SUMMARY

From high hopes of an INR 6,250 Cr IPO to its current beleaguered state — PharmEasy’s fortunes have swung wildly in less than a year

Inc42 has learnt that the company has reduced its workforce by over 500 employees through resignations or layoffs since last year

Former employees allege that despite having five cofounders, PharmEasy has serious leadership gaps, adding to the chaos around its financial state and debt situation

Thyrocare was seen as PharmEasy's moat but the diagnostic giant's profits have fallen to FY2019 levels and its franchise model is grappling with operational issues

Update: After Inc42’s in-depth look at the problems at pharmeasy

Click here to see how PharmEasy is trying to free itself from its pile of debt.

Our original story follows

From high hopes of an INR 6,250 Cr IPO to its current beleaguered state — the fortunes of healthtech unicorn PharmEasy have swung wildly in less than a year.

Before we delve deeper, here’s a quick snapshot of what is ailing the company:

- A serious lapse in franchise operations that has left franchisees exasperated

- Mismanagement of the profitable Thyrocare business after acquisition

- A fast-brewing financial crisis around its own $300 Mn Term B Loan (BYJU’S is not alone)

- Layoffs and departures of key personnel, with the tech team reduced to 100 employees from around 500 last year

- Employees allege lapses in the leadership despite five cofounders leading the various verticals for PharmEasy

The franchise model challenges have also spilled over to social media, where several individuals have blamed PharmEasy for charging them high fees and not providing adequate support.

Sources close to the company, pharma sector experts and former employees claim these issues have been bubbling for a few months and now things have come to a boil for the Mumbai-based healthtech unicorn.

Inc42 has learnt that the company has reduced its workforce by over 500 employees through resignations or layoffs since last year. Inc42 has reported on some of these layoffs over the past year, including an exclusive on the situation at PharmEasy subsidiary Docon Technologies.

Former employees, some of whom have recently quit the company, allege that despite having five cofounders, PharmEasy has serious leadership gaps, adding to the chaos.

PharmEasy did not respond to requests for comments and responses to the allegations of mismanagement or the lack of a financial safety net.

PharmEasy’s Pandemic Swing

Any story about PharmEasy inevitably speaks about how the company was founded by five friends who grew up in pretty much the same neighbourhood in Mumbai.

Dharmil Sheth, Dhaval Shah, Harsh Parekh, Siddharth Shah, and Hardik Dedhia teamed up to take the pharma ecommerce plunge with PharmEasy in 2015. Since then, the parent company, API Holdings, has rapidly expanded on the back of venture capital and debt, raising more than $1.5 Bn, as per Inc42 data.

Today, the company has as many as 36 subsidiaries that operate the B2C epharmacy ops, B2B pharma supply, franchise stores, SaaS for pharmacy management, pathological testing and ancillary telemedicine services.

