- Litecoin price hinting steep correction as TD Sequential indicator presented sell signal for 5th time in last five months.

- Supporting the bearish thesis are declining whale holdings, which increase the probability of a downswing.

- An upswing could come into the picture if LTC bulls manage to push past the recent high at $230.

Litecoin price has seen a 20% correction after hitting a local top on February 14. This correction shows signs of an extension as both technical and on-chain indicators have turned bearish.

Litecoin price primed for a downswing

Litecoin price saw a 100% impulse wave after bottoming on January 27. Now, the local top on February 14, signals the end of this rally.

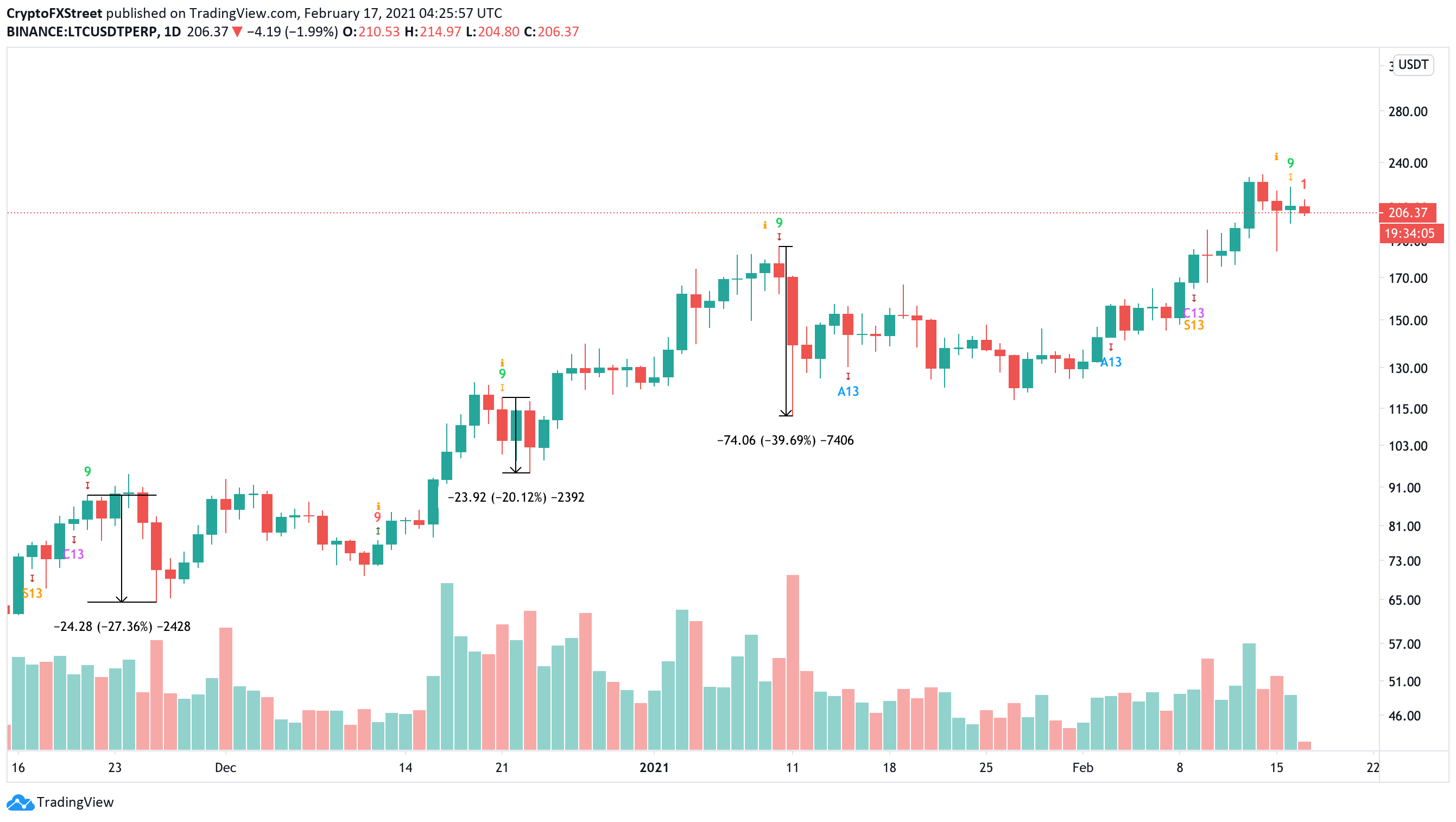

On February 16, the Tom DeMark (TD) Sequential indicator flashed the fifth sell signal in the form of a green nine candlestick since October 2020.

Since this technical formation forecasts a one-to-four candlestick correction, previous sell signals have resulted in a 20-to-40% correction.

Hence, investors must assume that the recent bearish indication might follow through.

