It’s nearly time for the Budget speech... and we’ll be live-blogging it all here:

Markets rise ahead of UK budget as UK services sector stabilises – business live

Rolling coverage of the latest economic and financial news

Wed 3 Mar 2021 07.05 EST

First published on Wed 3 Mar 2021 03.17 EST

Live feed

Back in the City, shares in airlines, hospitality firms, housebuilders and banks are continuing to rally as traders anticipate fresh help for the economy in the Budget.

British Airways’ parent company, IAG, is up 5%, followed by Whitbread (4.8%) which runs the Premier Inn hotel chain.

Barclays has gained 3.2%, helping to keep the blue-chip FTSE 100 up by around 0.9% or 60 points at 6674 points.

Among smaller companies cinema chain Cineworld is up around 7.5% and pub chain JD Wetherspoon is 4% higher.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, says expected Budget measures, such as the extension to the furlough scheme, will help these companies:

With business lifelines expected to be extended and a dose of extra support expected to be administered to ailing shops, pubs and restaurants, there has been a buoyant start for hospitality and landlords in early trading in London. Airlines, who have relied heavily on the furlough scheme are also higher given the likelihood it will be extended into the Autumn.

Expectations that the VAT cut to 5% will linger for longer for the hospitality industry helped boost Whitbread, which is reliant on bookings in its hotels and Thyme restaurants for its Premier Inn chain.

JD Wetherspoon is also higher with prospects that the cut will help it keep pint prices lower and volumes higher when its vast footprint of pubs reopens. Both companies have been big recipients of the furlough scheme and now it seems it is likely to be extended to the end of September, that has added another shot of relief.

Landlords British Land and Hammerson have built on gains in recent days as news trickles through of £5 billion in grants to help struggling high street shops and hospitality firms. This could help more units stay filled for longer in town and city centres already littered with empty shops.’

The imminent extension of the UK’s furlough scheme until September is being generally welcomed.

Jane Fielding, head of employment at law firm Gowling WLG, points out that it doesn’t specifically target the industries most hit by the lockdowns, but will give wider ‘breathing room’:

“This extension of the scheme will give employers further time to plan in the hope and expectation that the impact of the vaccine programme and subsequent lockdown easing will allow them to trade more normally.

An alternative approach would have been for the government to target the support to specific industries hardest hit by the pandemic, but clearly this wider support will give more breathing space not just to those industries but all employers and their staff continuing to face challenges.

Dr Anne Sammon, employment partner at Pinsent Masons, wonders whether firms will get further funding for Covid-19 workplace testing:

“Employers should now be in a position where they can properly plan and prepare for the coming months, hopefully removing the need for any knee-jerk reactions. It will be interesting to see whether the Chancellor is looking to provide targeted support for those sectors that continue to be restricted from operating, enabling a more nuanced approach than the current scheme

As employers look to welcome staff back in the coming months they will also need clarity around whether the funding for Covid-19 workplace testing, currently set to end on 31 March 2021, will be extended and if this cost needs to be factored in to their projections.”

UK-listed insurer group Hiscox has said it regretted “the uncertainty and anguish” suffered by customers who faced disputes when claiming business interruption insurance to cover losses suffered in the pandemic.

My colleague Julia Kollewe explains:

Hundreds of thousands of small businesses that were forced to close during the pandemic won a “historic victory” in January when the UK’s supreme court threw out the appeals from six insurance companies and largely supported the arguments made by the Financial Conduct Authority in a test case and a policyholder action group. Firms could receive insurance payouts of more than £1bn collectively.

Hiscox said it had begun paying claims and hired more claims handlers to speed up the process, with about one in three of its 34,000 UK business interruption polices paying out.

Bronek Masojada, the Hiscox chief executive, apologised for the episode.

“We clearly regret the uncertainty and anguish that the dispute has caused to our customers, so it is important that we learn from this experience. The most important lesson is the need for clarity in wordings, to ensure intent is properly reflected in the policy detail. In addition, the customisation of policies has to be restricted to ensure that there is not a long tail of wordings serving very small numbers of customers.”

Shares in Hiscox have fallen 10% this morning, defying the wider rally, with the company falling into a loss after paying out $475m for cancelled events, business interruption policies and other claims related to the coronavirus pandemic.

Having stabilised in February, the UK economy seems certain to contract this quarter as the lockdown continues to hit growth.

But the fast vaccine rollout should spur a recovery, argues Matthew Ryan, senior market analyst at UK fintech Ebury:

“Despite a modest downward revision to the preliminary estimate, this morning’s services PMI remained at a four-month high 49.5 in February, having rebounded strongly from the dismal print in January. While renewed confidence in the sector is undoubtedly encouraging, the economy remains firmly on course to enter into another sharp contraction in Q1, with the UK still stuck in one of the strictest lockdowns in Europe.