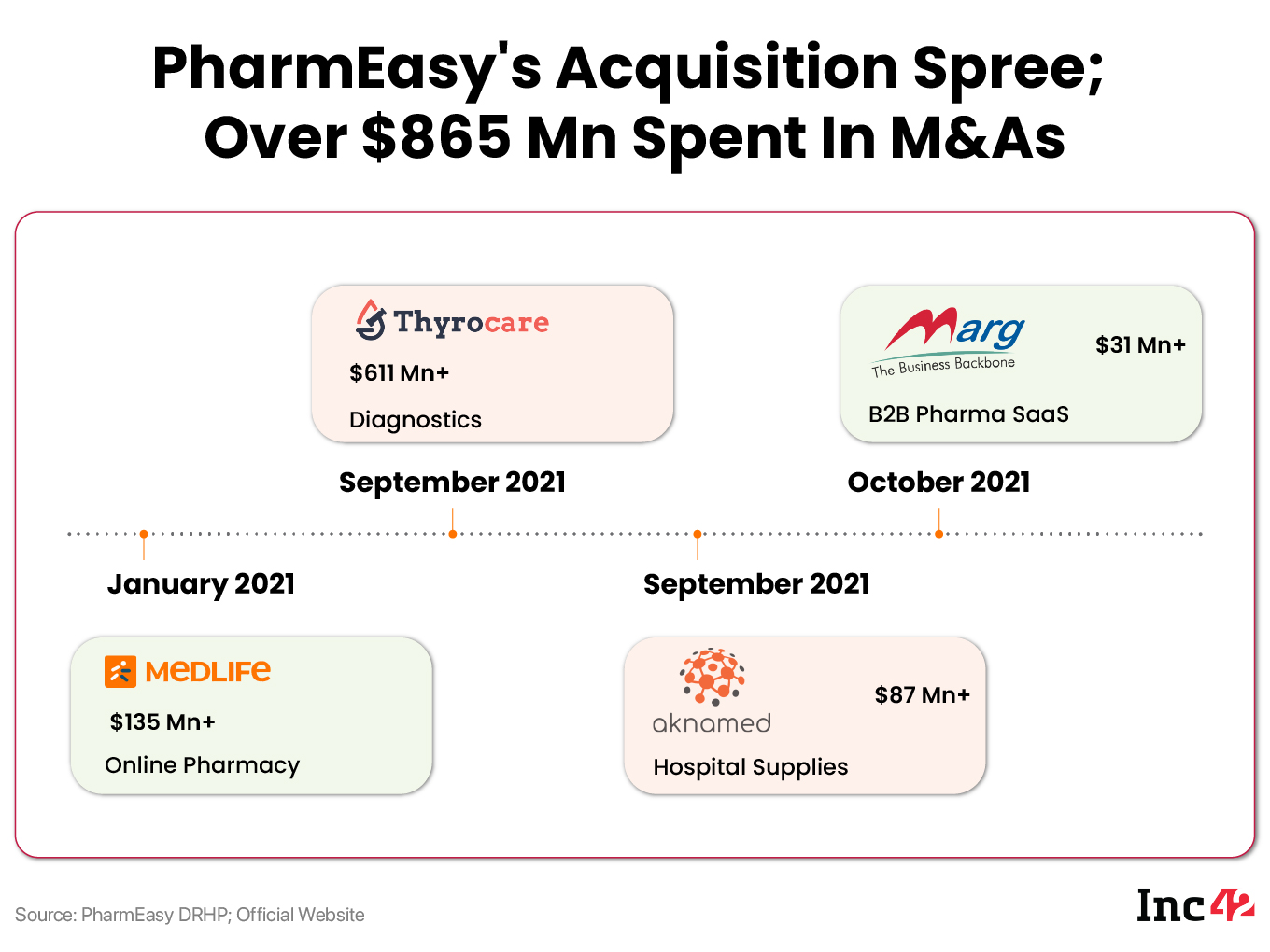

While other healthtech companies have stuck to one or two of these models as a core business, PharmEasy bullishly went after the entire stack. To get there, it went on an acquisition spree, spending more than $865 Mn in the process.

