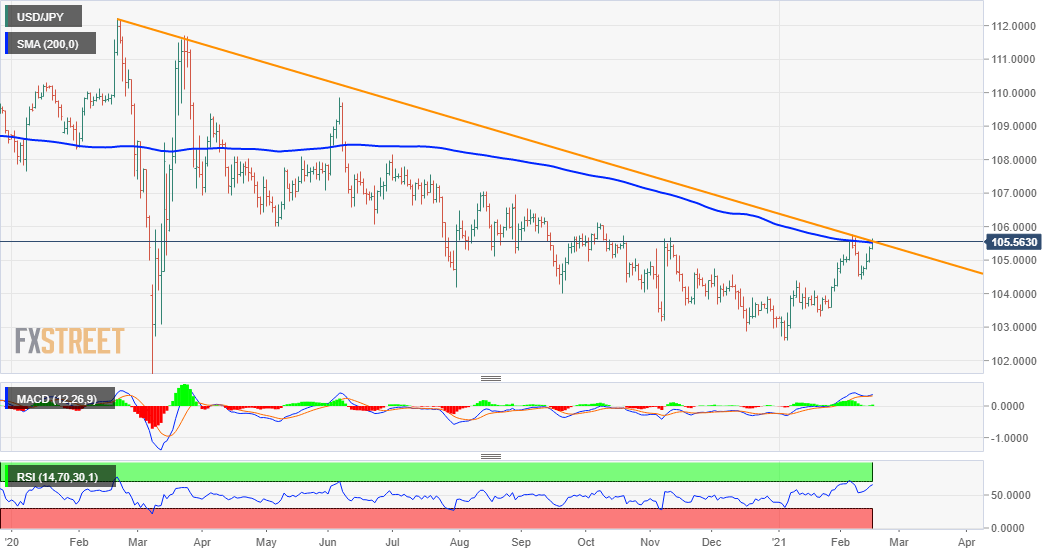

From a technical perspective, the pair might now be looking to build on the momentum beyond an important confluence hurdle comprising of the very important 200-day SMA and near one-year-old descending trend-line. A sustained move beyond YTD tops, around the 105.75 region, will confirm a near-term bullish breakout and set the stage for additional gains. The pair might then surpass the 106.00 mark and accelerate the positive move further towards the 106.50-55 supply zone.

On the flip side, the 105.25 level now seems to protect the immediate downside and is closely followed by the key 105.00 psychological mark. Failure to defend the mentioned support levels might prompt some technical selling and turn the pair vulnerable to slide back to last week’s swing lows support, around the 104.40 region. Some follow-through selling will negate any near-term positive bias and turn the pair vulnerable to slide further.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.