WATCH HEARING REPLAY: Florida Elections Commission Charge Robert Burns With 64 Counts of Election Fraud

By Space Coast Daily // April 17, 2024

FEC investigators: Burns failed to report political contributions, gambled with PAC funds

WATCH PART 3: The final hearing for Florida Elections Commission vs Robert Burns took place on Wednesday as Burns faces 64 counts of election fraud.

WATCH PART 2: The final hearing for Florida Elections Commission vs Robert Burns took place on Wednesday as Burns faces 64 counts of election fraud.

WATCH PART 1: The final hearing for Florida Elections Commission vs Robert Burns took place on Wednesday as Burns faces 64 counts of election fraud.

BREVARD COUNTY, FLORIDA – The final hearing for Florida Elections Commission vs Robert Burns took place on Wednesday as Burns faces 64 counts of election fraud.

Burns, who is the Space Coast Rocket editor-in-chief, was also recently indicted by a Federal Grand Jury in the United States District Court for the Middle District of Florida, Orlando Division, on three counts of wire fraud.

According to court documents, following a Florida Elections Commission investigation, the Commission found probable cause to charge Robert Burns with violating the following:

1) Accepting an excessive cash contribution,

2) Certifying that a campaign treasurer’s report was true, correct, and complete when it was not,

3) Failing to report contributions,

4) Deliberately failing to include information required by Chapter 106, Florida Statutes,