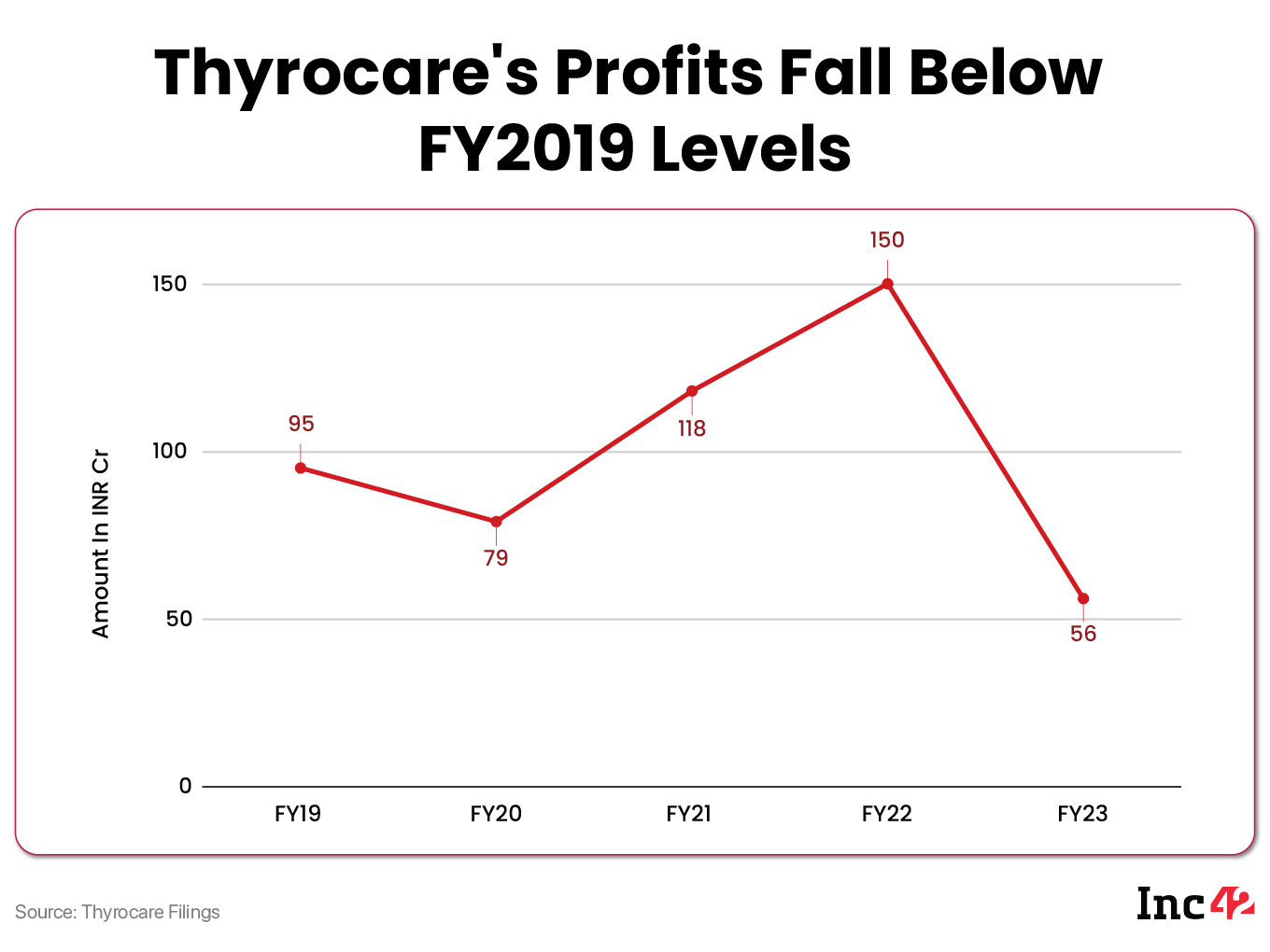

But acquisition does not equal success, and as we can see, Thyrocare’s profits have fallen to FY2019 levels after PharmEasy acquired the company in mid-2021.

In FY23, Thyrocare saw a major drop in revenue to INR 491 Cr from INR 568 Cr in FY22. Its profits plummeted in June 2021 (FY22). The deal coincided with the end of the second wave of Covid in India when testing numbers had peaked.

The diagnostics company reported profits of INR 34 Cr in the first six months of FY23, as opposed to INR 109 Cr in H1 FY22, just after the PharmEasy deal. A portion of these profits is also being used to pay the interest on the debt that PharmEasy had taken to buy the company.

