13 Analysts Assess Teladoc Health: What You Need To Know

In the latest quarter, 13 analysts provided ratings for Teladoc Health (NYSE:TDOC), showcasing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 6 | 5 | 0 | 0 |

| Last 30D | 1 | 2 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 3 | 2 | 0 | 0 |

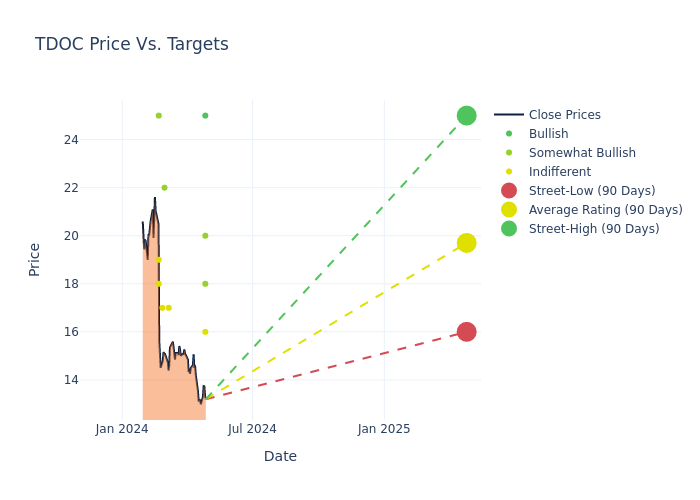

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $21.15, with a high estimate of $28.00 and a low estimate of $16.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 18.37%.

Interpreting Analyst Ratings: A Closer Look

The perception of Teladoc Health by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Sean Dodge | RBC Capital | Lowers | Outperform | $18.00 | $25.00 |

| David Grossman | Stifel | Lowers | Hold | $16.00 | $21.00 |

| Steve Valiquette | Barclays | Lowers | Overweight | $20.00 | $25.00 |

| Richard Close | Canaccord Genuity | Lowers | Buy | $25.00 | $28.00 |

| Jailendra Singh | Truist Securities | Lowers | Hold | $17.00 | $23.00 |

| Sarah James | Cantor Fitzgerald | Announces | Overweight | $22.00 | - |

| Michael Cherny | Leerink Partners | Announces | Market Perform | $17.00 | - |

| Gil Luria | DA Davidson | Lowers | Neutral | $18.00 | $22.00 |

| Daniel Grosslight | Citigroup | Lowers | Neutral | $19.00 | $21.00 |

| Sean Dodge | RBC Capital | Lowers | Outperform | $25.00 | $30.00 |

| Steve Valiquette | Barclays | Lowers | Overweight | $25.00 | $26.00 |

| Jessica Tassan | Piper Sandler | Lowers | Overweight | $25.00 | $30.00 |

| Richard Close | Canaccord Genuity | Lowers | Buy | $28.00 | $34.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Teladoc Health. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Teladoc Health compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Teladoc Health's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Teladoc Health's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Teladoc Health analyst ratings.

Unveiling the Story Behind Teladoc Health

Teladoc Health is a virtual health provider with a telehealth platform delivering on-demand healthcare via mobile devices, the internet, video, and phone. It also offers remote patient monitoring programs for chronic care management. It operates in Teladoc two segments Health Integrated Care and BetterHelp segments. The majority of its revenue generated from access fees on a subscription basis (per member, per month). The balance comes from visit fees and equipment rental and sales to hospital systems. Since inception, Teladoc has partnered with employers, health plans, and health systems to offer network access to their members; it has also started to market directly to consumers while expanding its service portfolio.

Teladoc Health: A Financial Overview

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Teladoc Health's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.58% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Teladoc Health's net margin is impressive, surpassing industry averages. With a net margin of -4.37%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Teladoc Health's ROE excels beyond industry benchmarks, reaching -1.25%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -0.66%, the company showcases effective utilization of assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.68, caution is advised due to increased financial risk.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.