Retailers Using D2C Playbook for New Store Concepts

Amid the pandemic in 2020, U.S.-based retailers said they would close more than 10,700 stores, some of the starkest evidence of COVID-19’s impact on the economy and consumers’ accelerated shift to shopping online.

But this year, store opening announcements are nearly double the number of store closures. In the first three quarters of 2021, according to The Daily on Retail, retailers announced approximately 5,725 openings, compared to 2,890 closure announcements.

Some of these storefronts are coming from digitally-native brands, such as Warby Parker, which plans to open 30-35 new stores and end the year with nearly 160 locations, and Allbirds, which in August opened its 30th location and shows no signs of stopping. But others, such as Petco’s Reddy boutique in New York City and the new PacSun kids’ store at the Mall of America, are offshoots of merchants that already have a physical presence and are looking to get more out of it by focusing on a particular brand or subset of consumers, much like direct-to-consumer (D2C) companies have done.

Related news: Wayfair Hints at Expanded Physical Presence in 2022

Even Amazon, it seems, has realized that eCommerce can only take it so far. Though the Seattle-based company has a nearly 50% share of all digital sales made, it reportedly is preparing to open curated department store-style locations in San Francisco and Columbus, Ohio. Though an Amazon spokesperson told PYMNTS that the company does “not comment on rumors or speculation,” The Wall Street Journal, citing unnamed sources, reported that the stores could open next year and will largely be a hub for selling T-shirts, jeans and other items from its own labels and a mix of third-party sellers.

Amazon already has stores across the U.S. that hawk books, groceries and a curated selection of the most popular items on its marketplace.

Readers also liked: Technology Front and Center in Proposed Amazon Department Stores

A Full Experience

Beyond just offering merchandise, though, many of these brick-and-mortar locations are presenting customers with a range of activities and experiences to keep them engaged and in the store longer. Petco’s Reddy boutique, for example, includes a lounge area with free Wi-Fi and phone charging as well as a fitting area for clothing, water stations, treats and on-site monogramming.

Dick’s Sporting Goods earlier this year told investors and analysts that it intends to lean into experiential shopping over the coming years, with plans to open eight specialty concept stores this year. This month, the company plans to open the second location for Public Lands, a new outdoor-focused specialty store that debuted earlier this year, as well as a redesigned Golf Galaxy Performance Center, which allows golfers to test and customize equipment in-store.

“We believe the future of retail is experiential, powered by technology and a world-class omnichannel operating model,” Ed Stack, executive chairman and prior CEO, told analysts on a conference call earlier this year. “We are reimagining the athlete experience, both across our core business and through new concepts that we have been working on for the past several years, which will collectively propel our growth in the future.”

Living in a Digital World

The influx of new retail concepts comes as shoppers are gearing up for what could be the most digital holiday season yet. PYMNTS research, conducted in collaboration with Kount, found that over 87% of consumers plan to shop online this year, compared to 77% in 2020, and nearly 15% of people say they will only make online holiday purchases.

See more: NEW DATA: Nearly 90% of US Consumers Plan Online Holiday Purchases in 2021 — 13% More Than in 2020

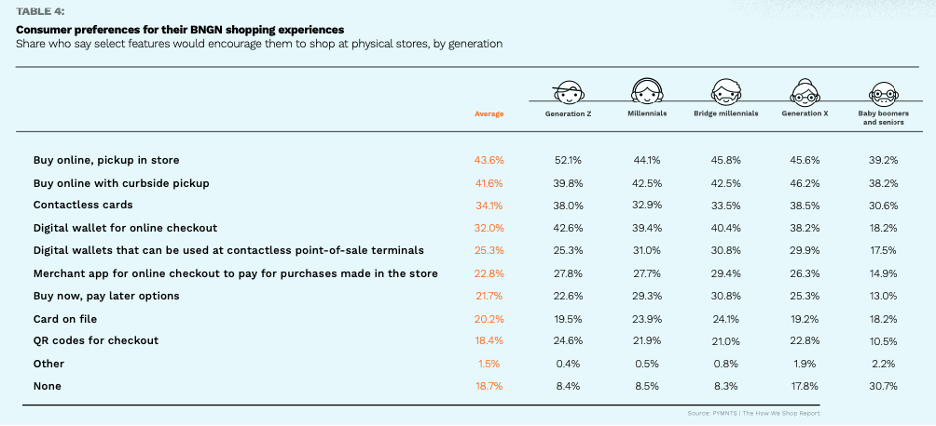

The brick-and-mortar location, though, remains an important asset for most retailers, especially as consumers prioritize those that offer curbside pickup and buy online, pick up in-store (BOPIS). Separate PYMNTS data show that 44% of consumers would be encouraged to shop at physical stores that offer BOPIS, and 42% say they would be more likely to shop at retailers that provide a curbside pickup option.

One obstacle to the adoption of some of these new retail concepts, though, may be consumers’ new mindset about when to shop online versus when to head to the store. Chris Abele, vice president of product strategy at Fiserv, told PYMNTS in a recent interview that shoppers are increasingly making decisions based not on product availability, but rather on what their schedule allows and when they need an item.

One obstacle to the adoption of some of these new retail concepts, though, may be consumers’ new mindset about when to shop online versus when to head to the store. Chris Abele, vice president of product strategy at Fiserv, told PYMNTS in a recent interview that shoppers are increasingly making decisions based not on product availability, but rather on what their schedule allows and when they need an item.

“Instead of running to the store … we are more willing to put our everyday purchases away from instant gratification and more toward a planned spending scenario,” Abele said.

Also see: COVID Taught Consumers That 2-Day Delivery Tops Instant Gratification