Plus, PharmEasy’s parent API Holdings is deep in the red. In FY22, PharmEasy’s consolidated revenue from operations grew to INR 5,729 Cr from INR 2,235 Cr in FY21. Its losses also shot up to INR 2,731 Cr in FY22 from INR 641 Cr in FY21.

The higher losses were a result of PharmEasy’s acquisitions in the year and its rampant marketing and salary spend. Employee benefit costs surged to INR 1,459 Cr from INR 270 Cr in FY21, while advertising and promotional activities accounted for INR 494 Cr, up from INR 134 Cr. Total expenses shot up to INR 8,492 Cr in FY22, nearly 3X higher than INR 2,981 Cr in FY21.

Without its FY23 numbers, we can’t say with any certainty that PharmEasy has managed to cut back the heavy spending. One way the company has looked to push revenue is through the franchise model for both PharmEasy-branded pharmacies as well as Thyrocare’s diagnostics biz, but these are fraught with major issues.

But the fact is that the company is faced with stiff competition in the epharmacy and diagnostics space, and employees allege that it continues to spend considerably on marketing and customer acquisition.

The shaky financial situation has created a host of problems for Thyrocare, which otherwise has a stellar reputation in the market. With Thyrocare’s profits also down, PharmEasy will have a tough time showing why investors should invest at a higher valuation.

Now that PharmEasy’s IPO ambitions have been put on hold, the company is still chasing a new funding round as it looks to get out of the debt hole.

Franchise Models Plagued By Issues

The franchise operations, like any other franchise model, hinge on PharmEasy attracting store owners and existing unorganised players in the diagnostics and pharmacy space. While theoretically it is a cost-effective way to expand and scale up, there are plenty of problems that have dogged this vertical.