5) Making or authorizing prohibited expenditures, and

6) Attempting to corruptly influence, deceive, or deter electors in voting

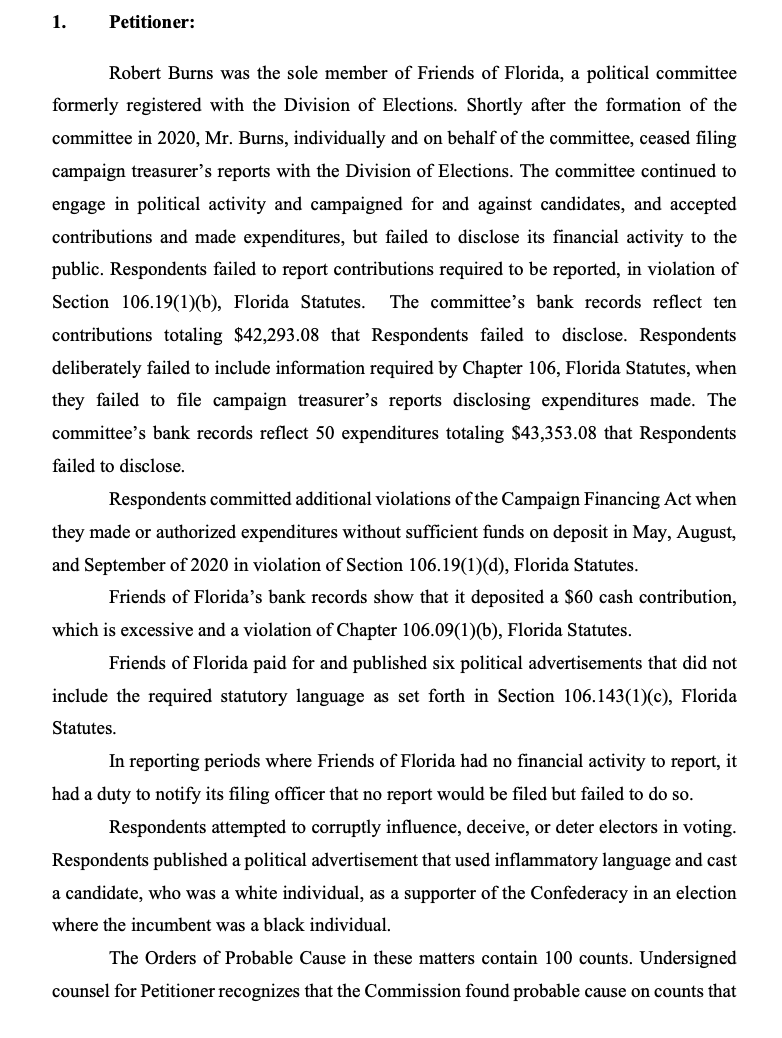

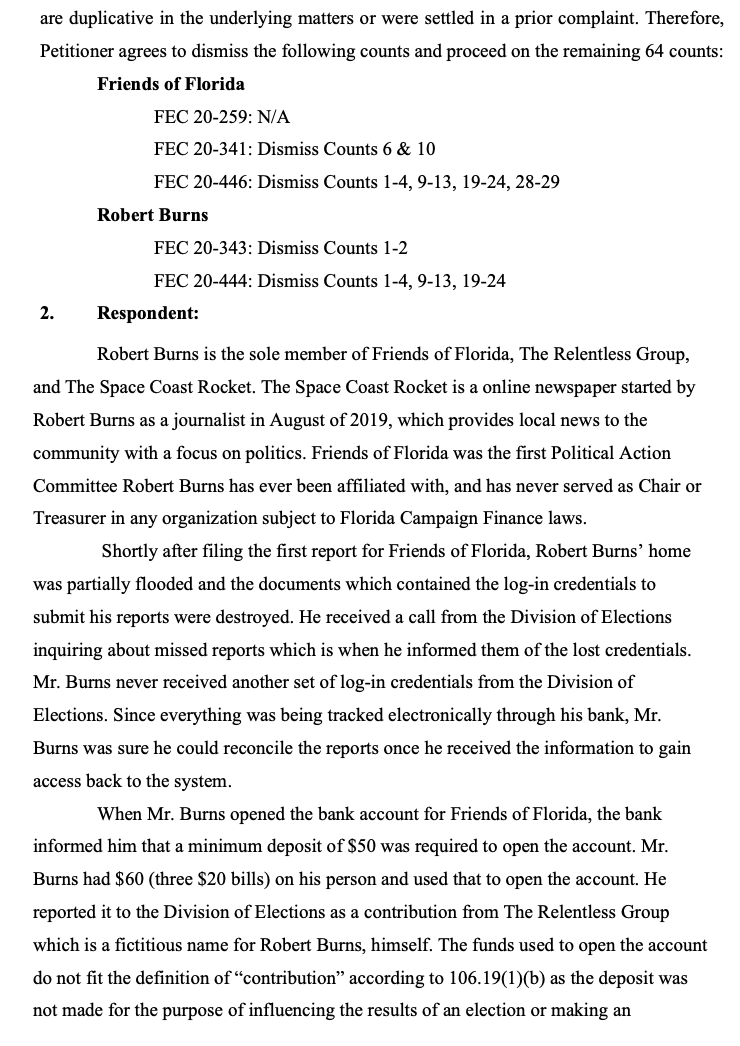

According to court documents, Burns was the sole member of Friends of Florida, a political committee formerly registered with the Division of Elections.

Shortly after the formation of the committee in 2020, Burns, individually and on behalf of the committee, ceased filing campaign treasurer’s reports with the Division of Elections.

The committee continued to engage in political activity and campaigned for and against candidates, and accepted contributions and made expenditures, but failed to disclose its financial activity to the public.

Burns failed to report contributions required to be reported, in violation of Section 106.19(1)(b), Florida Statutes.

The committee’s bank records reflect ten contributions totaling $42,293.08 that Respondents failed to disclose. Respondents deliberately failed to include information required by Chapter 106, Florida Statutes, when they failed to file campaign treasurer’s reports disclosing expenditures made.

The committee’s bank records reflect 50 expenditures totaling $43,353.08 that Respondents failed to disclose.

Respondents committed additional violations of the Campaign Financing Act when they made or authorized expenditures without sufficient funds on deposit in May, August, and September of 2020 in violation of Section 106.19(1)(d), Florida Statutes.

Friends of Florida’s bank records show that it deposited a $60 cash contribution, which is excessive and a violation of Chapter 106.09(1)(b), Florida Statutes.

Friends of Florida paid for and published six political advertisements that did not include the required statutory language as set forth in Section 106.143(1)(c), Florida Statutes.

In reporting periods where Friends of Florida had no financial activity to report, it had a duty to notify its filing officer that no report would be filed but failed to do so.

Respondents attempted to corruptly influence, deceive, or deter electors in voting. Respondents published a political advertisement that used inflammatory language and cast a candidate, who was a white individual, as a supporter of the Confederacy in an election where the incumbent was a black individual.

