Thai Central Bank Seeks to Allay Fears on Bond Registration Rule

Thai Central Bank Seeks to Allay Fears on Bond Registration Rule

(Bloomberg) -- Global funds will continue to have unfettered access to Thai bonds even when a rule on registration takes effect, the central bank said as it sought to allay concern the regulation could be used to curb speculative flows.

The proposal, which will kick off in October, requires foreign funds to open segregated onshore accounts instead of relying on omnibus facilities from international clearing firms such as Euroclear Ltd. This would enable officials to identify the ultimate holder of the nation’s bonds, doing away with the anonymity provided by global depositories which tend to combine transactions.

The regulation will help officials understand investors’ behavior, and isn’t intended to limit trading and speculation, Bank of Thailand Assistant Governor Vachira Arromdee said in a March 22 email interview. Policy makers don’t have a target for foreign ownership of Thai bonds as it’s crucial to have a diversified investor base, she added.

“We have been closely monitoring the impact of inflow/outflow and asset price changes in the Thai financial markets to ensure stability, which is crucial for supporting the economic recovery,” Vachira said.

The move to increase surveillance of the bond market comes as the central bank steps up efforts to deter speculative flows to rein in the baht. A rally in the Thai currency last quarter has cooled after policy makers relaxed rules on capital outflows and warned that rapid gains could hurt the economy.

The central bank said in November the registration “will allow close monitoring of investors’ behaviors and thereby enable the implementation of targeted measures in a timely manner.”

Vachira acknowledged there could be challenges in enforcing the proposal but noted that officials are working with global depositories to ensure “Thai bonds remain Euroclearable.” She did not elaborate.

Goldman Sachs Group Inc. has warned that a strict implementation of the rule could curb inflows as most foreign investors prefer to use international firms to clear their trades. One solution is to follow Malaysia’s model, which provides an exemption to global depositories while giving the authorities access to timely data, it said.

“Imagine a global EM bond fund manager who invests in almost 20 markets,” Danny Suwanapruti, Goldman Sachs strategist for emerging Asia, said. “Being able to settle through Euroclear for several markets compared to dealing with 20 different local custodians for each country makes a difference when it comes to operational efficiency.”

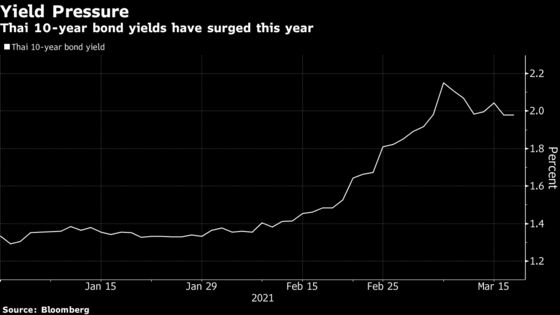

Like other bond markets, Thai debt has come under pressure as expectations for faster inflation and growth force investors to flee from fixed-income instruments. Baht securities delivered a loss of 5.6% this month in dollar terms.

Yields on benchmark 10-year Thai sovereign bonds leapt to 2.15% this month, the highest since July 2019. They have since fallen to around 2% with foreign funds pumping $224 million into the nation’s bonds in March.

Foreign investors held about 14% of Thai securities in February, compared with 24% for Indonesian securities, official data showed.

The second phase of the bond investor registration program, which is for local investors, will take place in the second half, Vachira said. The government’s increased funding needs due to the pandemic have been well-supported by the domestic investor base, she added.

©2021 Bloomberg L.P.