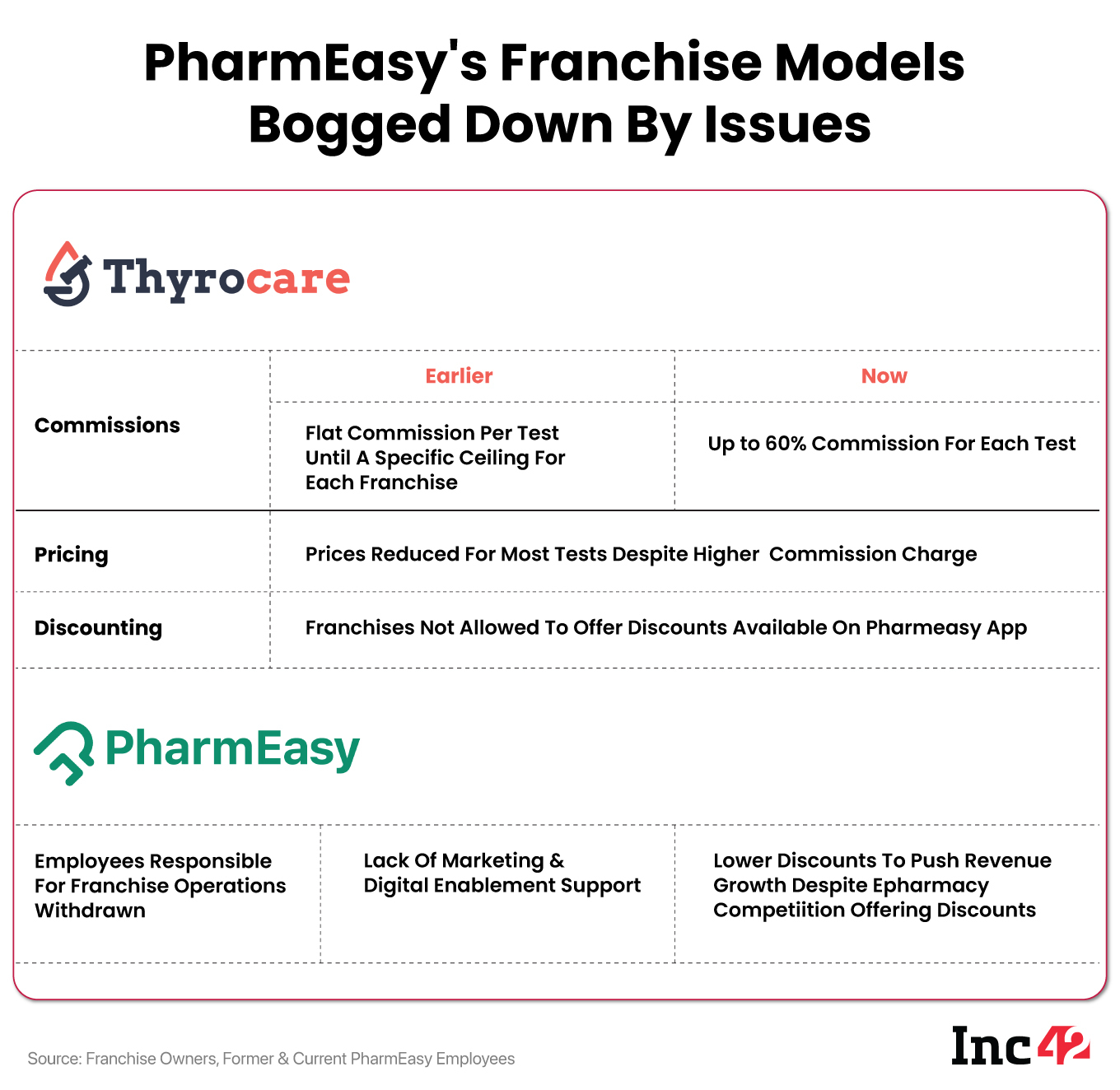

Franchise owners are unhappy with the commission terms being changed mid-way through FY23 and then again earlier this year (in the ongoing FY24). This has left franchises with very thin margins. Further, on the pharmacy franchise side, store owners bemoan the lack of support from the company in handling operations.

Let’s dive into these issues separately:

Thyrocare Feels The Heat From Rivals

“The franchise model is not unusual in the diagnostics business. Every major player wants a deeper presence in the major cities, but the likes of SRL and Lal Pathlabs offered better commissions for each walk-in or lead,” a former PharmEasy employee, who was working on the B2B and franchisee tech products, told Inc42.

Like any other franchise model, PharmEasy charged fees from pharmacists, store owners and merchants to open up new locations under the Thyrocare umbrella. In the initial days, the company took 10% as commission from a franchise store for each transaction until a certain fee ceiling was hit. For example, if the ceiling is INR 2 Lakh, PharmEasy would not charge any commission beyond this point.

This proposition appealed to several store owners. But the growing competition meant that PharmEasy could not afford to leave any revenue on the table when it came to the franchise model. In the diagnostics business, Thyrocare competes with the likes of Redcliffe, SRL, Abbott, Metropolis and many others. Almost all of these have heavy discounts for basic tests, which PharmEasy has to match to keep up pace, said one Thyrocare franchise owner based in Kalyan, near Mumbai.

Lately, PharmEasy has changed this structure, the franchise owner added. The company now charges a direct commission from each franchise for every test instead of the earlier model of charging commissions until a specific ceiling was hit. Moreover, franchises have to pay a small fee for each consumable (such as vials or collection kits) used in the collection process.

“If a test costs INR 150 for the patient, we are now being paid INR 60 instead of INR 80 earlier,” the franchise owner mentioned above told Inc42.

He also said that even though his Thyrocare outlet gets a lot of walk-ins, he is not empowered to offer the same discounts as the PharmEasy app where users can get offers such as buy-one-get-one offer for some tests. Customers who want to avail this offer cannot get it at a franchise location and have to use PharmEasy’s app with Thyrocare’s direct sample collection service, which bypasses franchises.

It’s no wonder that franchise owners claim the company is shortchanging them on commissions as well as potential new business.