“Investors are, however, focusing on the positives, namely the UK’s extraordinarily rapid vaccine rollout. This has raised hopes of a return to near normalcy by mid-2021 and lifted the pound to the top of the G10 FX performance tracker so far this year. It is for this reason that we think the UK economy could be set to outperform most of its European counterparts during the remainder of 2021.”

Markit: UK economy saw stability in February

The UK economy stabilised last month, after a sharp fall in activity in January as the latest lockdown restrictions hit companies.

That’s according to data firm IHS Markit’s latest PMI survey, which shows that private sector activity only dipped marginally in February after a slump in January.

Its survey of the services sector found that:

- Business activity was almost stable in second month of lockdown

- Slowest drop in staffing numbers since pandemic began

- Optimism continues to rise in response to vaccine roll out.

Markit says:

A degree of stability returned to the UK service sector after the sharp downturn in output at the start of 2021. Restrictions on travel, leisure and hospitality due to the national lockdown continued to curtail overall activity, but there were some pockets of growth in technology and business services.

The UK Services PMI Business Activity Index rose to 49.5 in February, up sharply from an eight-month low of 39.5 in January. That still shows a small contraction -- the sector won’t be growing again until the PMI is back over 50.

The wider Composite PMI, which covers both factories and services companies, rose to 49.6 in February, up from 41.2 in January.

UK service companies also reported a drop in overseas orders amid the pandemic, and a jump in input costs due to higher fuel bills and greater shipping costs.

Markit explains:

New business volumes fell only slightly during February, with the rate of contraction easing considerably from that seen at the start of the third national lockdown in January. Subdued demand was mainly attributed to a lack of sales opportunities and hesitancy among clients due to the pandemic. Survey respondents also cited Brexit-related difficulties as a factor holding back sales to customers in the European Union.

Latest data indicated that new work from abroad continued to fall sharply. While the rate of decline slowed since January, it remained sharper than that seen for total new orders. International travel restrictions were the most commonly cited reason for lower exports, followed by regulatory and supply chain issues that had arisen since Brexit.

UK services economy stabilised in February as output and employment fell at much slower rates and pockets of growth were seen in sectors such as technology and business services. Read more: https://t.co/iKorlC33Di pic.twitter.com/dKaeoXVyJo

— IHS Markit PMI™ (@IHSMarkitPMI) March 3, 2021

Eurozone on track for double-dip recession

Covid-19 lockdowns are dragging the eurozone into a double-dip recession, according to the latest survey of European companies.

Eurozone service sector firms have reported another fall in activity, with new orders continuing to drop last month.

Date firm IHS Markit’s Services PMI was little changed in February, rising to 45.7 from January’s 45.4 - showing another contraction (anything below 50 indicates the sector shrank).

Despite strong manufacturing growth, Markit’s overall Composite Output Index remained below 50 (rising to 48.8 in February, up from January’s 47.8). Germany and Italy’s private sectors returned to growth, while France and Spain continued to shrink.

It suggests the eurozone will shrink this quarter, having already contracted in the last three months of 2020.

On the upside, business confidence hit a three-year high, with European businesses hoping that vaccine rollouts will allow economies to reopen.

Chris Williamson, chief business economist at IHS Markit, explains:

“A fourth successive monthly drop in business activity puts the eurozone economy on course for a double-dip recession, though an easing in the rate of decline underscores how the latest downturn appears far less severe than the initial hit from the pandemic last year.

While many hospitality-based companies in the service sector continue to struggle due to COVID-19 related restrictions, manufacturing is faring well and alleviating the overall economic impact of lockdown measures.

Even some hard-hit parts of the service economy are showing greater resilience than last year, suggesting some adaptation to the constraints of social distancing.

Eurozone PMI data pointed to a further decline in private sector activity during February. Service sector weakness more than offset strong manufacturing growth. Germany and Italy were the only two covered countries to see an increase in output. Read more: https://t.co/CXmGS09Z58 pic.twitter.com/pQfJ5SZfDX

— IHS Markit PMI™ (@IHSMarkitPMI) March 3, 2021

Robert Alster, CIO at wealth manager Close Brothers Asset Management, says Rishi Sunak must ‘tread carefully’ as he considers tax changes:

“We’re not expecting too many surprises when the Chancellor takes to his feet to deliver one of the most widely leaked budgets in history. The key focus will clearly be continued support for the economy, as we navigate our way out of lockdown. Businesses will be listening closely for the approach to business rates and VAT cuts in the coming months.

“The question is how Rishi Sunak will balance the need for short term support while addressing the long term problem of the deficit. In recent weeks, speculation about tax rises has been rife. Specifically, a reform of capital gains tax, increasing corporation tax and potential ‘stealth’ taxes in the form of income tax band freezes.