The Orders of Probable Cause in these matters contain 100 counts. Undersigned counsel for Petitioner recognizes that the Commission found probable cause on counts that are duplicative in the underlying matters or were settled in a prior complaint. Therefore, Florida Elections Commission agrees to dismiss the following counts and proceed on the remaining 64 counts:

Friends of Florida

FEC 20-259: N/A

FEC 20-341: Dismiss Counts 6 & 10

FEC 20-446: Dismiss Counts 1-4, 9-13, 19-24, 28-29

Robert Burns

FEC 20-343: Dismiss Counts 1-2

FEC 20-444: Dismiss Counts 1-4, 9-13, 19-24

Here are the list of the charges as it pertains to Election Fraud filed by Florida Elections Commission:

Count 1:

On or around June 10, 2020, Robert Burns violated Section 106.19(1)(b), Florida Statutes, when he failed to report contributions required to be reported by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 M5 Report.

Count 2:

On or around June 26, 2020, Robert Burns violated Section 106.19(1)(b), Florida Statutes, when he failed to report a contribution required to be reported by Chapter I06, Florida Statutes, on Friends of Florida’ s 2020 PI A Report.

Count 3:

On or around August 7, 2020, Robert Burns violated Section 106.19(1)(b), Florida Statutes, when he failed to report a contribution required to be rep011ed by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 P6 Report.

Count 4:

On or around August 14, 2020, Robert Burns violated Section 1 06.19(1)(b), Florida Statutes, when he failed to report a contribution required to be reported by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 P7 Report.

Count 5:

On or around September 11, 2020, Robert Burns violated Section 106.19(1)(b), Florida Statutes, when he failed to report contributions required to be reported by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 G2 Report

Count 6:

On or around September 18, 2020, Robert Burns violated Section 106.19(1)(b), Florida Statutes, when he failed to report a contribution required to be repot1ed by Chapter 106, Florida Statutes, on Friends of Florida’s 2020 G2A Repot1.

Count 7:

On or around September 25, 2020, Robert Burns violated Section 106.19(1)(b), Florida Statutes, when he failed to report a contribution required to be reported by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 G3 Report.

Count 8:

On or around October 2, 2020, Robert Burns violated Section 106.19(1)(b), Florida Statutes, when he failed to report a contribution required to be reported by Chapter 106, Florida Statutes, on Friends of Florida’s 2020 G3A Report.

Count 9:

On or around June I0, 2020, Robet1 Burns violated Section 106.19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 M5 Report.

Count 10:

On or around June 19, 2020, Robert Burns violated Section 106.19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 PI Report.

Count 11:

On or around July 10, 2020, Robert Burns violated Section 106.19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter 106, Florida Statutes, on Friends of Florida’s 2020 P2A Report.

Count 12:

On or around July 24, 2020, Robert Burns violated Section 106.19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter 106, Florida Statutes, on Friends of Florida’s 2020 P4 Report.

Count 13:

On or around August I4, 2020, Robert Burns violated Section 106. 19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 P7 Rep0rt.

Count 14:

On or around August 28, 2020, Robert Burns violated Section 106.19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter 106, Florida Statutes, on Friends of Florida’s 2020 G I Report.

Count 15:

On or around September 11, 2020, Robert Burns violated Section 106.19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 G2 Report.

Count 16:

On or around September 18, 2020, Robert Burns violated Section 106.19(1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 G2A Report.

Count 17:

On or around September 25, 2020, Robert Burns violated Section 106.19( 1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 G3 Report.

Count 18:

On or around October 2, 2020, Robert Burns violated Section 106.19( 1)(c), Florida Statutes, when he deliberately failed to include information required by Chapter I06, Florida Statutes, on Friends of Florida’s 2020 G3A Report.

Count 19:

On or about May 27, 2020, Robe11 Burns violated Section 106.19(1)(d), Florida Statutes, when he made or authorized expenditures prohibited by Chapter I06, Florida Statutes, during the 2020 M5 reporting period.

Count 20:

On or about May 29, 2020, Robert Burns violated Section 106.19(1)(d), Florida Statutes, when he made or authorized an expenditure prohibited by Chapter 106, Florida Statutes, during the 2020 M5 reporting period.