Franchise owners also have to face the customer’s ire when it comes to delays from the PharmEasy/Thyrocare testing labs. Many franchise owners have taken to Twitter and other social media platforms to talk about the lack of support on the operations front from PharmEasy.

Besides diagnostics, the company also has a franchise arrangement for pharmacies under the PharmEasy brand. In this case, many store owners have complained that employees assigned as support personnel for franchisees have been withdrawn by the company in recent weeks.

Staff Crunch Hurts PharmEasy Franchise Ops

One such franchise store owner claims there is a group of 400-500 PharmEasy franchises that is dissatisfied with the company for charging up to INR 4 Lakh up front but not providing the support that is expected in the early days.

“Within 15 days, PharmEasy withdrew many of the people it had assigned to help us manage operations. They said they would handle marketing and digital enablement, but most of the time we cannot get hold of anyone in the company,” the PharmEasy franchise store owner mentioned above said.

As per the terms of the agreement, PharmEasy says it would provide fulfilment, marketing and digital enablement for franchise pharmacies, but franchise owners say that the company has reneged on these services.

The retail franchise model has become the go-to-market strategy for all leading pharma chains. Apollo, MedPlus, Wellness Forever and others have expanded rapidly on the back of franchise models even during the peak Covid times. And now, franchises are trapped in PharmEasy’s terms and conditions since they have already paid a cost up front.

Medical stores and diagnostics centres are typically clustered around major hospitals. This means moving to a rival franchise is also not always possible since there is very little possibility of multiple outlets of the same brand in one area.

The lack of hands-on support for franchises, employees allege, is directly related to layoffs and resignations at PharmEasy.

In many ways, PharmEasy’s debt situation has forced it into a corner. The company has to chase revenue through every avenue and cut costs significantly to raise its next round and free itself from the chain of debt, which began with the Thyrocare acquisition in 2021.

PharmEasy’s Tech Platform On Life Support

The tech platform, which was seen as a competitive moat for PharmEasy when it came to the Thyrocare acquisition, is also fast eroding due to layoffs and exits of key tech leaders, sources said.

Sources and former employees told Inc42 that there are hardly any employees left in the tech team to build new products, and most products are in maintenance mode.

For one, the technology or product that helps read prescriptions does not always work. This means PharmEasy is processing orders for prescriptions it has no idea about. “You can add any prescription and it will usually be accepted. In case of rejection, a doctor will call and prescribe medicines.”

Speaking to Inc42, one retailer in South Delhi alleged that medicines are often prescribed on the phone by PharmEasy agents without any diagnosis, and at times, these tele-doctors also upsell products.

This Twitter thread by the well-regarded TheLiverDoc highlights how telecallers look to tack on herbal medicines to other orders; these herbal medicines are not always safe for general consumption.

Indeed, retailer associations have complained about the lack of due diligence and compliance by epharmacies, including improper storage of medicines and selling medicines without prescriptions.

Employees allege that the company is no longer able to compete with other epharmacies through discounting due to a funding crunch.

“Even though whatever we sell has high margins, the volumes are down. We are currently doing 50K orders per day from an average of 80K in FY22; orders mostly coming from metros,” one former employee claimed.

Employees also allege that despite the exits of key personnel and the restructuring of the managerial layer, PharmEasy’s founders are typically missing from day-to-day operations and only address town halls once every quarter.

PharmEasy On The Funding Trail

It doesn’t help PharmEasy that a significant portion of its monthly expenses go towards debt repayments. As per reports, PharmEasy has a monthly repayment outlay of INR 15 Cr, and its monthly cashburn is also around INR 15 Cr.

The company also claimed that it reached a positive EBITDA for the first time in April this year, with a net revenue of INR 600 Cr. These numbers could not be corroborated in any regulatory filings.