LTC/USDT 1-day chart

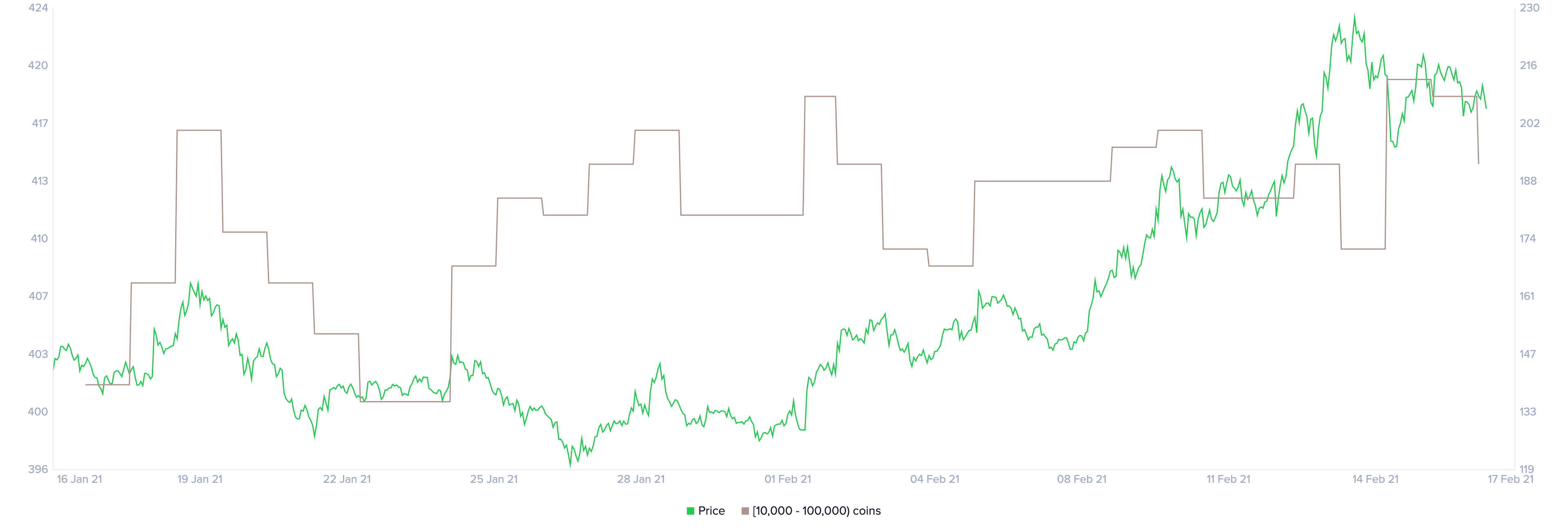

Adding credence to Litecoin’s bearish thesis is the declining number of whales holding between 10,000 to 100,000 LTC.

These whales have reduced from 420 to 415 between February 15 and 17 thus painting investors’ pessimistic outlook of Litecoin’s bullish potential.

Litecoin holder distribution chart

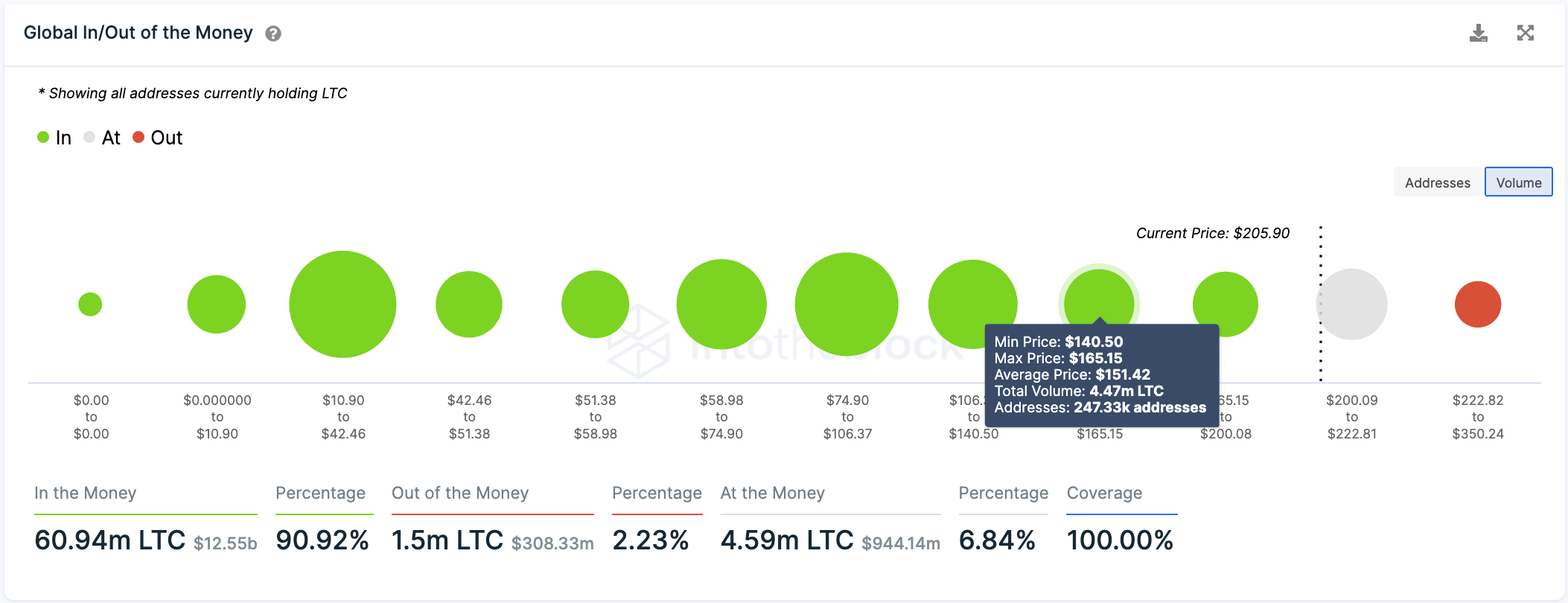

Litecoin’s downswing could extend up to the critical support at $150, which is a 30% drop from its current price.

Based on IntoTheBlock’s Global In/Out of the Money model, about 247,000 addresses purchased nearly 4.45 million LTC here.

Subsequent selling pressure leading to a breakdown of this support could trigger a sell-off pushing the altcoin to $130.

Litecoin GIOM Chart

While the bearish scenario seems likely and inevitable, it could be invalidated if LTC bulls manage to get a daily close above the recent high at $230.

If this were to happen, retail FOMO could push the coin up to $350 or the 161.8% Fibonacci level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?