Count 21:

On or about August 18, 2020, Robert Burns violated Section 106.19(1)(d), Florida Statutes, when he made or authorized expenditures prohibited by Chapter 106, Florida Statutes, during the 2020 G I reporting period.

Count 22:

On or about August 19, 2020, Robert Burns violated Section I06.19(1)(d), Florida Statutes, when he made or authorized an expenditure prohibited by Chapter 106, Florida Statutes, during the 2020 G I reporting period.

Count 23:

On or about August 31 , 2020, Robert Burns violated Section 106.19(1)(d), Florida Statutes, when he made or authorized an expenditure prohibited by Chapter 106, Florida Statutes, during the 2020 G2 reporting period.

Count 24:

On or about September 4, 2020, Robert Burns violated Section 106.19(1)(d), Florida Statutes, when he made or authorized an expenditure prohibited by Chapter 106, Florida Statutes, during the 2020 G2 reporting period.

Count 25:

On or about September 11 , 2020, Robert Burns violated Section 106.19(1)(d), Florida Statutes, when he made or authorized an expenditure prohibited by Chapter I06, Florida Statutes, during the 2020 G2A repotting period.

Count 26:

On or about September 22, 2020, Robert Burns violated Section 106.19(1)(d), Florida Statutes, when he made or authorized an expenditure prohibited by Chapter 106, Florida Statutes, during the 2020 G3A rep011ing period.

Count 27:

On or about August 10, 2020, Robert Burns violated Section 104.061(1), Florida Statutes, when he attempted to corruptly influence, deceive, or deter electors in voting.

If found guilty on all counts and criminally referred, he could face life in prison.

Below are the court documents filed in the State of Florida:

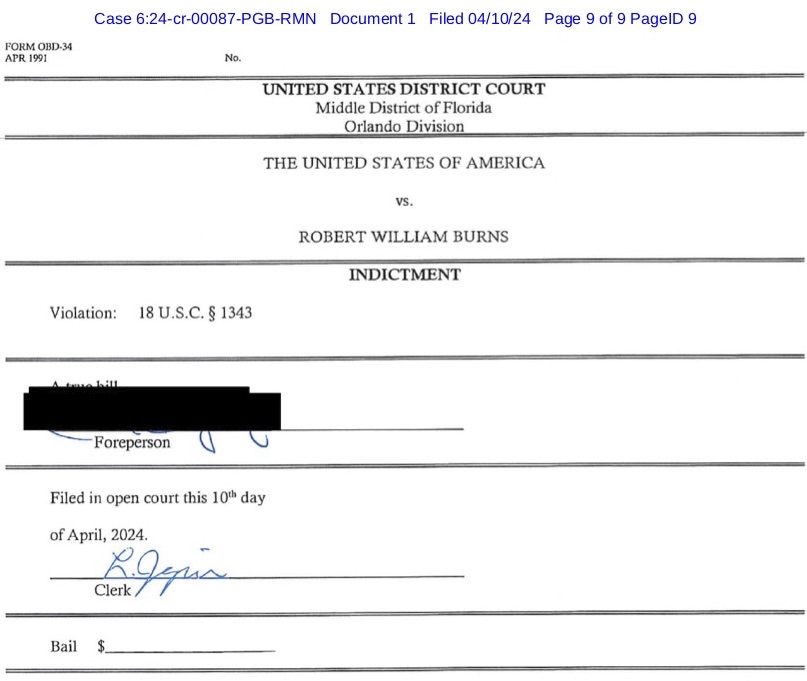

Burns was also recently indicted on three counts of wire fraud by a Federal Grand Jury in the United States District Court for the Middle District of Florida, Orlando Division.

In the Indictment handed down on April 10, the Grand Jury found that there is enough evidence and adequate legal basis to bring criminal charges against Burns.

Burns will now have to appear in court for his arraignment, at which time he will have to plead guilty, innocent or nolo contendere (accepts a conviction as though a guilty plea had been entered, but does not admit guilt).

Penalties under federal law are often more severe than their state equivalents. Federal prosecutors tout above a 95% conviction rate, which is primarily due to the fact that most cases never make it to trial.