“However, the overarching factor in this Budget is the need to remain politically expedient in an already sensitive environment. The Conservative manifesto pledge not to increase taxes is frequently cited by Tory backbenchers and commentators alike, and the Chancellor will have to tread carefully.

Reuters’ Andy Bruce has helpfully wrapped up some of the various ‘trailed’ announcements:

Can't wait to find out what's going to be in #Budget2021!

— Andy Bruce (@BruceReuters) March 2, 2021

(Aside from £5 billion restart grant scheme, £400M budget boost for culture and arts, £300m sports recovery package, £150m Community Ownership Fund, £520m ‘Help to Grow’ for SMEs, Thalidomide survivor funding...

...£10m for veterans' mental health, £1.65 billion for COVID vaccine rollout, sovereign green savings bond, Lord Hill report on reforms to London stock market listings per Sky News, Immigration reforms - fast-track visas for certain sectors, £5 billion restart grant scheme...

— Andy Bruce (@BruceReuters) March 2, 2021

...£375 million ‘Future Fund: Breakthrough', £12 billion capital & £10 billion of guarantees for UK infrastructure investment bank, £100 million crackdown on COVID fraudsters, new mortgage guarantee scheme, £15 billion extension to furlough, other support schemes...

— Andy Bruce (@BruceReuters) March 2, 2021

...income tax freezing of £12,500 / £50,000 thresholds, corporation tax increase plan, 3-month extension to Stamp Duty Holiday, SEISS grants of up to £7.5k)

— Andy Bruce (@BruceReuters) March 2, 2021

Apart from those things, should be a total surprise!

The publisher of the Daily Mail has acquired the renowned weekly science and technology magazine New Scientist in a £70m cash deal – the latest round of consolidation in the publishing sector.

Sunak to reform stock market to shore up City of London's position

Rishi Sunak will pave the way for sweeping reforms of the stock market to attract more fast-growing companies to list in the UK, amid the growing risk to London’s status as a leading financial centre after Brexit.

In a development to coincide with the budget on Wednesday, the chancellor will publish the findings of a landmark review into UK listings rules to boost Britain’s attractiveness as a place for firms to grow and be taken public.

Led by the former EU financial services commissioner, Lord Jonathan Hill, the overhaul could introduce the most significant reforms in the City of London in decades.

The proposals including liberalising rules regarding special purpose acquisition companies, known as Spacs.

These “blank cheque” shell companies are launched to raise money from investors first and then hunt for a business to buy later. They’re one of the hottest trends on Wall Street this year....and controversial too. Because a Spacs’ share price can surge if it lands a successful acquisition, retail investors have been piling into them, with mixed results.

As Reuters explained earlier this week:

Churchill Capital IV Corp has provided the most vivid example of the pitfalls. Its shares had risen as much as 548% from its IPO, for a market valuation of almost $17 billion, following a Reuters report last month that it was nearing a deal to merge with luxury electric vehicle startup Lucid Motors at a roughly $12 billion valuation.

But the shares dropped 42% last week, wiping out over $8 billion in market value, after the deal was announced with a last-minute private investment that diluted stock market investors.

The domestically-focused FTSE 250 index, which contains more UK companies than the FTSE 100, has also gained over 1% this morning.

Software group Micro Focus is leading the way, up 15% after announcing an agreement with Amazon Web Services to help customers migrate their mainframe applications and workloads to the cloud.

Cinema operator Cineworld (+5.5%) and transport company FirstGroup (+6.2%) are also in the risers - both companies have been badly hit by the lockdowns.

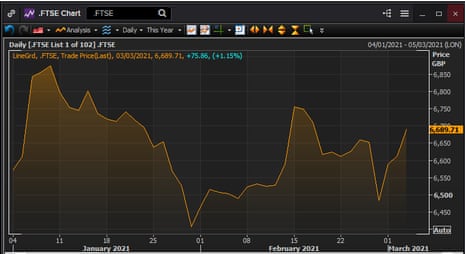

FTSE 100 jumps over 1%

The London stock market has made a strong start to Budget Day, with shares jumping in early trading.

The FTSE 100 index has gained 76 points, or 1.15%, to 6690 points in early trading, as it continues to recover from last week’s selloff.

UK-focused firms are among the top risers, with hotel chain Whitbread up 4%, catering company Compass gaining 3.3% and publishing and exhibitions group Informa rising 3.2%. Retail chain JD Sports is 2% higher.

Nearly every stock is higher, with banks and commodity companies also lifting the index on hopes of economic recovery this year.

The news that the furlough scheme is to be extended until September should bolster companies reliant on UK consumer spending.

David Madden of CMC Markets says the economy still needs “massive fiscal support” despite the success of the vaccination programme, with certain industries most in need:

Industries like leisure, hospitality and aviation were given some much needed help by the year-long relief on business rates, but extra help is needed. It would not come as a surprise if those sectors saw further relief seeing as activity levels are unlikely to return to normal until the summer. Airlines, pub chains, hotel groups, leisure groups, event companies and transport firms have arguably been the hardest hit by the health crisis, so they might be in for special treatment as they won’t be out of the woods for a long time.

As a reaction to the pandemic, VAT was slashed from 20% to 5% but that is due to come to an end later this month. Mr Sunak could well maintain a low rate for longer as a way of encouraging spending, so hospitality stocks could be in for a lift.

China service sector growth hits 10-month low

Over in China, services sector growth has slowed to a ten-month low as the pandemic continued to hit demand.

The latest survey of service sector bosses found that firms struggled with sluggish demand and high costs in February, leading to a rise in job cuts.

The Caixin services purchasing managers’ index dropped to 51.5 in February from 52 in January. That’s the lowest reading since last April, and close to the 50-point mark showing stagnation.

New export business also shrank after expanding for three months, indicating that Covid-19 lockdowns across the globe were hitting demand.

Despite the fall in orders, companies are optimistic that conditions will improve over the coming 12 months.

Wan Zhe, senior economist at Caixin Insight Group.

“Service providers were generally optimistic about the economic recovery, and were especially confident that both the domestic and overseas epidemics would fade.”

China Caixin services PMI extend decline for the third consecutive month, to the lowest since May 2020, as the growth of supply and demand in the service sector continued to slow down, employment situation deteriorated and inflationary pressure increased.#PMI #services pic.twitter.com/4FqxDCphc5

— CN Wire (@Sino_Market) March 3, 2021

China’s wider composite PMI also fell, to 51.7 from 52.2, with data over the weekend showing that manufacturing growth also slowed amid supply chain problems.

Introduction: Budget day and US stimulus in focus

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

More than a year into the Covid-19 pandemic, the prospect of more government spending continues to support the financial markets.

European stocks are expected to rally this morning, as City traders prepare for today’s Budget -- and welcome the prospect of Joe Biden’s $1.9trn stimulus package making it through Congress soon.

European Opening Calls:#FTSE 6668 +0.81%#DAX 14117 +0.55%#CAC 5846 +0.62%#AEX 667 +0.52%#MIB 23230 +0.63%#IBEX 8408 +0.63%#OMX 2079 +0.57%#STOXX 3728 +0.55%#IGOpeningCall

— IGSquawk (@IGSquawk) March 3, 2021

Budget-wise, Chancellor Rishi Sunak is expected to pledge to do “whatever it takes” to help businesses and people through the pandemic - adding to the £280bn of support already spent since the crisis began.

That will include a six-month extension to the UK’s job retention scheme, until the end of September, to protect jobs as the economy reopens. It means workers will continue to be guaranteed 80% of their salary for a further three months after the government hopes to have lifted restrictions in June, with the scheme slowly being phased out.

An extra 600,000 people will now be eligible for state financial help too, through the Self-Employment Income Support Scheme (previously the scheme used tax returns for 2018-2019, so recently self-employed people didn’t qualify. It will now include those who became self-employed in 2019-20).

Plenty of other measures have been trailed in recent days, including billions of pounds of funding for the UK’s new infrastructure bank; a new mortgage guarantee program to support 95% mortgages, and £5bn of additional grants to help retail, hospitality, accommodation, leisure and personal care companies reopen.

We’re also expecting:

- An extension of the £20 a week boost to universal credit.

- Extra measures to support the long-term unemployed through the Kickstart scheme for the under 25s and the Restart scheme for older workers.

- An extension to the stamp duty holiday for properties under £500,000.

The latest fiscal and economic forecasts could also show improvements on November’s forecast; with the deficit in 2020-21 expected to come in below the record £394bn forecast four months ago.

Sunak is also expected to flag the prospect of tax rises down the line to address the cost of the crisis, which could include an increase in corporation tax.

The latest survey of UK services companies, due this morning, will show how firms are coping in the lockdown.

Meanwhile in the US, the Senate is preparing to start debating Joe Biden’s $1.9trn stimulus package, which includes checks for families, more help for small businesses, and extra funding for schools, state and local governments and vaccine distribution.

But with the Senate tied 50:50 between Democrats and Republicans, getting a package finalised will be tough:

One reason late nights are expected and that will make the job of Democratic leadership more challenging is that senators are walking into a legislative minefield later this week since the relief bill is being considered under budget reconciliation rules that allow a free-flowing amendment process, meaning senators can force votes on as many amendments as they like.

That means if two Democrats break ranks, they could amend the bill with the backing of 49 Republicans.

The agenda

- 9am GMT: Eurozone service sector PMIs for February

- 9.30am GMT: UK service sector PMIs for February

- 12.30pm GMT: The UK budget

- 1.15pm GMT: ADP payroll survey of US employment last month

Comments (…)

Sign in or create your Guardian account to join the discussion