PharmEasy reached a valuation of $5.6 Bn with its last funding round of nearly $350 Mn in October 2021, which saw investments from Amansa Capital, ApaH Capital, Janus Henderson and others. Cut to June 2023 and Janus Henderson’s regulatory filings showed a markdown of its PharmEasy investment with a valuation of $2.7 Bn.

Plus, the online pharmacy has reportedly breached a loan covenant in its INR 2,280 Cr ($285 Mn) Term B loan agreement with Goldman Sachs in August 2022.

As per the loan covenant, PharmEasy had to raise an equity round of around INR 1,000 Cr ($120 Mn) to fund its monthly burn. However, it has failed to do so, and today, the company continues to repay the loan at an interest rate of up to 18% per annum.

PharmEasy raised INR 750 Cr through convertible notes in October last year from existing investors and also raised a debt round from Temasek’s EvolutionX, but a majority of this has gone in debt repayments.

The company was reported to be in the process of raising further equity funding to push for scale and growth on both epharmacy and diagnostics front. However, so far, there’s no official indication that PharmEasy has improved its financial position enough to attract investors.

Earlier this year, PharmEasy is said to have appointed Avendus Capital as advisors for fundraising, but there’s no certainty of the company actually raising any funds given its current situation. Avendus did not respond to a comment on the funding talks.

Given the global macroeconomic slowdown, investors are primarily looking to back companies that have made some meaningful progress in terms of sustainability.

PharmEasy hoped to pay off INR 2,000 Cr of its debt from the proposed IPO proceeds of INR 6,250 Cr. Having postponed its IPO plans to 2025, the epharmacy unicorn is looking to raise equity capital, but the healthtech and epharmacy landscape has changed drastically.

Two More Complications: Regulations & Competition

For PharmEasy, operational and executional challenges are compounded by the regulatory pressure on the epharmacy segment as well as growing competition. In April this year, it was reported that the government sought a report from epharmacies to understand what consumer benefits they were providing beyond discounts.

The lack of direct regulations pertaining to epharmacies in India has exposed startups such as PharmEasy to legal challenges from retailer associations and other bodies.

Delhi-based South Chemists and Distributors Association (SCDA) is one of the bodies that had moved the courts against epharmacies. SCDA’s legal and media head Yash Aggarwal believes authorities need to temporarily shut down epharmacy platforms until a full-fledged legislation is drafted.

“When things are against the law, especially with regard to the health of the public, follow court’s directions and shut these platforms till norms are promulgated in the matter,” SCDA’s Aggarwal told Inc42.

Indeed, many epharmacy platforms were pulled up by the Drugs Controller General of India (DCGI) in February for allegedly violating rules under the Drugs and Cosmetics Act, 1940.

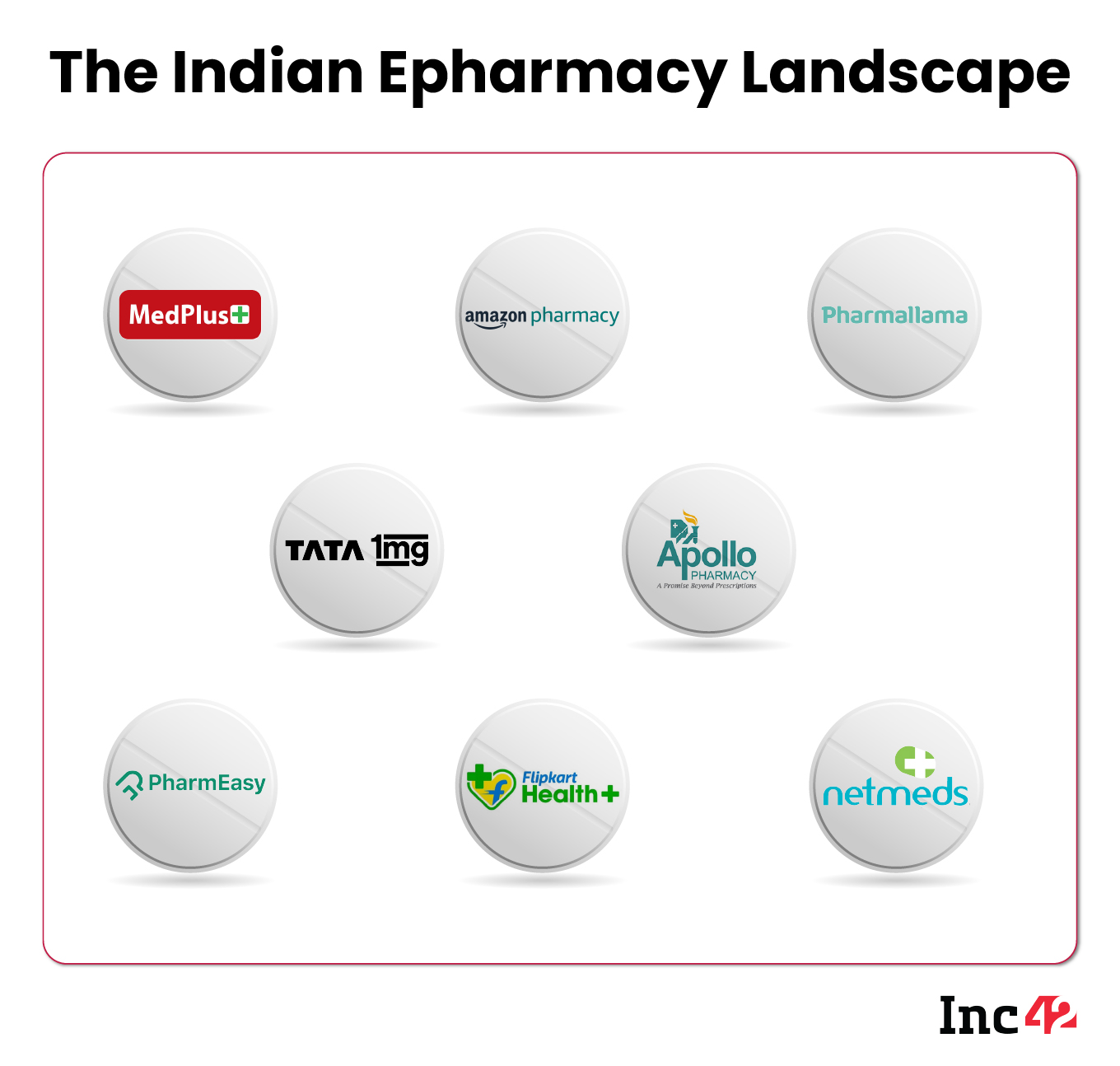

The situation is particularly precarious given the high competition in epharmacies with players such as PharmEasy, Tata 1Mg, Flipkart Health+, Amazon, NetMeds and others. The entry of horizontal ecommerce marketplaces such as Jio, Tata, Flipkart and Amazon has certainly catalysed the regulatory crackdown on epharmacies.

Former employees managing PharmEasy’s online business told Inc42 that no player can afford to ignore the threat from Amazon, Flipkart, Tata (1Mg) and Reliance (NetMeds). The vertical integration and specialisation that epharmacies have built over the years can easily be nullified by the scale of these large players.

The likes of Reliance, Tata and Flipkart have taken the ‘super app’ route to compete with pure-play epharmacies such as PharmEasy. Reliance Retail-owned NetMeds has also entered the retail pharmacy space with physical stores in Chennai. Reliance Retail claims it will open 2,000 such stores in a year.

PharmEasy might have grabbed the healthcare industry’s eyeballs with its Thyrocare acquisition and rapidly building its telemedicine stack, but it’s looking more and more like the unicorn needs a bigger dose of funding to continue on this trajectory. Will the cost-cutting and changes in its franchise model be enough to bring in long-term sustainability and convince gun-shy investors amid this funding winter?