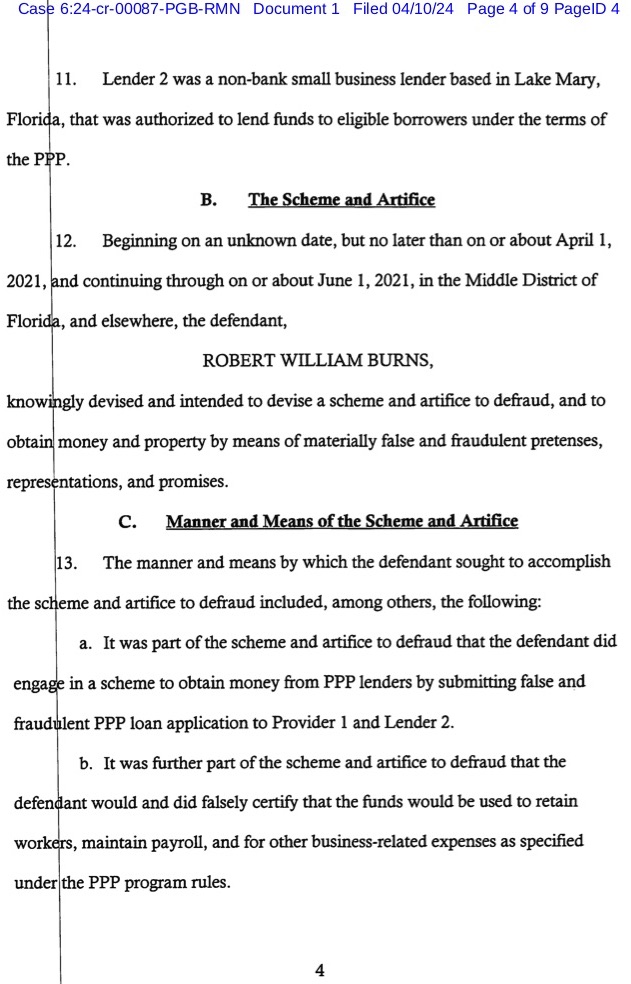

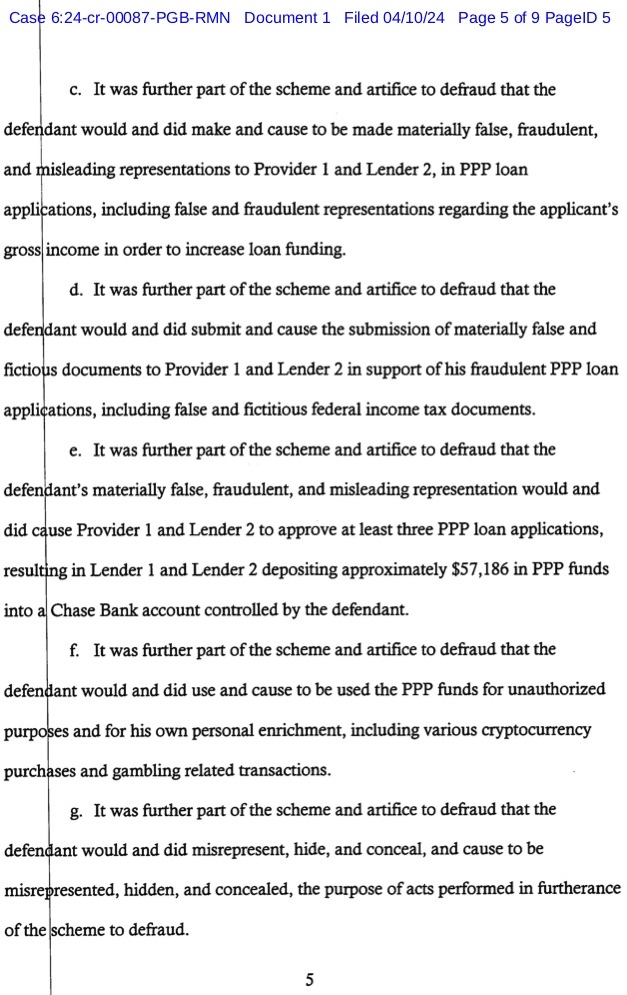

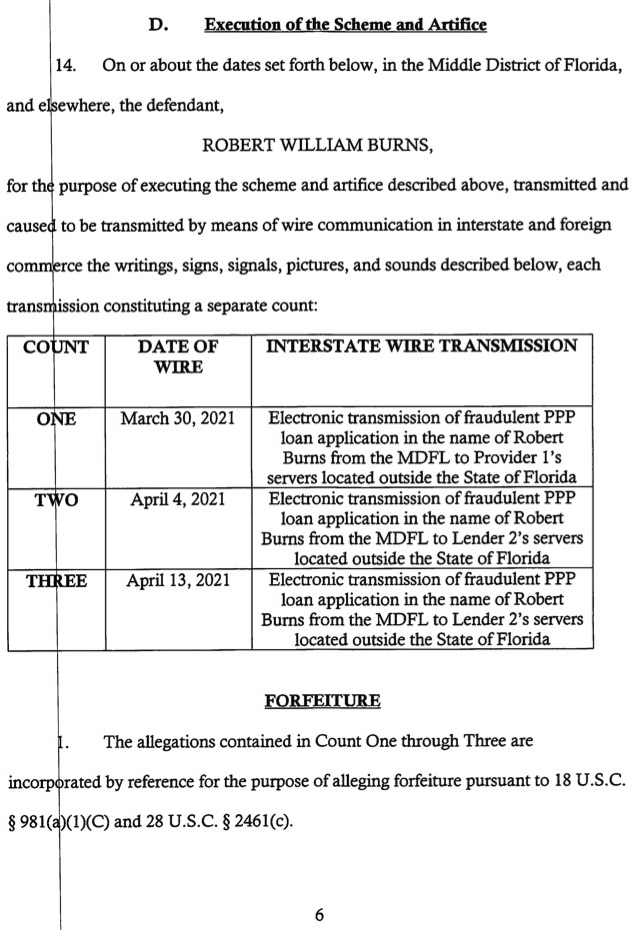

In the nine-page indictment, which can be seen HERE, federal prosecutors explain in detail how, beginning around April 1, 2021, Burns schemed to defraud and to obtain money and property from the “Payroll Protection Program” by means of false and fraudulent pretenses, representations and promises.

The Indictment states that Burns knowingly submitted false and fraudulent PPP loan applications to receive over $57,186 in Covid “CARES ACT” funds and used the funds for his gambling and cryptocurrency purchases instead of using the funds for workers payroll.

The Federal prosecutors also state in the indictment that Burns filed false and fictitious federal income tax documents.

Upon conviction, Burns will face criminal penalties and be forced to forfeit to the United States government, any property, real or personal, which constitutes or is derived from proceeds traceable to the violation.

Robert Burns Indicted By Federal Grand Jury on Fraud Charges, prosecutors also say in the indictment that Burns filed false and fictitious federal income tax documents.

ORLANDO, FLORIDA – Robert William Burns, editor-in-chief of The Space Coast Rocket, has been indicted on three counts of wire fraud by a Federal Grand Jury in the United States District Court for the Middle District of Florida, Orlando Division.

In the Indictment handed down on April 10, the Grand Jury found that there is enough evidence and adequate legal basis to bring criminal charges against Burns.

Burns will now have to appear in court for his arraignment, at which time he will have to plead guilty, innocent or nolo contendere (accepts a conviction as though a guilty plea had been entered, but does not admit guilt).

Penalties under federal law are often more severe than their state equivalents. Federal prosecutors tout above a 95% conviction rate, which is primarily due to the fact that most cases never make it to trial.

In the nine-page indictment, which can be seen in its entirety below, federal prosecutors explain in detail how, beginning around April 1, 2021, Burns schemed to defraud and to obtain money and property from the “Payroll Protection Program” by means of false and fraudulent pretenses, representations and promises.

The Indictment states that Burns knowingly submitted false and fraudulent PPP loan applications to receive over $57,186 in Covid “CARES ACT” funds and used the funds for his gambling and cryptocurrency purchases instead of using the funds for workers payroll.

The Federal prosecutors also state in the indictment that Burns filed false and fictitious federal income tax documents.

Upon conviction, Burns will face criminal penalties and be forced to forfeit to the United States government, any property, real or personal, which constitutes or is derived from proceeds traceable to the violation.

You can see the complete Indictment below: